LAEDC to Industry: Capitalize on the 'L.A. Look'

Southern California’s apparel and textile industries have been losing jobs—particularly entry-level and low-wage jobs, but companies can survive through sharp marketing skills and by latching onto Los Angeles’ contemporary design image.

That’s the message from “The Los Angeles Area Fashion Industry Profile,” a study recently conducted by the Los Angeles County Economic Development Corp. (LAEDC), a nonprofit organization created in 1981 to retain companies and attract businesses to the area.

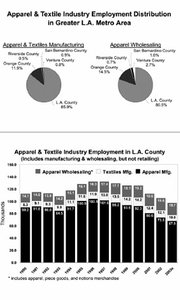

The study of the $24 billion apparel and textile sector shows that in the past seven years, the apparel manufacturing industry in Los Angeles County has lost nearly 35 percent of its jobs, mostly to foreign competition. In 1996, there were 103,900 people working in the industry. In 2003, estimates are 67,900.

The decline was slightly less dramatic for the textile industry, which tends to rely more on machinery and less on labor. In 2000, textile companies in Los Angeles County employed 14,200 people. This year, that total is estimated to have dipped to 10,000 people, about a 29.5 percent drop, after high electricity and natural-gas costs in 2001 forced several textile companies to close.

“The industry is changing, and the key message we are getting is that people have to look at it in a new light and understand the opportunity out there,” said Jack Kyser, chief economist at the LAEDC.

Kyser noted manufacturing jobs in the sector will continue to shrink as manufacturers seek apparel factories overseas to produce goods cheaply.

L.A. look

That means the strength of the Los Angeles apparel industry is its design and production of the casual style commonly called the “L.A. look.”

It is a look that Japanese merchandise managers desire for their department store shelves. And several months ago, a contingent of Chinese buyers toured the California Market Center in Los Angeles looking for California goods to attract China’s growing middle class to their stores.

“The California lifestyle look is stronger than it has ever been,” said Roger Williams, president of swimwear manufacturer Authentic Fitness Corp. and a member of the California Fashion Association.

The CFA, which was founded to promote business opportunities in the state’s apparel and textile sectors, helped organize the industry-sector profile, released on Dec. 10.

“Everything changes, but I don’t see this as a dying industry,” said Bruce Corbin, senior vice president of the Union Bank of California and also a CFA member.

Companies need to concentrate on beefing up their design teams and producing stylish garments that will sell well across the world.

“The number of design companies and brands we have in the city speaks highly of Los Angeles,” Williams observed. “It is a trade-off for losing low-paying jobs and getting middle- to high-paying jobs.”

Focus on higher-wage jobs

Indeed, the LAEDC report notes that many of the lowest-paying sewing jobs have gone to China and other foreign countries, leaving Los Angeles with contractors who primarily specialize in quickturn items to fill in orders or work on high-end designer garments.

Still, local garment workers are at the lower end of the manufacturing pay scale. They make about $8.11 an hour, less than 60 percent of what the average production worker makes, the study said. California’s minimum wage is $6.75 an hour.

About 65 percent of garment workers in Southern California are women, 81 percent are Latino, and 16 percent are Asian.

But local designers and technical workers earn good wages. According to the study, designers make $80,000 to $180,000 per year, depending on the size of the company. Some earn even more because of royalties and profit- sharing arrangements.

“You are finding people better paid in the industry,” noted Lonnie Kane, president of contemporary womenswear company Karen Kane Inc. and president of the CFA. “Overall, the industry in Southern California has changed drastically from being mainly a manufacturing base to being more of a design base. We have manufacturing companies here, but I don’t know if you could call them manufacturing companies. They generally manufacture offshore and run their business and design and distribution from Los Angeles.”

Kane added that more Los Angeles companies are developing a fashion mentality, particularly with the increase in fashion shows during the last Fall and Spring market weeks. “There is more hype of the glamour and fashion of California than there ever was before,” he noted.

Under the spotlight

To increase their revenues, company executives need to capitalize on the California fashion image that is mushrooming with the media exposure focused on Los Angeles’ fashion weeks.

Los Angeles Fashion Week took on a new dimension at the beginning of this year, when IMG’s Mercedes-Benz Shows L.A. and Smashbox Studios’ Smashbox Fashion Week entered the mix and organized scores of runway shows for the Fall and Spring collections. IMG and Smashbox will continue to produce shows next year.

The study suggested that Los Angeles companies should exploit the “Designed in Los Angeles” and “Made in Los Angeles” concepts, much as New York has done with its apparel industry.

New York is also supporting designer training programs, strengthening the brand-building capabilities of local businesses, developing the industry’s export capacity and promoting the “Made in New York” brand.

Said Jack Kyser: “We need to grab people by the collar and say, ’This is a $24 billion industry in Los Angeles. New York is starting to encourage its industry. What are we doing?’”