LAEDC Predicts Dip in Apparel Employment This Year

The Los Angeles County Economic Development Corp. has been reading the tea leaves in 2006 for Southern California in its latest forecast.

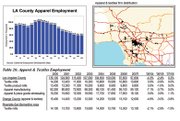

One of the predictions by Jack Kyser, the group’s chief economist, is that employment in the local apparel and textile industries will dip by 2,400 jobs this year, going from 100,000 workers in 2005 to 97,600 jobs in 2006. Jobs should hold steady in 2007.

But the straight facts and figures may not capture the health of the entire industry. “More manufacturers are using temporary help and outsourcing many things, from graphics and shipping services to package designs,” Kyser said. He estimates that about 8,000 contract workers are employed by the apparel and textile industry. However, they don’t show up in the state’s count of apparel and textile workers.

Despite the dip in employment, Kyser handed out a C+ grade for the apparel industry in 2006, compared with a C-rating during the previous economic outlook in July 2005.

“After some difficult times and significant job losses, better times could be in the offing for the local apparel and textile industry,” Kyser predicted in his economic forecast. “The important point is that the industry is transitioning from a focus on manufacturing to a design/marketing/logistics center. Better yet, more international buyers are coming to Los Angeles.” He added that there is a surge in start-up firms by people already in the apparel industry.

Macy’s mania

One negative factor affecting apparel manufacturers is the merger last year of two major department stores, Federated Department Stores Inc., which operates stores under the Macy’s and Bloomingdale’s nameplate, and The May Department Stores Co., which operated stores under the Robinsons-May, Filene’s and Lord & Taylor names. After March 1, Federated is closing at least 82 May Co. stores across the country and divesting itself of the Lord & Taylor stores. This spring, Federated plans to cut more than 1,100 positions from its regional headquarters in North Hollywood, Calif.

“Firms selling to May Co. are trying to get in the door at Federated, which is pushing its own store brands,” Kyser noted.

Despite a decline in apparel manufacturing jobs, Kyser pointed out there is positive news for the downtown Los Angeles Fashion District. There is a development boom with new construction of retail showrooms, condo showrooms and artist lofts.

In the retail sector, Kyser said store owners will experience an employment dip due to the merger between Federated and May. But taxable retail sales in Los Angeles County are expected to rise 8.5 percent.

“Despite the clouds on the horizon, retail development will continue at a merry pace in the region,” the economist said.

He cited expansion and development of several regional shopping malls such as Americana on Brand, a major retail project being undertaken in Glendale, Calif., by developer Rick Caruso, who built The Grove shopping mall in Los Angeles four years ago. Also, in Torrance, Calif., the mammoth Del Amo Fashion Center, one of the biggest shopping centers in the United States, is undergoing a renovation and will be adding stores such as Anthropologie, Crate & Barrel and Urban Outfitters this year.

Kyser’s grade for the retail industry went from a C+ last July to a C for 2006. —Deborah Belgum