Juniors Brands Make a Move Into Contemporary Territory

Juniors brands have grown adept at turning upscale inspiration into sharply priced goods for the price-conscious shopper and the younger set. Now, the specialty stores and boutiques that once provided fashion fodder for juniors brands are welcoming them to their racks.

“There were times when I passed on really cute [brands] because I thought they were not exclusive enough, not independent enough, not avant-garde enough,” said Jennifer Phillips, owner of the Sirens & Sailors boutique in Los Angeles’ hip Echo Park neighborhood.

“Now customers want all those things, but they also want affordability. These days, it’s about making them happy and making their wallet happy, and I am open to all kinds of resources I would never have considered in the past, including juniors brands.”

The stigma, Phillips said, of picking up juniors brands has faded as the economy tanked. “We want to maintain our upper-boutique status by carrying [contemporary and designer] brands, but it’s a new day. If a brand has the right look at the right price point, we’ll pick it up.”

These days, $60 juniors dresses hang alongside Sirens & Sailors’ carefully chosen vintage and young designer offerings that retail in the $200 echelon.

That’s good news for some juniors brands that are struggling with department stores that demand bargain-basement pricing combined with fast fashion–style garments.

Gloria Brandes, founder and designer of the BB Dakota young contemporary brand and Jack by BB Dakota juniors brand in Irvine, Calif., said wrangling with department stores’ demands is pushing her to seek alternative distribution avenues—not the least of which are contemporary boutiques.

Barry Balonick, owner of the Lunachix juniors brand in Los Angeles, agreed. “There is a big push for drop-dead cheap clothes in department stores,” said Balonick, who also manufactures private-label juniors apparel.

Juniors brands capable of upgrading their fabrication and offering trend-right pieces at a reasonable price are finding new opportunities at boutiques and specialty retailers—or in the contemporary departments of major retailers.

As if to illustrate that point, Brandes is transforming BB Dakota, which started out as a true-blue juniors brand, into a young contemporary brand. Jack by BB Dakota, which was launched to fill the juniors void left by its big-sister brand and retails for 30 percent less, is also moving more upscale, Brandes said. “I’m doing almost no business with juniors departments [in department stores] because they are so price-oriented. We’ve abandoned them for more specialty departments, and, as of spring 2010, we’ll be out of juniors departments completely. I have no interest in it,” she said. “Juniors is an over-populated segment. It isn’t the success story it once was.”

Eyeing the competition

Luckily, contemporary buyers for years have been sneaking a peek at juniors brands. “Why wouldn’t they? Contemporary is taking on a younger edge, and juniors brands have been skewing a little older. The lines were already blurring, and then the economy pushed it all over the edge,” Lunachix’s Balonick said.

Lunachix has enjoyed a strong uptick in interest among contemporary retailers actively searching out juniors resources. The brand, which offers a full range of garments—including knit and woven tops and pants, dresses, and denim—was one of the first to take its fabrications more high-end than the typical juniors fare. The breadth of its offerings, its fabrications and its $24–$80 retail price points have been the key to getting the brand into non-juniors distribution channels, Balonick said.

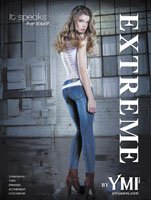

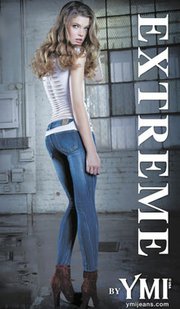

YMI, a Los Angeles–based juniors denim brand, is looking for wider distribution possibilities by fast-tracking its expansion into sportswear and activewear for Spring 2010. Deke Jamieson, the brand’s executive vice president of licensing, said that while YMI will remain a true juniors brand, expanding its offerings is key to growing.

“Expanding into tops, dresses and activewear, while maintaining a high price-to-value relationship, is going to make us a more important brand to both retailers and consumers,” he said.

From a design perspective, juniors brands and more high-end brands are pulling from the same sources for inspiration. “We’re all looking at the same magazines, the same trend reports, the same everything. Where juniors brands differentiate themselves is price point,” Jamieson said.

To communicate its new positioning, which includes upgraded styling and fabrications, YMI dropped the “Jeansshy;wear” tag from its label and went to the MAGIC Marketplace in September with a new booth for the new concept. “The booth was bigger and featured a fresh, new look for the brand. It didn’t look like a booth for jeans, and it communicated that to buyers,” Jamieson said.

Barbara Fields, founder of the Los Angeles–based buying office bearing her name, said there are many juniors brands, both established and brand new, waiting in the wings for their shot at specialty and contemporary retailers. “I’m looking at a list that’s five pages long of new juniors brands that don’t want to be in department stores and are targeting good specialty stores,” she said.

The burgeoning “better juniors” market, as Fields calls it, is making it so that specialty stores can still get exclusivity and “attitude.” “These new resources offer elevated perception at juniors prices,” she noted.

Creating a new price point

Balonick thinks the interest from contemporary buyers will remain even when the economy recovers. “There is less resistance on the part of [specialty and contemporary retailers] now toward juniors because everyone is looking for help keeping their doors open and their lights on. But we’ve created a new price point in the market, and it will stick.”

Camille de Soto, owner of the Lady boutique in Los Angeles’ Eagle Rock neighborhood, agreed. She has stocked her shop with a mix of contemporary, vintage and juniors brands since she opened in 2007 and can’t see losing the wallet-friendly juniors resources. “Most customers don’t realize if it’s a juniors line. They’re not aware and it doesn’t matter. I’m always going to buy [from juniors resources] because the fashion is fun and inexpensive and it sells,” she said.

Kaitlyn Whalen, the manager and buyer at the Animal House specialty store in Los Angeles’ Venice Beach, said juniors apparel accounts for 25 percent of her business. The store stocks goods from high-end and mid-range brands as diverse as Mike & Chris, !It Jeans, Jack by BB Dakota, Ella Moss and Joe’s Jeans. “We’ll keep selling [juniors goods] because our customers keep buying it. People like a $60 jacket that is of decent quality,” Whalen said. “Joe’s Jeans aren’t flying out the door [at over $120], but we sell a lot of !It Jeans [in the $50 range].”