Store Closures Add Another Stake to Economic Downturn

California’s retail landscape is being pelted by a spate of store closures by national retailers. That could spell trouble for many real estate investors, but, at the same time, the news may open up opportunities for retailers in expansion mode.

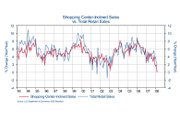

While concepts such as Caruso Affiliated’s The Americana at Brand, which recently opened to a full house, appear to be on a high road, suburban malls and neighborhood shopping centers are feeling the brunt of a sluggish economy beset by high gasoline and food prices, a slowing housing market, and a weak U.S. dollar.

Most of the national chains that are downsizing are moderate-level specialty stores that are typically based in more-traditional, enclosed centers.

The most recent announcements come from Clifton, N.J.–based Linens ’n Things, which earlier this month filed Chapter 11 bankruptcy and said it would close 120 stores, about one-quarter of them in California. The news came on the heels of announcements by Burbank, Calif.–based Walt Disney Co., which said it plans to close 100 Disney Store units while retaking control of the remaining stores from The Children’s Place.

Even Home Depot is slowing down. The Atlanta-based home-improvement chain announced this month it is closing 15 stores.

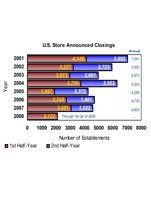

During the first quarter, Pacific Sunwear of California said it is closing down its footwear chain, One Thousand Steps, as well as 147 d.e.m.o. stores, which sell urban and streetwear. Other announced closures came from Ann Taylor (117 units), Charming Shoppes (150 units), Foot Locker (140 units), Wilson’s Leather (158 units) and Talbots (78 units).

In the first quarter of 2008, retail closures totaled 2,122 stores nationwide—a figure that surpasses last year’s halfway mark, according to the trade organization International Council of Shopping Centers. Apparel stores led all retailers, making up 38 percent of the closures, and California was a key focus of the retailers. If the rate continues through the year, the level of closures should reach 6,500 stores, the highest level since 2001, reported ICSC economists. That will almost certainly mean higher vacancy rates at malls.

A report by Boston-based Property & Portfolio Research estimated that retail vacancies could climb to the 10 percent to 12.5 percent level. It singled out markets including Southern California, Las Vegas, Phoenix and Florida as those taking the biggest hits because of its heavy retail concentration. Absorption rates are also expected to fall to 3.7 million square feet, compared with 60 million square feet last year.

ICSC economist John Connolly said the numbers are high but may not be as bad as they appear because of the amount of existing retail. Even though 803 apparel stores were set to close across the country during the first quarter, it represented only 0.6 percent of all clothing stores.

But it shouldn’t be overlooked, said Jack Kyser, senior economist for the Los Angeles Economic Development Corp.

“It is impacting us here. You have big-box stores like Levitz and Wickes [furniture] stores closing. Bombay Stores, Starbucks and Talbots are closing stores, too, as are restaurant chains. A lot of retailers are going through their portfolios and seeing where they can save.”

The impact, however, is unlikely to affect retail rents in the near future, according to Kyser, who said he does not expect retail rents to go down soon. Neither does retail consultant George Whalin of Carlsbad, Calif.–based Retail Management Consultants.

“It’s probably too soon to see how it’s going to affect rents,” he said. “In the past, it hasn’t had a major impact because these mall operators will maintain or raise rents regardless of the economy. How they do that, I don’t know. But the closures will have an effect. You’re going to see more empty spaces, and it will continue at the specialty store level.”

Whalin said the difference between now and the big decline in the ’90s was that most of those previous closures came from department stores, leaving big vacancies in shopping centers. However, the closures by big-box retailers such as Home Depot could have a significant impact if they continue.

Reza Etedali, chief executive officer of Irvine, Calif.–based Reza Investment Group Inc., which invests in retail properties, said he has seen an increase in delinquencies among shopping-center tenants and softening demand across many sectors.

“A lot of the retailers went in ahead of housing developments and got caught,” he said. “But strong markets like Orange County or Los Angeles are not going to be affected as much.”

Ron Kuykendall of the Washington D.C.–based National Association of Real Estate Investment Trusts (NAREIT), which represents many shopping-center owners, said the closures have yet to trickle down to the bottom lines of shopping-center REITs.

“Fundamentals in the retail REIT sector remain strong, and the companies have recorded solid earnings results this spring,” he said.

Stepping in

The store closures are creating more space for retailers looking to expand. Retailers such as Abercrombie & Fitch’s Hollister division have taken over some of the vacancies, said the ICSC’s Connolly.

“It appears to be more of the newer brands taking advantage,” he said.

The vacancies aren’t coming just at the malls. As previously reported, streets such as La Brea Avenue in Los Angeles, which is inhabited by boutiques, have also experienced a number of closures.

That profile is more fitting for retailers such as Los Angeles– based American Apparel.

Indeed, the company may soon take advantage of the opportunities.

“There’s a lot of real estate out there now because a lot of retailers are struggling,” Chief Executive Officer Dov Charney said at a recent investor conference. “That’s an opportunity for us.”