Despite Challenges, October Retail Sales Increase

October Retail Sales

As of Thursday, November 19, 2020

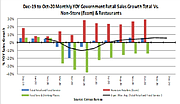

There was a 0.3 percent uptick in retail sales in October over September, according to data recently released from the United States Census Bureau. In a year-over-year comparison, October 2020 sales grew 5.7 percent compared to a 3.2 percent rise in October 2019.

Economists and retail analysts greeted the news as proof that the American consumer has been resilient during a time when the COVID-19 pandemic and the U.S. presidential election put stress on the economy. The good news from the Census Bureau report was echoed by reports of strong third-quarter business by retail giants Target and Walmart.

Jack Kleinhenz, chief economist for the National Retail Federation, thought that the uptick was cause for optimism.

“The steady expansion of retail sales is good news against the background of these unusual economic circumstances and climbing virus cases in recent weeks,” Kleinhenz said. “Early holiday shopping appears to have supported October’s increase in sales. The rise in COVID-19 cases continues to be a factor that weighs on consumer perceptions, sentiment and spending, and there could be retrenchment if we cannot thwart this latest wave. Nonetheless, retailers are well prepared to safely fulfill holiday shopping lists, and the October results suggest, So far, so good.”

October sales slightly missed forecasts, according to a recent research note released by Ken Perkins, president of the Retail Metrics market-research company. Perkins wrote that the consensus forecast of Wall Street analysts predicted that the market would climb 0.5 percent.

He noted that a major driver of business during October was the Amazon Prime Day sales event, which was held Oct. 13–14. Amazon declined to release financials regarding Prime Day, but the research group Digital Commerce 360 estimated that Amazon made $10.4 billion.

Mass retailers such as Target and Walmart also produced special sales events in October to kick off the 2020 holiday season. Some of the biggest winners for the month were digital-commerce retailers, according to Census Bureau data. October sales for digital commerce were up 3.1 percent compared to September sales.

Analysts also noted that some retail segments, such as home-improvement stores and electronics sellers, enjoyed strong business during the month. October sales for electronics sellers increased 1.2 percent in a month-over-month comparison Sales for home improvement and gardening stores were up 0.9 percent month-over-month. Perkins noted that building materials and garden-supply chains have enjoyed monthly gains in each of the last six months because the COVID-19 pandemic has driven strong nesting trends throughout the country.

However, this rising tide did not lift all boats. Clothing stores experienced doldrums during October. Clothing sales declined 4.2 percent in October in a month-over-month comparison, according to the NRF’s breakdown of the Commerce Department’s data. Clothing sales have declined since the pandemic began earlier this year, which many analysts attribute to people remaining in their homes instead of working in offices and limiting their social interactions, both of which take away opportunities to put on fashionable clothes.

News on October sales was released as consumer confidence dipped, according to a survey recently released by The Conference Board, a nonprofit market-research group. The survey found that consumers were less optimistic about the short-term outlook for the economy in October than they were in September.

The percentage of consumers expecting business conditions to improve over the next six months decreased slightly from 36.7 percent to 36.3 percent, while those expecting business conditions would worsen increased from 15.8 percent to 17.0 percent, the Conference Board’s survey reported.

In their releases of their third-quarter earnings, Target and Walmart followed this year’s trend of skyrocketing e-commerce sales. Target’s sales during its third quarter earned $22.3 billion, a 21.3 increase over the same quarter in the previous year. Same-store sales at physical stores increased 9.9 percent during the quarter. Same-store sales for its digital business grew 155 percent.

Walmart’s third-quarter earnings totaled $134.7 billion, for an increase of $6.7 billion compared to the same quarter in the previous year. Its same-store sales at physical stores increased 6.4 percent, and its e-commerce sales grew 79.0 percent during the quarter.