Quiksilver Debuts Line for Older Big Kahunas

Maturity was never a high concern for the easygoing, youth-obsessed surf industry. But Quiksilver Inc. hopes that the debut of its newest clothing line will prove that the men who loved surf clothes as boys can comfortably wear these togs to the beach, and to pricey restaurants.

Quiksilver’s upcoming Santa Monica line was made for the 35- year-old guy who can afford a sleek car and an expensive restaurant. To be introduced Aug. 28 at MAGIC Marketplace in Las Vegas, it will be priced 40 percent higher than the company’s main line, which is aimed toward those age 14 to 24.

Santa Monica is part of Quiksilver’s campaign to appeal to new markets, and perhaps to new retailers, said John Bathurst, the 44-yearold vice president of Quiksilver Edition, the division of the Huntington Beach, Calif.–based company that is handling the debut.

The 57-style line will mostly consist of tops that should fit comfortably with premium denim, Bathurst said. He hoped that it would be sold at boutiques and better department stores such as Bloomingdale’s, where Quiksilver is not currently sold.

Santa Monica will be part of the greater Quiksilver Edition collection, which produces aloha shirts and boardshorts for men 40 and up. This original Quiksilver Edition collection will be renamed Malibu.

Although the Malibu line will be produced for men to wear at the beach, Santa Monica is inspired for that same guy when he wants to dress to impress yet stay casual.

“There’s a huge void in the marketplace,” Bathurst said of highquality casual clothes for men over age 35. “He doesn’t have a lot of options outside of premium denim.”

Woven shirts, cashmere sweaters and fleece will be the first offerings to roll out of Santa Monica. Retail price points will range from $60 to $120 for the collection. It will include $45 for a premium T-shirt and $120 for a blended cotton cashmere sweater. The line’s bottoms programs will offer earthtone-colored denim, corduroy, chinos and leather sandals.

The line might represent new ground for Quiksilver and other surf companies that may not have considered how guys in their mid- 30s might want to dress. But this direction has been explored by such boutique brands as Modern Amusement and Ambiguous, which have surf and skate roots, said Todd Kellogg, director of marketing and production for Beach Bums Inc., an Anaheim, Calif., retailer with 14 stores.

The sales of these boutique brands have helped Beach Bums, Jack’s Surfboards and Active increase the threshold of their price points by selling these brands and such premium-denim labels as Diesel. Traditional surf boutiques keep price points lower because they often stick with the less-expensive surf brands.

Kellogg said an older market could embrace Quiksilver’s Santa Monica. “The new generation of guys in their 30s grew up wearing Quiksilver,” he said. “Surf retailers could sell it well, if they can make the older customer feel welcome at their store.”

The debut of a new men’s line seems like a good risk for Quiksilver. Its menswear has made solid gains in the year. According to Security and Exchange Commission documents filed June 9, revenues in its men’s categories increased 8 percent to $183.8 million in the six months that ended April 30, compared with $170.4 million earned in the same period the previous year.

Revenues in the women’s category decreased 1 percent to $183.9 million during the six months that ended April 30. This category earned $186.4 million during the same period the previous year.

Bathurst declined to forecast how much the new line would earn, but he did say it could initially be sold at 125 doors after the debut.

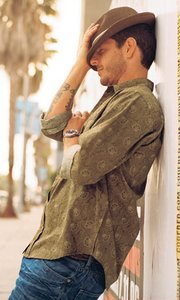

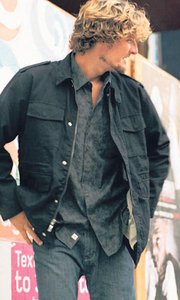

The company also has not decided on how word on Santa Monica will be spread. Long Beach, Calif.–based artist and surfer Sandow Birk and skateboard team manager/fashion photographer Mark Oblow were photographed wearing the Santa Monica collection. Their images were used as part of a limited-edition look-book that Quiksilver has been distributing. It also may take out ads in glossy magazines whose readers are often big kahunas age 35 and up.