Difficult First Quarter, Recovery on Horizon

The first quarter of 2002 still finds California’s economy struggling with a full plate of challenges, according to Jack Kyser, chief economist at the Los Angeles County Economic Development Corp. (LAEDC).

“It’s probably going to be a difficult first quarter,” said Kyser. “We’re still dealing with the tech crash, and we’re still dealing with the impact of [the events of Sept. 11] on the tourist industry.”

Kyser also said that the state’s business environment is experiencing some “unnerving” setbacks.

“There’s an increase in workman’s comp insurance, and there’s a lot of legislation being proposed in Sacramento that is not the most favorable to the business community,” said Kyser.

Even in the face of those challenges, Kyser said that he thinks California can still experience recovery by the third quarter.

“We are looking for a recovery to get underway by mid-year, driven by a still favorable performance in the housing industry and an upturn in imports as the U.S. economy recovers and we become the locomotive for the world again,” he said. “You’ll see recovery in the motion picture industry and you will see the benefit from the increased spending on defense and homeland security.”

On the road to recovery, there are a few bumps that California businesses have to navigate.

“Things that a businessperson needs to watch include the expiration of the longshoreman’s contract on July 1, and on July 31, the UPS contract with the Teamsters will expire,” said Kyser. “Then we have to watch what goes on in Japan because their economy is struggling and it will have multiple ramifications. They are not taking the right steps to revitalize their economy and get it on the right track.”

The apparel industry will likely face its own specific challenges. The industry earned a C- on a recently released LAEDC economic forecast, which rates segments of the Los Angeles business community on a scale of A+ to D-.

Los Angeles currently has 97,800 apparel workers and 16,000 textile workers. The LAEDC is forecasting the erosion of 3,500 of those jobs in 2002 and another 2,800 in 2003, attributing this to consumers’ continued focus on value, a lack of interest from local political leaders and an uncertain retail industry.

“The Gap just had a lousy earnings report—and I’m using that word ’lousy’ a lot lately [for retail],” Kyser said. The move of Menomonee Falls, Wis.-based discount retailer Kohl’s into the Southern California market could shake up the apparel business—particularly for such retailers as Mervyn’s, JCPenney, Sears and Robinsons-May, Kyser added.

Indeed, value retailers received a B+ rating on the LAEDC’s forecast, thanks to Kohl’s entry into the market and the expansion efforts of Target and Wal-Mart in the region.

Another issue that businesses have to contend with is the misperception of the apparel industry as a sweatshop environment.

“In Los Angeles County, as of January, there were 88,000 people working in apparel manufacturing,” said Kyser. “The concept is that these people are sitting at sewing machines and that’s not true.”

Kyser noted that 69 percent of apparel employees work in skilled areas, including design, marketing, logistics and data processing.

“We have to make people understand that you can do all of the design here as well as the logistics and if people are afraid of cut-and-sew, that can be done offshore,” said Kyser.

The ripple effects from the Sept. 11 terrorist attacks could continue to be felt late in the year, according to Kyser, who noted that the downturn in travel since the attacks could reverberate throughout many industries. “First, you still have the fear factor in flying and the hassle factor,” he said. “Then, corporate profits have been weak and businesses are using this as a reason to cut back on travel.”

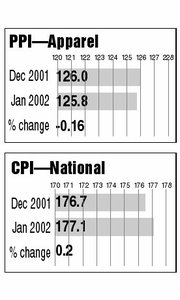

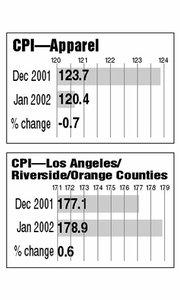

Consumer and Producer Price Indexes

The Consumer Price Index (CPI) for all urban consumers rose 0.2 percent in January, while the Producer Price Index (PPI) for apparel declined by 0.16 percent, according to reports from the Bureau of Labor Statistics of the U.S. Department of Labor.

The annual average of the CPI for the 12-month period ending in January increased by 1.1 percent. The annual average of the PPI during the same time period decreased by 1.2 percent.

Economists at the Bureau of Labor Statistics did not attribute the drop in the PPI to the Sept. 11 terrorist attacks.

The CPI provides a statistical measure of the nation’s economic well-being and is used to adjust wages and salaries as well as keep pensions, rents, royalties and other regular payments in line with changing prices. The PPI measures the average change in selling prices over time that domestic producers receive for their products. Both measurements are made by the Bureau of Labor Statistics.