2004 Retrospective: California Commercial Real Estate Rents: Showroom Space, Retail Remain Strong

Low interest rates and rising values kept the California real estate market strong in 2004.

In the Los Angeles Fashion District, the California Market Center and Gerry Building showroom centers sold for prices at least 60 percent higher than the building’s previous going rates. Similarly, retailers took advantage of favorable interest rates. Macy’s purchased its Union Square store in San Francisco after leasing it for years. Real estate companies Metropole Realty and Heller Properties bought a 7,500-square-foot retail property on Rodeo Drive in Beverly Hills for $20 million. A number of shopping centers were sold to real estate investment trusts, some of which are seeing returns as high as 25 percent.

Leasing activity remained solid to stable for retail and manufacturing/ warehouse space in the Los Angeles area. Rodeo Drive rents averaged $25 per square foot in 2004, compared with $22 in 2002, according to Dembo & Associates. The increase in rents on Melrose Avenue ranged from 10 percent to 13 percent. Rents in the area east of Fairfax Avenue are now $3 to $4.50 per square foot, while the area west of Fairfax commands $4 to $5 per square foot, according to Rob Bader of Sachse Real Estate. West Melrose was boosted by new entries such as Miss Sixty, and Marc Jacobs is opening a store on the street in a couple of months.

San Francisco continues to struggle with a high retail vacancy rate—8 percent to 12 percent—caused by a drop in tourism and other economic factors. But rentals in Union Square are commanding $22.30 per square foot, according to Starboard Commercial Real Estate. And the market is expected to gain support when Spanish retailer Zara opens up shop in the city next year.

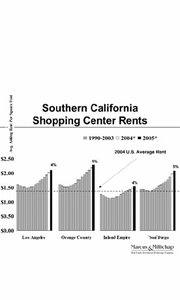

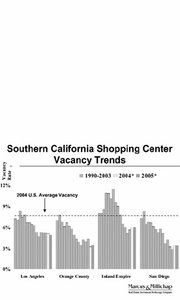

The average retail lease in California is about $1.50 per square foot and is growing about 5 percent a year, according to Marcus & Millichap.

Vacancy rates for warehouse and manufacturing space in the central Los Angeles market dropped to 3.1 percent in 2004 from 4.8 percent in 2003, according to Cushman & Wakefield. The market includes Vernon and Commerce, where most of the region’s apparel industry maintains manufacturing and distribution facilities. Rental lease rates currently range from 27 cents for manufacturing buildings to 39 cents for warehouses.

The industrial real estate market in Orange County, where many surfwear brands are based, has been fueled by demand for smaller buildings in the greater airport area and the south part of the county. Rental rates remained flat at an average of 72 cents per square foot in 2004, while vacancy rates dropped to 4.9 percent.

In San Diego, industrial vacancy rates averaged 7.9 percent, and rental rates averaged 76 cents per square foot for warehouse space and $1.35 per square foot for high-tech/R&D space, according to Colliers International.

In Northern California’s East Bay market, industrial vacancy rates dropped from 11 percent in 2003 to 9.4 percent in 2004, while rates declined from 37 cents per square foot in 2003 to 34 cents per square foot in 2004.

—Robert McAllister