Rising Employment, Interest Rates and Inflation Set the Economic Tone for the Next Few Years

Finance

As of Friday, March 10, 2017

A new Trump administration should be good for the U.S. economy over the next couple of years, but there might be some bumps in the road for California, according to a UCLA report released March 8.

With the threat of millions of immigrants being deported, California’s workforce could be adversely affected, particularly in the agriculture industry, where some 50 percent of the laborers are believed to be in the country without proper documentation, economists wrote in the quarterly UCLA Anderson Forecast.

Jerry Nickelsburg, a senior economist with the forecast group and an adjunct professor of economics at the UCLA Anderson School, notes that no one is sure what Trump plans to do about the 10 million illegal immigrants in the country but he keeps threatening to do something.

“The changed rules of engagement by immigration have sent a chill through the immigrant community,” Nickelsburg said. “We don’t know what is going to happen, but we do know that it can cause people to withdraw from the labor force, at least temporarily.”

In California there are four areas where immigrants primarily work. They are in gardening and minor home maintenance, construction, agriculture, and nondurable goods manufacturing, which includes the apparel industry.

If there were forced deportations, the agriculture industry would take a big hit with a significant reduction in the production of food, food processing and particularly in the preparation of meat products. The report said residential construction and garment manufacturing would also be adversely hit.

“This is a risk that will be watched closely and, were it to become more of a reality in the next three months, will lead to a downward revision of the economic forecast,” Nickelsburg wrote.

Another dent to the state economy will be to the tourism industry. With a new travel ban imposed on certain foreigners and the rising value of the dollar, the number of tourists coming to the Golden State could decline as overseas travelers find it harder to get a visa and as travel to the United States gets more expensive.

“At the moment, the dollar is relatively stronger that many other currencies, which makes America a more expensive vacation and other countries a cheaper vacation,” Nickelsburg said. “When it comes to visas, while California doesn’t receive a lot of tourists from the Middle East, there are some Asian countries where tourists come from that have a significant Muslim population. The visa process is going to discourage some people because it will take more time and be more difficult to get a visa.”

Furthermore, the United States now is being perceived as less friendly toward foreigners and that will discourage some international tourists.

(See related story, "Retailers Anxious over Travel Ban.")

In 2015, the U.S. Department of Commerce said there were 17 million international travelers to California, including 7.8 million people from Mexico, 1.1 million from China, and 580,000 people from India and the Middle East. During that same year, international visitors spent $15.2 billion, of which 64 percent was on leisure and hospitality and about 19 percent was on retail.

The strong dollar alone is expected to reduce the number of foreign tourists coming to California by 5 percent this year and 1.1 percent next year. That translates into a loss of $7.5 billion in direct income in 2017 and a drop of $9.2 billion in 2018.

Delayed tax cuts

One of Trump’s major rallying cries has been for a sizable cut to personal income and business tax rates. At first, UCLA economists thought this financial gift would materialize later this year, but now they believe that it will happen in the first quarter of 2018.

“With $500 billion in [personal and business] tax cuts arriving in the first quarter of 2018, we expect a short-term growth spike that will soon fade as the economy bumps against its full-employment ceiling,” wrote UCLA senior economist David Shulman.

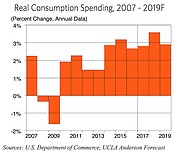

Initially, the tax cuts will prompt a 2.8 percent increase in consumer spending this year and another 3.6 percent jump in 2018.

That, in turn, will lead to a 2.4 percent growth this year in the country’s gross domestic product, a 3 percent GDP jump in 2018 and a 2.2 percent gain in 2019.

But a large tax cut will lead to a big boost in the federal deficit, which is expected to exceed $1 trillion in 2019 compared to $600 billion in 2016. This will probably lead to more inflation.

Jobs should continue to grow over the next three years, with 170,000 jobs being added every month this year and next and then trailing off to 110,000 jobs a month by 2019. The unemployment rate should bottom out at 4.1 percent in late 2018 and then gradually rise.

On the inflation front, the benchmark interest rate is expected to rise with a possible 0.25 percent increase coming at the mid-March meeting of the Federal Reserve Board, chaired by Janet Yellen. Yellen has indicated in past interviews that there could be two more interest rate increases this year after March.

By the end of the year, UCLA Anderson economists forecast that the funds rate is expected to be near 2 percent and reach 3 percent by the end of 2018.

Higher interest rates means that the rate on a 30-year fixed-rate mortgage is forecast to exceed 6 percent by 2019, up from the current 4.25 percent and almost double the recent low of 3.5 percent.

Despite all the talk of border taxes and increased protectionism, the strong dollar and tax cuts will ignite an import boom. After increasing by only 1.1 percent in 2016, imports will inch up by 4.3 percent in 2017 and climb 7.3 percent in 2018.

But export growth will be minimal as the strong dollar and retaliation from the administration’s protectionist views will limit export opportunities in the aircraft and agricultural sectors, UCLA economists said.

Also, a trade war with Mexico could harm the U.S. and California economies. In 2015, the United States exported $236 billion in goods and services to Mexico while importing $309 million.