RETAIL

Economy Healthy Amid Mixed Holiday 2019 Retail-Sales Results

Sales for the 2019 holiday season were robust, and U.S. retailers made $730.2 billion—an increase of 4.1 percent over the 2018 holiday, according to the National Retail Federation, America’s largest retail trade group. The results met the high end of the organization’s forecast for holiday business, which ranged from 3.8 percent to 4.2 percent, said Matthew Shay, the NRF’s president and chief executive officer.

“This is a strong finish to the holiday season, and we think it’s a positive indicator of what is ahead,” he said.

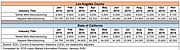

Holiday 2019 results are still coming in, and there has been a wide range of opinion regarding how American retail performed during the season and how it will affect the 2020 economy. Economists and forecasters predict that the U.S. and California economies will continue to perform well. However, employment declined in apparel manufacturing in California and Los Angeles County, a center of the industry, in 2019. In the state, employment in the apparel-manufacturing field declined from 34,700 jobs in January 2019 to 32,200 in November. In Los Angeles County, about 1,700 apparel manufacturing jobs disappeared by November, according to the state of California’s Employment Development Department.

Raymond Sfeir, an economics professor at Chapman University in Orange, Calif., said that employment in the state’s fashion manufacturing will probably continue to be hampered by tough competition from overseas manufacturers. The jobs picture in the state’s apparel-manufacturing segment differs from the national picture, where unemployment rates stand at 3.5 percent, an historic low.

The NPD Group, an influential market-research company, said that holiday sales were basically flat. In a Jan. 14 statement, NPD’s weekly point-of-sale results found that retail sales did manage an uptick of 0.2 percent. Sales were deflated by retailers making big promotions before the season started, Marshal Cohen, NPD’s chief industry analyst, said. Many consumers bought a significant amount of holiday gifts before the season started.

“Additionally, consumers continue to migrate to more ‘intangible’ gifting, putting more emphasis on experiences than things and focusing more on how they live than how they look this holiday,” Cohen said.

Readings on holiday results can vary because individual organizations evaluate data with different methodologies, said Craig Sherman, the NRF’s vice president of government affairs. The NRF finds its data from U.S. Commerce Department/Census Bureau data. On Jan.16, the Census Bureau announced that U.S. retail sales increased 0.3 percent in December.

The 2019 holiday season’s business was an improvement over the 2018 holiday season, when NRF forecasts were missed. Holiday 2018 sales grew 2.9 percent, but the NRF had forecasted an increase of 4.3 percent. The trade group assessed financial-market volatility and a government shutdown as reasons for the missed 2018 forecast.

The 2019 holiday season was not easy, said Jeff Van Sinderen, a retail analyst with B. Riley FBR Inc.The selling season was six days shorter than the 2018 holiday season. The shorter calendar hurt retailers. “If you have fewer days to shop, it is harder to make up the business,” he said. “You have to do that much more sales in the remaining days, and that’s hard. You may get a big surge Christmas week and Black Friday Weekend, but are you going to make up for six days of sales that you didn’t have?”

Paula Rosenblum of market researchers RSR Research said that the full story of the holiday season won’t be known until all retailers report their fourth-quarter and year-end earnings. Also, consumers still have not redeemed gift cards given as presents during the holiday. She forecasted that the economy would continue to hum along because the American consumer is spending. “The American consumer remains resilient,” she said. “Even though wages are stagnant, there is a comfort with the economy.”

Consumer confidence has remained high, said Chapman University’s Sfeir, who also serves as the director of the A. Gary Anderson Center for Economic Research.

In a survey of consumer confidence in the state of California, as well as Los Angeles and Orange counties, consumer optimism on the economy has remained high, Sfeir said. “The economic situation in California and nationwide is positive. You have low unemployment,” he said. “There is more discretionary income. It’s why retail did well.”

Sfeir forecasted that employment numbers would remain high and the U.S., California and local economies would continue to do well. But success might inhibit growth, he said.

“How do you increase output when you don’t have as many people ready to join the labor force and produce?” he asked. “You need more labor to grow, and we don’t have this labor. In 2020, we will not be able to create as many jobs as we did in 2019.”