2005 Retrospective: SoCal Retail Rents Show Strength

Real estate continued on a strong path in 2005, fueled by a number of factors. Demand for specialty fashion increased the need for boutique space on prime thoroughfares in Los Angeles and San Francisco. And institutional investors looked to real estate to fulfill their clients’ needs as alternative investment channels, such as Wall Street and money markets, didn’t come close to providing the returns of real estate investments.

As a result, a number of major shopping centers and commercial buildings changed hands. In the Los Angeles Fashion District, Hertz Investment Group sold the California Market Center in May for about $135 million to Jamison Properties Inc. MJW Investments sold off the first phase of its Santee Court residential development to a pension fund group, and it sold its Gerry Building showroom center for about $13 million to LaeRoc Partners Inc., of Manhattan Beach, Calif.

Retail interest also drove up rents along fashionable streets in Los Angeles, including West Third Street and Melrose Avenue, especially on the west side between Doheny Drive and Fairfax Avenue.

Average rents climbed to about $3.50 per square foot, an increase of 10 percent to 15 percent over the past year. West Melrose Avenue rents jumped about 25 percent to about $6 per square foot, said Philip Klaparda, an associate with Dembo & Associates commercial real estate in Beverly Hills.

“The caliber of tenants Melrose is drawing is helping to increase demand there,” said Klaparda. Newer tenants include Diane von Furstenberg.

Shopping centers are taking a page from specialty stores by shifting away from the typical department-store anchor setup to more lifestyle- and specialty-oriented tenants. Examples of this can be seen at Westfield Topanga in Canoga Park, Calif., and at Bella Terra in Huntington Beach, Calif., where the center’s roof has been torn down to create an open-air shopping experience. The redesigned center also includes nouveau-cuisine restaurants and an REI outdoor-equipment store.

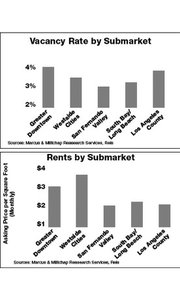

Retail construction in Los Angeles County is on track to increase slightly in 2005 to about 2.3 million square feet, compared to 2.1 million in 2004, according to real estate firm Marcus & Millichap. Shopping-center vacancy is expected to drop 20 basis points to 3.9 percent by the end of the year. In Orange County, retail vacancy rates are expected to drop 10 basis points to 2.7 percent by the end of the year. Marcus & Millichap reported that most of the demand is coming from strengthening consumer spending and an increase in higher-paying jobs in the region. —Robert McAllister