Economic Forecast Holiday 2004: Gas Prices, Job Outlook Could Dampen Holiday Sales

Retailers were looking forward to some Holiday cheer this season, but a Grinch is about to steal Christmas. That Grinch is the price of gas.

No one predicted that oil prices this October would surpass $54 a barrel, particularly when only six months ago no one could have fathomed petroleum prices fetching more than $40 a barrel.

But here we are with unleaded gas costing more than $2.31 a gallon and economists projecting that the rise in home heating oil and natural gas will throw low-income consumers for a loop.

“Gasoline prices are absolutely wreaking havoc with consumer spending, particularly among the lower-income groups,” said Kurt Barnard, president of Barnard’s Retail Consulting Group in Upper Montclair, N.J. “And for many people, there is the large specter of unbelievably high heating- oil prices. And that, in conjunction with the gasoline prices, is a very serious impediment to spending sprees.”

Southern Californian consumers are not as affected by heating- oil prices as people in the Northeast and Midwest, but Southern Californians are affected by high prices at the pump.

Last December, a gallon of regular self-serve unleaded gasoline in Southern California sold for $1.70 a gallon, according to the Automobile Club of Southern California. On Oct. 12 the average price of regular self-serve gasoline in the Los Angeles–Long Beach area was $2.35 a gallon.

The rise in pump prices has prompted Britt Beemer, founder and chairman of America’s Research Group in Charleston, S.C., to revise his Holiday forecast.

“Only 8 to 12 percent of consumers have cut back on their spending so far because of gas prices,” Beemer said. “But I would say with the price of gasoline going a little higher for Christmas, it might be 14 to 16 percent of consumers will adjust their spending.”

The NPD Group Inc., the Port Washington, N.Y.–based group that follows the retail industry, released a survey in early October noting that nine out of 10 consumers said they would spend the same amount they spent last year, alloting about $655 for the Holiday season.

Even U.S. Treasury Secretary John W. Snow noted that oil was “creating headwinds for the otherwise very strong economy.”

Economist Ellen Beeson of the Bank of Tokyo-Mitsubishi Ltd., which tracks sales at more than 70 U.S. retail chains, said the rise in gas prices is expected to shave 0.3 percent to 0.5 percent off gross domestic product growth this year. If petroleum continues to sell for more than $40 a barrel, the price increase will knock off 0.5 percent from next year’s GDP.

Beeson, however, still expects Holiday sales to attain a decent 4.3 percent growth this year. If gas prices had not increased so steeply recently, retailers might have experienced a 5 percent increase, she added.

Meanwhile, the National Retail Federation predicts Holiday sales will be up 4.5 percent over last Holiday season, accounting for nearly $220 billion in sales. In 2003, Holiday sales grew 5.1 percent, compared with only 1.2 percent in 2002.

Rising gas prices will mostly affect retailers that cater to lowincome consumers, such as Wal- Mart Stores Inc., whose average customer has a household income of $35,000. Target Corp. and Kmart Corp. will also be hit heavily.

High-end retailers, such as The Neiman Marcus Group Inc. and Nordstrom Inc., will fare better.

“Clearly, the key worry is that high energy prices have been a drag on overall retail demand. But the effects have been on the lowerincome consumer,” said Michael Niemira, chief economist for the New York–based International Council of Shopping Centers. “One of the things I worry about this year is that the high gas prices, if they last for an extended period of time, will show up as a problem for middle-income households. So far, that hasn’t been a problem.”

On a bright note, many economists are expecting that Microsoft Corp.’s one-time special dividend payout of $3 a share in early December will provide a pleasant Holiday boost for many retailers.

Jobs still scarce

Of more concern to economists is the job situation. The U.S. Labor Department reported that employers added only 96,000 jobs in September, much fewer than the 150,000 jobs expected. That means that President George W. Bush will go into the November elections with 821,000 fewer jobs in the country than when he took office nearly four years ago.

Employment plays a key role in Holiday sales.

quot;Jobs are still hard to get,” Barnard said. “As we like to say in the industry, consumer spending is driven by a four-letter word: jobs.”

In California, the employment situation has improved slightly. In August, the unemployment rate was down to 5.8 percent, its lowest rate since September 2001, when it was 5.7 percent. It is still behind the national unemployment rate of 5.4 percent.

Since the beginning of the year, Los Angeles County has added 24,000 jobs. These jobs are mostly in retail, finance and insurance, professional and technical services, administrative support, transportation and warehousing, and the leisure and hospitality industries.

“Things are gradually improving,” said Jack Kyser, chief economist at the Los Angeles County Economic Development Corp., a nonprofit organization that works to bring more jobs to the region. “The aerospace industry is hiring, and construction activity is holding up nicely. International trade is strong.”

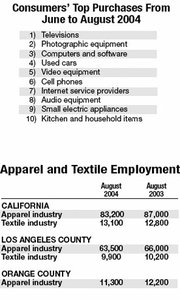

But the apparel industry, both in California and Los Angeles, continues to experience job losses. As of August 2004, there were 63,500 people employed by apparel companies in Los Angeles County, compared with 66,000 a year earlier, according to the LAEDC.

Job attrition in the apparel industry is expected to continue when apparel quotas disappear on Jan. 1, 2005, among the 148 members of the World Trade Organization, making it easier to import clothes from Asia.Future looks fuzzy

Economic soothsayers are predicting that job growth in California will be steady but slow for the rest of 2004. For 2005, Southern California will experience a modest 2 percent increase in jobs, and the state will inch along with a 1.5 percent job growth, said Christopher Thornberg, senior economist with the UCLA Anderson Forecast.

“The reality is that in the next year to year and a half, the consumer issue is a big problem. Real estate looks like it is softening,” Thornberg said. “That means there will be a cooling off of consumer spending. Right now, people are willing to spend because they think they are rich because of housing prices. So the beginning of 2005 will be decent. But by the end of 2005 and at the beginning of 2006, there will be a consumer letdown.”

For California, the state budget and how it is balanced is a key factor in determining growth. UCLA Anderson Forecast Senior Economist John Hurd noted that the state is borrowing from cities and counties across California in an attempt to balance the budget.

Hurd predicts that cities and counties, if forced to forfeit funds to the state’s coffers, will lay off employees. Those layoffs could total 45,000 jobs in 2004 and 2005 if the budget is not balanced.