Will Shipping Rates Float Importers' Boats?

LONG BEACH, Calif.—Negotiations begin soon on new shipping-rate contracts that start on May 1. But at this point, it is anybody’s guess where rates will go.

Last year, shipping rates from Asia to the West Coast declined or were flat for most of the year even though trade volumes on that route were up about 10 percent.

That doesn’t seem to make sense. But when you consider that shipping lines have been taking delivery of newly built megaships that carry as many as 10,000 20-foot containers, then you realize there is a big supply-and-demand issue here.

Last year, with bigger ships on the sea, there was a great deal of cargo capacity, which meant shipping lines began discounting rates to fill those vessels with metal containers jammed with furniture, toys, apparel, television sets, iPods and anything else that is made in Asia.

But this year could be a different story.

Julie Lim, executive director of Asia-Pacific transportation research at Goldman Sachs in Hong Kong, said she believes that trans-Pacific rates will rise slightly this year for a number of reasons. “Confidence has returned to the liners since the third quarter of last year, buoyed by very strong demand in Europe and decent demand in the United States,” she told a group of industry leaders at the seventh annual Trans-Pacific Maritime Conference, held March 5–6 at the Long Beach Convention Center. “Shipping lines have realized that they shot themselves in the foot in early 2006 [when they lowered rates]. We believe there is an increasing likelihood that freight rates could rise this year.”

Another factor that led to softening freight rates last year was the housing slump in the United States. Declining home sales in 2006 led to soft furniture sales. Furniture makes up 12 percent of all goods being shipped from Asia to the West Coast. Last year, shipments of furniture were flat, Lim said.

However, apparel shipments increased 12.4 percent, auto parts were up 7 percent and footwear rose 4.3 percent. “Load factors in 2006 were fairly decent and remained above 90 percent for a significant part of 2006,” Lim noted.

Another indicator of rising shipping rates is a jump this year in those fees charged by shipping lines serving the Asia- Europe route. Trade along this sea passage grew 13 percent last year, said Ron Widdows, chief executive officer of APL Ltd., a subsidiary of Singapore-based Neptune Orient Lines. “In January, the rate improvement in Asia-Europe sent some fairly significant signals to the marketplace,” Widdows told the group of logistics experts, customs brokers, trucking executives and shipping-industry professionals. “What that means for the trans-Pacific is hard to say.”

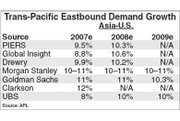

He said most analysts believe that trans-Pacific trade will be flat or down a little in 2007. But there will probably be a growth in rates on the all-water route that goes from Asia through the Panama Canal and to the East Coast as intermodal fees charged by railroads and trucking companies continue to climb.

Railroads have finally been seeing significant revenue growth now that intermodal shipping has grown, with the number of containers being sent from the West Coast to the East Coast increasing.

Peter Keller, chief operating officer and executive vice president of NYK Line, based in Tokyo, noted that intermodal services now account for about 23 percent of all rail revenues, surpassing revenue from coal transportation.

That is expected to rise when the federal government makes all truckers hauling containers in and out of the ports enroll in the Transportation Worker Identification Credential Program. To get a TWIC card, truckers must undergo a background check and verify their legal residency in the United States. It is feared many independent truckers will not qualify because as many as 20 percent are believed to be illegal immigrants.

Brian McDonald, vice president of intermodal marketing and sales for Union Pacific, said it is likely that rates will go up as the company invests $3.2 billion in capital this year for upgraded rails and other projects. Intermodal capital investment accounts for two-thirds of those dollars. “I think the largest rate increases are behind us,” Mc- Donald said. “You will continue to see increases, but the big rate issues are over.”

Transportation experts said ports will have to become more efficient to handle the onslaught of cargo expected to be arriving on the West Coast in the future. Not only will more technology have to be integrated in the system, but more on-dock loading of cargo containers onto trains will have to occur instead of trucking containers to a local rail yard.

Now, about 28.9 percent of railbound cargo at the Port of Los Angeles is loaded at the docks. At the Port of Long Beach it is only 17.6 percent.