June '04 Sales Slump, But Economists Forecast Growth

Is it a hiccup or a long-term economic slowdown?

That was the question on the minds of many economists as they searched for reasons why the American business scene stumbled in June.

Retailers across the United States complained about anemic profits, and even formerly highflying specialty retailers such as San Francisco–based Gap Inc. and City of Industry, Calif.–based Hot Topic Inc. took a tumble in comparable-store sales.

The economy’s lackluster June performance was a surprise because it followed a five-month sprint to high profits for retailers. Sales rose by an average of up to 6 percent during that go-go period, which started during the 2003 Holiday season.

June’s year-over-year same-store sales merely rose 2.9 percent, the slightest gain in exactly one year, according to Michael Niemira, chief economist for the New York–based International Conference of Shopping Centers (ICSC). He did, however, say he believed the June gloom would lift soon.

“Leading indicators are pretty upbeat,” Niemira said. “These trends will hold up through the remainder of the year. What happens in 2005 is another story.”

Niemira highlighted a healthy demand for housing as an indication that the U.S. economy will continue to grow throughout the year.

Other analysts agreed that the economy will continue to grow, albeit at a slow rate. Andy Graves, senior equity analyst at San Francisco–based Pacific Growth Equities Inc., said Americans are spending slightly less this year because they’re recovering from the consumer- goods buying binge that followed the declaration of the end of the Iraq war last year.

Increasing oil prices, credit-card debt and co-payments for health care have taken bites out of consumer spending, according to Graves. The recent rise in domestic and international travel has also curbed retail spending because more people are spending money on airfare, accommodations and other travel-related expenses instead of on consumer goods, he added.

“It’s not a death warrant for consumers,” Graves said. “It portends a slowing growth. Discounters will see earnings disappointments.”

He forecast sales during the rest of 2004 will grow 1 percent to 3 percent, compared with the 4 percent to 5 percent growth rate seen in the early part of the year.

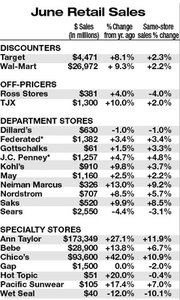

Across the board, discounters, off-pricers and department stores for moderate incomes reported weak profits. Bentonville, Ark.–based Wal-Mart Stores Inc. posted a mere 2.2 percent same-store sales increase. Newark, Calif.–based Ross Stores Inc. reported a 4 percent comp-store sales decline, and Little Rock, Ark.–based Dillard’s Inc. posted a 1 percent decline.

Luxury department stores and most higherend specialty stores reported decent profits. Dallas-based The Neiman Marcus Group Inc. posted a 9.2 percent increase in samestore sales.

The ICSC and many retailers blamed slow sales on cold weather in the Northeast and Midwest and wet weather in the South and Southeast. Niemira said July’s increasing temperatures may beckon consumers to market.

—Andrew Asch