B.B. Dakota Eying Possible Sale or IPO

B.B. Dakota, a young contemporary brand based in Irvine, Calif., has tripled its business since its debut in 2005.

Now sold in roughly 5,000 stores domestically and overseas, founder and designer Gloria Brandes said she is looking for the right opportunity to fund the company’s continued growth. With that in mind, B.B. Dakota has hired Roth Capital Partners, a Newport Beach, Calif.– based investment bank, to look for acquisition possibilities or even consider an initial public offering. Paul Zaffaroni, vice president of investment banking at Roth Capital, confirmed the company has been retained to pursue strategic alternatives but wouldn’t comment on the agreement.

“The young contemporary arena is the hot business today. Our brand, which is only 3 years old, has had such amazing growth. There are so many opportunities for growth that we want to be able to take advantage of this fortunate situation in which we find ourselves,” said Brandes, who wouldn’t divulge the company’s revenues.

While the B.B. Dakota brand is young, the business behind it is very well-established. Initially Brandes launched her business in 1984 as International Buying Office, a private-label manufacturer that designed and made apparel for major juniors retailers such as Wet Seal, Charlotte Russe, American Eagle Outfitters and Aeropostale. She credits the strength of her fledgling brand, in part, to that experience. B.B. Dakota, an in-house brand Brandes started producing sporadically in 1986, was reborn from Brandes’ eagle-eye view of the young contemporary market.

Brandes studied the market and found a niche, offering upscale styling at a competitive price. “We [are] not as juniors in product as other juniors brands, and we [are] priced better than contemporary,” Brandes told the California Apparel News earlier this year.

Wholesale prices for the line range from $12 to $150, and styles range from T-shirts to leather outerwear. Department stores, now a mainstay of B.B. Dakota’s distribution, initially didn’t know what to make of the brand’s unique approach. Instead, the brand found support among independent and specialty retailers. “Now it seems the new buzzword is juniors contemporary, and suddenly we are viable,” she noted.

Sold at Macy’s, The Buckle, Nordstrom, Urban Outfitters, Karmaloop (www.karmaloop.com) and Up Against the Wall as well as specialty boutiques, B.B. Dakota has managed to find retail success despite a soft retail climate and stiff competition from fast fashion.

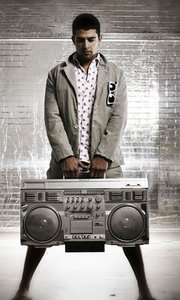

Brandes spent the last two years further parlaying her experience into expanding the brand. In 2007, B.B. Dakota launched a handbag collection. And for Spring 2008, the company is debuting Dakota, a new 50-piece men’s collection focusing on woven shirts, bottoms and blazers.

Retailers have come to appreciate B.B. Dakota’s unique take on the market. “There aren’t that many better juniors lines that are collections,” Wendy Red, a fashion director at Up Against the Wall, told the California ApparelNews earlier this year.

In 2005, the company entered into a licensing agreement with Irvine, Calif.–based manufacturer nZania. The deal gives nZania, which holds licenses with Hurley, Reebok, Disney and Levi’s, rights to manufacture, sell and distribute B.B. Dakota’s young contemporary, men’s and accessories offerings. Brandes is in charge of design and marketing.

Now, Brandes is hoping to grow the brand and make it a major international player. “The young contemporary market is the most lucrative in terms of gross margins, the most scalable in terms of building the volume and appreciation of the brand,” Brandes said.

Already sold overseas in Japan, Europe, Australia and Brandes’ native Canada, B.B. Dakota stands to benefit from wider international sales due to the weakness of the American dollar. To do all of this, Brandes said, she needs to increase her financial capacity. Partnering with Roth could “also create some strategic relationships as well,” she said.

Because it is still early in the process, Brandes, who has majority ownership of the brand, won’t speculate on what is more likely—going public or being acquired. But she does say the ultimate goal is marked growth.

For 2008, the plan is to focus on expanding international distribution, but loftier goals include opening retail outlets. “That’s a ways off, but it is something we’d certainly like to do,” she said.