February '08 Sees Shaky Gains

Economists judged February to be a better month for retail sales than they had initially forecasted, but the gains were shaky.

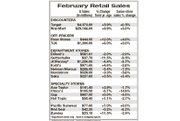

Reports were mixed as to the extent of the increases. According to the New York–based International Council of Shopping Centers, February retail sales increased 1.9 percent. Economists for New York–based The Bank of Tokyo-Mitsubishi reported that American retail sales increased 2.4 percent in February compared with the same time in the previous year.

Both economic forecasters credited Wal-Mart with boosting the entire retail outlook in February. According to the Bank of Tokyo, if Wal-Mart’s gains were taken out of the picture, American retail sales would have climbed 0.5 percentage points less.

Going forward, the retailer issued a conservative forecast for March, with sales increases ranging from flat to 2 percent. Wal-Mart Chief Financial Officer Tom Schoewe said the discounter’s customers want to cut back on spending.

Tepid sales were felt across the retail sector, according to Michael Niemira, chief economist for the ICSC. “Sales were weak for apparel specialty and department stores, as well as the luxury sector,” Niemira said. “Looking forward to March, we expect spending to improve slightly, as we are projecting an increase of about 2 percent,” he added.

Typically strong luxury performer Neiman Marcus reported a decline of 7.3 percent. However, Saks’ comparable sales increased 3.4 percent over the same time in the previous year. Dillard’s, JCPenney and Gottchalks all reported same-store sales declines. In other department-store news, Macy’s said recently that it will stop reporting its monthly sales beginning in February.

Specialty stores experienced an uneven market. Chico’s declined 14.9 percent in February. Wet Seal’s same-store sales dropped 8.2 percent. But Anaheim, Calif.–based Pacific Sunwear reported an increase of 6 percent. Sales improved because its apparel business has been very strong, according to Jeffrey Van Sinderen, a retail analyst for Los Angeles–based B. Riley & Co. The teen retailer’s outlook has also improved since it announced Jan. 4 that it would shutter demo, its urbanwear retailer. —Andrew Asch