Gifts Are Big Business for Apparel Boutiques

Some apparel specialty stores dabble in gifts—which have grown to represent an important component of their sales—but the Brown Eyed Girl boutique in San Francisco lets gifts take center stage.

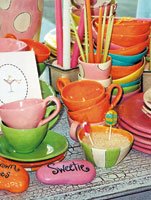

Set up like a best friend’s home, the 1,800-square-foot store is chockablock with merchandise ranging from feminine picture frames and wedding albums to couches and $4,500 hand-painted bed frames—all of which complement the displays of clothes set up in the backdrop in armoires. So, shoppers will see Shoshanna bikinis and Underglam panties near a bathroom filled with fluffy towels, slippers and beauty products. Shirts by Three Dots and Paper Denim & Cloth are folded neatly beside a $990 dining room table, which is available in 22 different finishes from crackled to distressed.

Besides providing a looky-loo atmosphere for her customers, who linger longer, owner Danielle Bourhis says her strategy makes smart business sense, noting that margins can nearly triple for gifts compared to the 100 percent markup for clothing.

“I never understood why a retailer would pay someone a retail price for a couch and put it in their store to sell,” said the 25-year-old owner, who plans to open a store later this year in Los Angeles. “I buy it at wholesale and take orders for it at retail prices. We have great furniture orders. I can have a $15,000 order for the day and feel like I can close my books.”

Her gift approach, which represents 15 percent of her almost $1 million in sales, is just one of the ways retailers are benefiting from the popularity of gifts, which are fast becoming the equivalent of the candy bar at the grocery checkout stand. These impulse items can represent significant profits for owners, often providing higher margins than apparel or simply creating another reason for a shopper to visit. In a soft retail and apparel market, gifts are also a way to buttress sales.

“It’s a really easy way to up-sell your customer,” said Debbie Allen, a retail consultant based in Tempe, Ariz. “By diversifying their product selection, [retailers] can get more dollars from their existing customer base. Yet, it’s still a way to connect with the customer with the emotion, the lifestyle and fashions.”

The current gift trend is not lost on gift show officials, who have seen a growing interest from boutiques at their shows.

“For the last three years, we’ve been seeing more and more crossover buying between apparel and gift in Dallas,” said Cindy Morris, executive vice president of marketing for the Dallas Market Center and the California Market Center (CMC), the newly expanded gift and apparel showroom complex in downtown Los Angeles formerly known as the California Mart.

“What started it was that apparel stores first bought a few picture frames and personal-care items, displaying them on the counters, and realized how quickly they could turn products,” Morris said. “Now, they’re expanding into other gift items.”

Recently, CMC officials converted the 100,000 square feet of space on the center’s 12th and 13th floors into seven gift showrooms, with plans to eventually convert half the complex into gift and home showrooms. The center will host buyers at its upcoming gift market running April 7–9, right before Los Angeles Fashion Week, which begins April 12. Based on the results from the last gift show at the CMC in January, officials are optimistic about attendance.

CMC executives say they hope the complex’s merchandise mix will attract the hundreds of apparel and gift boutiques located in the surrounding area as well as out-of-town buyers.

“We had 3,000 registered buyers at our January show, which tripled our expectations,” said Morris, adding that the center mailed out 35,000 direct mail invitations to retailers for this month’s show.

Some of those buyers they’re hoping to attract are boutique owners who have made gifts an essential core of their businesses. One such business is the 11-year-old Tracey Ross boutique in West Hollywood, Calif. There, paintings, movie posters, leather-embossed dictionaries, silver engravings and other gifts can comprise 30 percent to 50 percent of business depending on the season. Owner Tracey Ross, whose store carries Juicy, Chloe and Marc Jacobs, keeps the mix current by traveling the world in search of unusual knickknacks that include $300–$800 smoking pipes from Vietnam, cotton pajamas from China, and beaded jewelry pieces from Tanzania and Kenya.

Her research typically pays off.

“I can make three times more in profits [by selling gifts], and if I get it from a different country, sometimes five times more,” said Ross, who says she plans to regularly visit the CMC.

Gifts can also open the door to larger sales. For example, Ross has made corporate gift-giving an indispensable staple of sales. Ross’s corporate gift clients include local movie and record companies.

The availability of gifts provides another bonus at her women’s apparel boutique: the male shopper.

“I do a lot of business with men who come in looking for gifts for their honey or for business reasons,” she said.

Other retailers say they want to stick to their apparel roots and simply maintain a small core collection of gifts.

“We do well with what we have, so I don’t plan on expanding the collection. I don’t want to get off track with what we’re selling,” said Erica Berge, who opened her Erica Dee boutique in Corona del Mar, Calif., last June.

Along with selling designs from Theory, True Couture and Diane von Furstenberg, Berge carries a mix of items ranging from $3 Vogue greeting cards that highlight the magazine’s vintage covers to $85 bamboo photo albums by Tasha Blasi. She says that she has to constantly reorder items.

“Illume and Votivo candles both sell like hotcakes,” she said. “They make the store smell great and are irresistible. They add on to every single sale.”