Mid-Year Review: California Expected to Follow Nation Out of Economic Slump

Is it time to break out the party balloons and celebrate a turnaround in the economy?

Federal Reserve Chairman Alan Greenspan thinks so. He is practically giddy with optimism about the economy being on the verge of a big expansion.

His reasons? The stock market is looking bullish. The SARS epidemic has been squashed. Retail sales are showing signs of life.

But is it time for a party? Not in California. Not yet.

Economists said the rest of the nation may be poised for a fairly good economic turnaround, but California will be dragging behind.

“The economy is going to return to normal, but growth will be halting, grinding, chugging along,” said Christopher Thornberg, senior economist with the UCLA Anderson Forecast, the economic research arm of the Anderson School of Business at the University of California, Los Angeles.

That was emphasized by the Los Angeles County Economic Development Corp. (LAEDC), which recently released its midyear economic forecast for the area. The bits of bright news floating among the statistical data showed a modest recovery for Los Angeles County this year, with all the growth occurring during the second half of 2003.

“We feel that California and Southern California will lag behind the national economy with the [Gov. Gray Davis] recall issue, the state budget deficit and the workers’ compensation problem,” said Jack Kyser, the LAEDC’s chief economist. “This will create a lot of uncertainty, which makes businesses nervous.”

Others concurred. “The growth we’re predicting right now is extremely anemic,” said Esmael Adibi, director of the A. Gary Anderson Center for Economic Research at Chapman University in Orange County.

Some employment relief ahead

The LAEDC report noted that Los Angeles County’s unemployment rate, which was 6.8 percent in June, should average 6.4 percent this year—down from 6.8 percent in 2002.

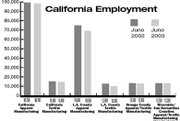

Nonfarm jobs in the county should increase by just 0.4 percent this year or 17,200 jobs. But the manufacturing and information sectors will continue to see record losses.

California continues to lose manufacturing jobs. In June, about 4,900 such jobs were cut. The most recent drop brings the total number of manufacturing jobs lost in the last two years to more than 290,000.

So what does this mean for the apparel and retail industries?

The economic outlook for these sectors predicts slight improvement for the rest of the year. Economists said there is a load of pent-up consumer demand lingering and people will be hitting the malls more frequently during the second half of the year than they did during the first half.

Already experts have predicted that this year’s holiday season will be slightly better than last year’s.

But some financial gurus forewarn that many consumers are “up to their eyeballs” in debt as they have taken advantage of low interest rates to max out their credit cards and buy cars and houses.

“Debt won’t change until income levels start changing,” Thornberg noted.

On the employment front, the Southern California apparel and textile industries, which have seen many jobs skip town and go to overseas factories, will continue to experience job losses.

Apparel manufacturing in the Los Angeles area is expected to lose 4,500 jobs this year. The textile industry is expected to shed 2,200 jobs.

“I think there are a lot of people going overseas because of the tremendous cost pressures on business,” Kyser said. “It is also driving people into the informal sector of the economy.”

The informal sector involves employing people temporarily, whether they are illegal immigrants or not, and paying them under the table in cash. Or it means hiring subcontractors to avoid paying workers’ compensation fees.

Mixed messages on recovery

While many apparel and textile jobs are going to factories in China, Mexico or India, Los Angeles remains the design and idea hub for West Coast fashion.

Los Angeles designers are getting more national media exposure now that Smashbox Studios in Culver City, Calif., and 7th On Sixth, a division of IMG in New York, have organized dozens of fashion shows during the twice-yearly Los Angeles Fashion Weeks.

On the retail front, the National Retail Federation is predicting that store sales nationwide will be up 4.5 percent during the second half of the year, compared with 2.2 percent during the first half of the year.

Experts said the $350 billion tax-cut bill pushed forward by President George W. Bush started to take effect on July 1, leaving more dollars in people’s wallets. Recordlow interest rates make credit-card charges more enticing. And dipping mortgage rates have helped homeowners lower their monthly payments.

“I think the signs we are seeing for retail are fairly encouraging,” said Richard Giss, a retail expert for Deloitte & Touche’s Los Angeles office. “I think the stock market has solidified and improved. I think some corporate earnings reports have been a little better, and I think we haven’t had as much bad news from the business community, which is causing people to feel the worst is over.”

But a few dark clouds are hovering on the horizon. Energy prices in California remain higher than in the rest of the nation, hurting businesses that use natural gas in their production. Workers’ compensation insurance has doubled in the last three years, and no solution is in sight. And license-plate fees in California will triple in October, raising $4 billion to patch the state’s controversial $38 billion budget deficit. This will affect everybody, from individual consumers to businesses that operate trucks and vans. And it will add one more element of uncertainty to the future.

“Right now, it is unclear where the economy is headed here,” said UCLA’s Thornberg. “It’s a little fuzzy out there.”