2005 Retrospective: Wall Street Gives Decent Marks to Target and Ross

One of the biggest business stories of Holiday 2005 has been promotions, and discounters such as Wal-Mart Stores Inc. and Target Corp. and off-pricers such as Ross Stores made promotions a key part of their strategies.

While newspaper headlines noted heavy crowds shopping discounters on Nov. 26—called Black Friday, the traditional start of the Holiday buying season—Target and Ross reported modest gains for November.

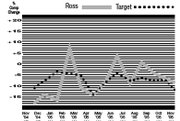

Ross earned a 5 percent comparative- sales gain over the same period in the previous year but stumbled from its double-digit gains of June and August.

Target marked its second-lowest showing of the year in November. It reported comparable sales of 2.6 percent compared to a peak monthly sales high of 9.4 percent in January 2005.

Target Chairman Bob Ulrich said the performance was in line with the company’s revised outlook for the month, and the Minneapolis-based discounter remained optimistic that the rest of the Holiday would be profitable.

Many financial services firms supported Ulrich’s optimism. UBS Investment Research, for example, recommended Dec. 13 that its clients buy the retailer’s stock.

Ross, based in Pleasanton, Calif., also continued to gain support from the financial community throughout much of the year. Sun Trust Robinson Humphrey upgraded its stock recommendation from “neutral” to “buy” on Oct. 6, and Morgan Stanley gave Ross a high recommendation on June 24.

Although Ross’ same-store sales may have been unimpressive for much of this year, Nathan Parmelee, an analyst at The Motley FoolWeb site, said that it was unfair to judge a company on one quarter’s slump. “After all, this is a company that has rewarded shareholders with significant gains not only since 2000 but since going public,” he said, “and it doesn’t look like there’s any structural reason to believe that the company can’t continue doing so.” —Andrew Asch