April Sales Mixed as Economy Continues to Recover

April retail sales were mixed, scuttling hopes of a brisk economic rebound.

After robust retail sales in March, some economic analysts had forecast that if April sales were good, it would be solid proof of economic recovery.

The International Council of Shopping Centers called April’s 0.8 percent increase over last year “better than expected.” But not all retailers fared well.

Still, despite the mixed results, the economy is definitely in recovery, said Jack Kyser, the founding economist of the Kyser Center for Economic Research at the Los Angeles County Economic Development Corp.

“This is not your typical recovery,” he said. “There was a Great Recession. There were huge job losses nationally. hellip; Companies are being cautious. Smaller firms still have problems in accessing credit.”

However, some retailers are expanding store fleets, public works projects are expanding in the state of California and car sales are increasing nationally, he said.

The ICSC and many retailers blamed some of the tepid sales performances on the April 4 Easter holiday. The early date meant many people did their Easter shopping in March. Also, some consumers stayed home from shopping when cold weather overtook parts of the East Coast and the Midwest in April.

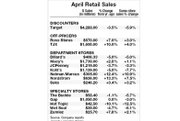

Discounter Target Corp. saw a decline in its same-store sales of 5.9 percent. Target Chairman Gregg Steinhafel said the result was below the retailer’s expectations.

Specialty stores mostly suffered during April. Gap saw a same-store-sales decline of 3 percent. Buckle saw a decline of 5.7 percent. Wet Seal’s same-store sales dropped 6.1 percent. The company still raised its guidance for its first-quarter earnings to 5 to 6 cents per diluted share from its prior guidance of 4 to 5 cents. Roth Capital analyst Liz Pierce noted that Wet Seal had improved its management and merchandise mix recently.

Department-store results were mixed, with Macy’s reporting a same-store increase of 1.1 percent but Kohl’s reporting a decline of 7.7 percent.

March was good for off-price retailers. Ross reported a same-store-sales increase of 3 percent, and TJX reported an increase of 4 percent.

For May, sales are forecast to increase 3.5 percent, according to the ICSC.—Andrew Asch