Retail Vacancies Are Up in L.A. County

Retail

As of Friday, May 17, 2019

Blame the closure of big-box stores for an uptick in retail vacancy rates in Los Angeles County during the first part of 2019.

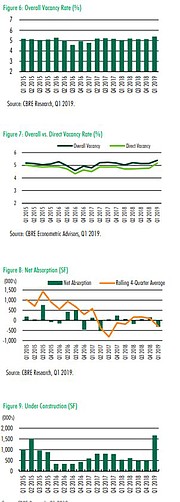

According to a recently released report by CBRE, a real-estate and investment-services company, overall retail vacancies inched up to 5.4 percent in the first quarter of this year from 5.1 percent in the fourth and third quarters of 2018.

Overall retail vacancies across the county grew because of the closure of big-box stores such as National Stores’ Fallas and Sears. Both filed for Chapter 11 bankruptcy protection last year.

But the CBRE report remained bullish on the retail-real-estate scene in L.A. County because of upcoming development projects. Plans were announced in September to start development on the Los Angeles Premium Outlets in Carson, Calif. Mall developers Macerich and Simon will work together to develop the new outlet mall, scheduled to open in the fall of 2021.

The CBRE report also broke down vacancies by individual L.A. County neighborhoods. The area with the highest overall retail vacancy rate was the greater downtown Los Angeles area with 8.8 percent of retail spaces being empty. This includes the Arts District and the intersection of 9th Street and Broadway, which had been widely anticipated to be the next hot spots for specialty retail.

CBRE’s Andrew Turf said downtown has a greater vacancy rate because more properties are coming on the market. He anticipates in the future there will be increased demand for downtown Los Angeles space.

“There is great demand for downtown,” said Turf, CBRE’s senior vice president of high-street retail services. “Everyone is going to see the potential when the big boys open.”

An Apple flagship is taking over the historic Tower Theatre on Eighth Street and Broadway as the interior of the 1927 historic structure is being revamped to retain some of the original finishes in a big dose of modernity.

Next to the Apple store, a Vans flagship is scheduled to open this summer, as is a Paul Smith store not too far away on Broadway.

Turf said he recently closed a deal to bring Makoto, a high-end Miami restaurant, to a food hall being developed at 755 Los Angeles St., which is located in the Fashion District.

A bullish outlook on downtown Los Angeles is not shared by everyone. Commercial-real-estate agent Brigham Yen has been publishing the commercial-real-estate blog “DTLA Rising” for almost a decade.

He observed that downtown’s retail-real-estate market hasn’t been growing as fast as anticipated for two reasons. One is that the huge homeless population scares away affluent shoppers, and parking is a major issue because the majority of shoppers travel to the area by car.

“There is no free or cheap parking,” Yen said of downtown Los Angeles. “If 90 percent of Angelenos rely on driving, you’re going to need more parking. You’re going to need convenient, cheap parking to compete with other retail districts in the region.”

Downtown Los Angeles parking areas also need to be easier for out-of-town visitors to find, he said.

According to Yen, the most successful retail area in downtown Los Angeles is the Fig@7th mall, which is located next to a parking structure with 500 spaces. He also said Little Tokyo, near downtown Los Angeles, has been thriving because of parking structures.

“If we don’t mitigate the homeless issue and add parking, it’s going to limit and hurt the potential of downtown L.A. The [area follows a] suburban, metropolitan model. This isn’t Tokyo. This isn’t London or New York. Let’s stop pretending.”