Sweet May '06 Sales Could Bring Strong June

May was a good month for retail. And June is looking good, too.

Retail sales increased 0.1 percent for the week ending June 3, according to the New York–based International Council of Shopping Centers. The numbers follow a strong showing for May, when retail sales for chain stores increased 4.1 percent from the previous year.

A low unemployment rate in California— 4.9 percent in April, according to the California Employment Development Department—should set the stage for increased consumer demand this summer, said Jack Kyser, chief economist for the Los Angeles County Economic Development Corp. “I think we’ll have a good month in June because the economy is stronger than people imagine,” he said.

Warm weather across the country increased demand for summer clothes, according to the ICSC.

But skyrocketing fuel prices—more than $3.20 for a gallon of gas in Los Angeles— put a limit on that demand. Rising fuel prices is one reason why apparel chain stores reported a modest gain of 2.7 percent in May, according to the ICSC.

California-based chains Hot Topic Inc. of City of Industry, Pacific Sunwear of Anaheim and Wet Seal of Foothill Ranch reported negative same-store sales in May. The weak numbers, however, may not indicate a slowdown in this market segment, said Jeffrey Van Sinderen, a retail analyst for financial services company B. Riley & Co. in Los Angeles.

“Historically it’s been the teen segment that has been the most insulated from economic turbulence,” Van Sinderen said.

While teenagers’ allowances may be less likely to be affected by economic trouble, retailers may not be protected against their own mistakes.

Analysts forecast that Pacific Sunwear would report same-store sales in the positive low-single digits for May. Instead, it showed a decline of 2.6 percent. Van Sinderen blamed a poor footwear business for the decline.

Sales have declined for 21 of the past 24 months at Gap Inc., which reported a same-store sales slide of 6.0 percent in May. The San Francisco–based company hopes to turn its fortunes around with new merchandising and a new look for its stores, President Cynthia Harriss said June 6 at the Piper Jaffray Consumer Conference in New York. She announced that Gap stores would be remodeled with new Gap merchandise sold at several mini-shops inside the larger Gaps.

Retail analyst Cynthia Chen said Gap’s new looks would help—eventually. “They’re doing the right thing, but it won’t work out overnight,” said Chen, who works for Pacific Growth Equities in San Francisco.

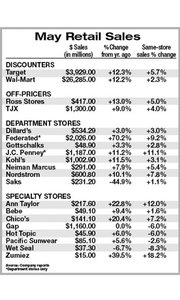

Department chain stores also performed well in May. According to the ICSC, the category’s sales increased by 6.7 percent. Federated Department Stores, Inc. had a stellar month. The department store giant’s net sales shot up 70.2 percent, a boost credited to last year’s merger with May Company. The new company earned $2.026 billion compared to total sales of $1.189 billion in the same period last year.

On the other end of the spectrum was Saks Inc. which saw its net sales plummet 44.9 percent. Its May same-store sales increased 1.1 percent.

Analysts have blamed Saks’ declining sales on a range of reasons from a failure to contain costs, to dumping solid money makers such as its private label in an effort to become more active in the contemporary market, according to a May 2 research note by Merrill Lynch. —Andrew Asch