2005 Retrospective: Textile Jobs Hold Steady While Apparel Manufacturing Work Continues Decline

In California, the number of apparel manufacturing employees, including those working in apparel knitting mills and cut-and-sew factories, fell by 3.1 percent to 80,200 in October 2005 from 82,800 the previous year. The number of workers staffing textile mills rose a healthy 5 percent to 14,700 this October from 14,000 in the same period last year. Retail industry jobs grew less than 1 percent to 178,500 from 177,300 last year.

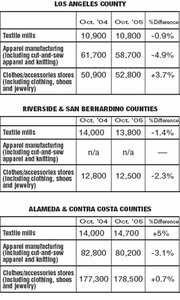

In Los Angeles County, the number of textile workers fell nearly 1 percent to 10,800 from 10,900 one year earlier. Escalating competition from China and other countries continued to lure apparel manufacturing jobs overseas. As a result, apparel manufacturing employment in the county dropped 4.9 percent to 58,700. The retail industry enjoyed a good year, however. The number of workers in clothing, jewelry and shoe stores grew nearly 4 percent to 52,800 individuals in October 2005, up from 50,900 in the same period last year.

After experiencing a significant uptick in clothing retail employment figures in 2004, Riverside and San Bernardino counties saw the number of retail workers fall in 2005. Together the counties saw a 2.3 percent drop in the number of retail jobs, settling in October at 12,500. The number of textile workers dropped 1.4 percent to 13,800 from 14,000.

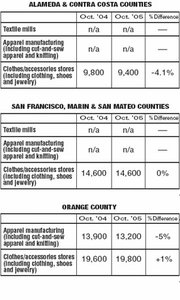

The EDD no longer compiles information on textile mills and apparel manufacturing for the Bay Area, which includes San Francisco, Contra Costa and Alameda counties. Retail employment dropped 4.1 percent in Alameda and Contra Costa counties from 9,800 jobs in October 2004 to 9,400 in October 2005. The number of retail workers in San Francisco, Marin and San Mateo counties remained constant at 14,600.

Orange County saw a 5 percent drop in textile and apparel workers to 13,200. The number of jobs in the county’s retail industry grew 1 percent to 19,800 from 19,600 in the same period last year.

The erosion of manufacturing jobs and the continued strength of the textile industry are forcing a redefinition of the state’s fashion industry. “A lot of interesting things happened this year,” said Jack Kyser, chief economist at the Los Angeles County Economic Development Corp. “Textile employment has been holding steady, even in the face of the uproar caused by outsourcing to China,” he said. To compete with overseas rivals, California’s textile manufacturers are becoming more specialized, he said.

Kyser also sees a silver lining in the apparel manufacturing numbers. “It looks like the industry has reached its bottom,” he said. “Right now the perception is that there are sweatshops in L.A., but there is the opportunity to transition from a heavy cut-and-sew emphasis to an emphasis on design,” Kyser explains.

Still, he warns, there are factors that threaten to disrupt business. The threat of avian flu in Asia is a concern because so much is sourced there, he said. “If a human strain spreads, it can cause disruptions similar to those caused by SARS all over again,” he said, referring to the breakout of severe acute respiratory syndrome that killed hundreds of people and put the brakes on China’s economy in 2003. —Erin Barajas