June '05 Retail Sales Surge

Good business to last through summer, forecast says

Apparel was hot in June. Clothing retail sales increased by 4.7 percent, the strongest segment gain since October 2004, according to the New York–based International Council of Shopping Centers. The group said the good news was shared by the entire retail sector.

Retailers reported an increase of 5.3 percent in June, compared with the same period last year, according to the ICSC’s index charting the monthly sales of 70 chain stores. ICSC Chief Economist Michael Niemira credited the growing demand for clothes to the summer heat that drove East Coast and Midwestern consumers to buy warm-weather clothes.

But June was temperate in California; temperatures frequently hovered near 64 degrees Fahrenheit. Still, cooler temperatures did not keep Californians away from the malls, according to Jack Kyser, chief economist for the Los Angeles County Economic Development Corp.

Kyser said Californians bought as much apparel as the rest of the country. Because national retail chains do not separate out regional sales, Kyser said he relies on anecdotal data for breaking news on the local economy. “It’s finding out information such as whether shopping center parking lots are full. They are, and people seem to be spending,” he said.

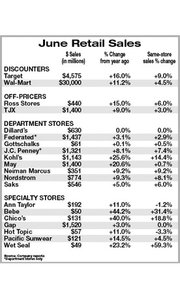

The top nationwide performers serve the retail categories that have been doing well for most of 2005: the teen and luxury markets. Dallas-based luxury dealer Neiman Marcus reported a good comparable-store sales increase of 9.2 percent. New Albany, Ohio–based youth clothier Abercrombie & Fitch Co. reported comparable-store sales rose 38 percent.

Foothill Ranch, Calif.–based The Wet Seal Inc. reported a same-store sales increase of 59.3 percent. But many retail analysts noted that Wet Seal’s strong numbers were based on comparing the teen retailer’s currently profitable business with its dismal business during the past two years.

“It goes back to a matter of comparison. If their business hadn’t been so bad for so many years, their comps wouldn’t be so high,” said Jeffrey van Sinderen, an analyst with Los Angeles–based B. Riley & Co.

Wet Seal suffered through two years of double-digit declines in same-store sales. The company began making profits again in early 2005. Van Sinderen credits Wet Seal’s return to health to the company’s merchandising strategies.

City of Industry, Calif.–based Hot Topic Inc.’s same-store sales decreased 3.3 percent, but analyst Liz Pierce said she has faith that the mall-based chain will see better days because the retailer’s biggest selling seasons, Back-to-School and Halloween, are just around the corner.

And the good days should continue, according to Niemira, who forecasted that retail sales will continue to grow through September. —Andrew Asch