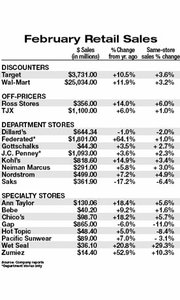

February '06 Cold Puts a Chill on Retail Sales

Sales at apparel chain stores declined by 1 percent in February, but, for the most part, America’s business was good, according to Michael Niemira, chief economist for the New York–based International Conference of Shopping Centers.

“The customer keeps spending. That trend is still quite robust,” Niemira said.

The ICSC’s index of chain store sales grew 3.2 percent in February. It was the softest performance since July 2005, when the index grew 3.6 percent. February’s sales performance also had the poor luck of following the stellar sales of January 2006, when the ICSC index reported gains of 5.2 percent for the retail sector.

Both January and February have been traditionally slow times for retailers. Niemira forecast that March might be slow too, with an increase of only 3 percent. Easter falls on April 16 this year and economists expect sales to climb in that month.

A retail boost might arrive earlier, according to the National Retail Federation. The Washington D.C.–based trade organization forecast that consumers will spend an estimated $2.69 billion on St. Patrick’s Day, March 17, marking a significant increase from $1.94 billion in 2005.

Economists blamed February’s sluggish sales on a decrease in gift-card redemptions. More than 40 percent of gift cards given in Holiday 2005 were redeemed in January, according to the ICSC.

February’s cold weather also sapped interest in Spring fashions. Consumers were more apt to buy heavy winter clothes at a discount store than the latest premium jeans at a specialty store, according to Niemira.

The poor weather was blamed for highperforming retailers such as Abercrombie & Fitch Co. and American Eagle Outfitters Inc. reporting single-digit same-store sales, 5 percent and 6 percent respectively, not the double-digit comparable-store sales they have enjoyed in the past year.

The attention paid to cold weather is one reason Pacific Sunwear, the Anaheim, Calif.–based purveyors of surfwear, reported a 3.1 percent decrease in same-store sales. It was their first same-store sales decrease since April 2005.

Pacific Sunwear’s performance was a disappointment, according to Liz Pierce, a retail analyst for financial services firm SandersMorrisHarris, but it was not evidence of a general decline. She wrote in a March 3 research note that she believed sales would return because of the company’s long-standing strengths such as its typically firm operating performance, its solid balance sheet and the strength of the company brand.

One February bright spot was the performance of Wet Seal Inc., based in Foothill Ranch, Calif. The teen retailer’s same-store sales increased 29.3 percent. Pierce gave Wet Seal’s performance high marks.

“We believe that Wet Seal is sitting in a very sweet spot,” she wrote in another March 3 research note. “We think this month’s performance really validates the company’s merchandising and pricing strategies.” —Andrew Asch