Discounters Drive July Sales

Discount retailers had a lot to cheer about in July. Consumers flocked to stores such as Wal-Mart and Ross Dress for Less to find deals.

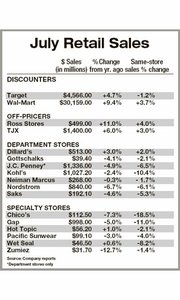

Wal-Mart reported a same-store sales increase of 3.7 percent in July, and its chief executive, Eduardo Castro-Wright, credited bargains for driving consumer traffic to the store. Ross Stores Inc., the Pleasanton, Calif.–based parent company of Ross Dress for Less, reported a same-store sales increase of 3 percent in July. Michael Balmuth, president of Ross, said his company’s profits depended on offering low prices. Warm weather also helped make dresses a top sales item at Ross.

Discounters and clearance sales helped drive the retail sector to a 2.6 percent sales increase, compared with July of the previous year, according to the New York–based International Council of Shopping Centers. During July, most department stores and specialty retailers reported weak performances.

Little Rock, Ark.–based Dillard’s stood apart from most other stores when it reported a same-store increase of 2 percent for July. Same-store sales for Seattle-based Nordstrom dropped 6.1 percent in July. Plano, Texas–based JC Penney’s same-store sales declined 6.5 percent, and luxury department store Neiman Marcus reported a decline in its same-store sales of 1.7 percent.

Chico’s FAS Inc., based in Fort Myers, Fla., reported a steep drop of 18.5 percent in its same-store sales for July. According to a company statement, the lower earnings were a result of lower sales for the quarter and higher markdowns of the Chico’s brand. Chico’s President Scott A. Edmonds said his company’s low sales in July could make for better business going forward. “Our inventories are better positioned as we go into the Fall season. Our balance sheet remains strong.”

Menomonee Falls, Wis.–based Kohl’s reported a decline of 10.4 percent in same-store sales in July. Kohl’s Chairman Larry Montgomery said his stores’ inventory sales were significantly lower in July, which affected sales. However, the lower inventory also led to an improved gross margin, and Montgomery said Kohl’s is well-prepared for the Back-to-School season.

July was a tough month for many specialty stores. The Wet Seal Inc., based in Foothill Ranch, Calif., reported a decline of 8.2 percent in same-store sales. The long-suffering San Francisco–based retailer Gap Inc. reported a decline of 11 percent.

Some bright spots in the specialty scene included Los Angeles–based American Apparel Inc., which reported a 25 percent increase in its July same-store sales for its 145 stores. Teen retailer Aeropostale reported an increase of 13 percent in its July same-store sales. Urban Outfitters also reported a 13 percent increase in same-store sales for its third fiscal quarter. Their performance led analyst Christine Chen to write that consumers are still spending money for fashion.

“We believe unique, quality, trend-right product is even more valuable to the consumer in this environment as shoppers make purchases on a ’want it’ versus ’need it’ basis,” Chen wrote in a research note Aug. 7. Chen covers retail for San Francisco–based Needham & Co. LLC. —Andrew Asch