Newsmakers of 2007

California’s fashion industry was at the center of a host of changes in 2007 as fashion went eco—and so did the local port. Fashion took the top spot in online spending and the blogosphere exploded with fashion-related chatter.

On the fashion front, streetwear surged in popularity, as did demand for “The L.A. Look,” which basked in the spotlight on the runway at Los Angeles Fashion Week and on the trade-show floor at the Project Global TradeShow and Designers and Agents.

But the focus on Los Angeles fashion came at the same time as a renewed interest in intellectual-property protection— from fighting counterfeiters to debating the limits of copyright laws.

Meanwhile, manufacturers streamlined their businesses with new technologies, and boutique contractors opened shop to handle the demand for high-end and exclusive sewing and pattern-making.

In Los Angeles, the downtown renaissance continued with new public and private development, and in San Francisco, a new upscale mall now borders the city’s Union Square neighborhood.

The weak dollar opened up new opportunities for Los Angeles labels overseas.

Those in the lingerie sector had their pick of several new trade shows that courted West Coast business. Premium-denim brand 7 For All Mankind sold for top dollar, as did specialty retailer Barneys New York.

These are just a few of the news-making people, companies and ideas that had an impact on California’s apparel and textile businesses.

7 For All Mankind

7 For All Mankind showed the business world that not only are its blue jeans premium-priced, so is the company.

The Los Angeles label commanded a $775 million price tag this summer when it was sold to Greensboro, N.C.–based VF Corp., the world’s biggest apparel maker, which hopes to pump up sales with more-contemporary brands.

Seven’s meteoric rise from a new concept in 2000 to one of the hottest denim brands around, with $300 million in revenues, demonstrates that Los Angeles is one of the top centers for fashion ideas and concepts.

Under VF’s tutelage, 7’s No.1 priority for revenue growth is expanding into other apparel concepts. So is retailing. The company opened its first retail store in November on upscale Robertson Boulevard, where the brand is trying out new styles such as cashmere sweaters for men and women and accessories and footwear. More stores are on the way, with at least 10 more in the works by the end of 2008.

Little did longtime apparel maker Peter Koral know what was in store for him when he was first approached at the MAGIC Marketplace in Las Vegas to back a new blue-jeans brand.

Designer Jerome Dahan and marketing executive Michael Glasser were looking to partner with someone to build a premium-denim brand selling for more than $150. The label, made in Los Angeles of quality denim and known for its squiggle design on its back pockets, busted out of the stores soon after the company was launched in 2000. The look caught on with Hollywood glitterati such as Cameron Diaz and Gwyneth Paltrow and made the glossy pages of several fashion magazines.

VF’s plans for the denim label include growing revenues by 15 percent a year, eventually making non-denim products at least 50 percent of revenues. —Deborah Belgum

Barneys New York

Barneys New York got a new owner this year. Dubai-based investment company Istithmar purchased the luxurydepartment-store chain from Jones Apparel Group Inc. for $942.3 million. The deal was announced in August.

Istithmar won a bidding war for the iconic retailer against Tokyo-based Fast Retailing Co. Ltd. According to some industry observers, Barneys’ new international ownership bodes well for the young designer lines carried in the store.

“Hopefully, [Istithmar’s] plan will be to expand the Barneys brand globally and increase the business opportunities for the California resources that sell to them,” said Ken Wengrod, president and founder of Los Angeles–based FTC Commercial Corp., to the California Apparel News earlier this year.

Barneys is also making good on its promise to open more flagship stores around the country, offering customers more shopping opportunities.

The Las Vegas Strip will be the next venue for Barneys’ latest flagship, scheduled to open Jan. 18. It’s an 85,000-square-foot emporium debuting at the opulent Shoppes at the Palazzo, a new mall adjacent to The Venetian.

In addition, the venerable luxury department store found new popularity in the last few years with its Barneys New York Co-Op stores. A Barneys New York Co-Op was built in 2005 at South Coast Plaza in Costa Mesa, Calif. In March, one was opened at The Grove shopping center in Los Angeles. Another is on the horizon, scheduled to open at the Americana at Brand shopping center in Glendale, Calif., next year.

But 2007 saw the return of the flagship. On Sept. 19, a Barneys New York opened at 77 O’Farrell St. in San Francisco. It serves as a landmark to the renaissance of luxury retail in Union Square, bordered by a host of other highend retailers. The five-story Barneys New York offers collections of some of the world’s most exclusive designers such as Paul Smith, Nina Ricci and Martin Margiela.

In 2008, Barneys New York is scheduled to open a flagship in Scottsdale, Ariz., and relocate and expand the Barneys flagship in Chicago. —Andrew Asch

Boutique Contractors

The demand for quick turnaround and lower minimums pushed Los Angeles’ boutique contractors to the forefront in 2007. Companies such as PDR Knitting, The Evans Group and MKP Development—which cater to contemporary designers and offer services ranging from pattern- making to production and design consultation to tech packs—found themselves at the center of a feeding frenzy.

Designers, often caught between the difficulties of producing overseas and the high minimums of domestic contractors, latched onto boutique contractors to create some of their more-challenging and unique pieces. “There are knitters for brands doing large quantities, but finding a knitter who will do smaller quantities and one-of-a-kind pieces is nearly impossible,” said Coryn Madley, the Los Angeles–based designer of 5-year-old knit brand Madley and the owner of a Venice Beach, Calif.– based boutique of the same name.

PDR Knitting launched in October 2006 and in 2007 creates knits for brands such as Mike & Chris, Rodarte, The Maitlands, Twelfth Street by Cynthia Vincent and Anzevino & Florence. The vertically integrated Evans Group—which does production for brands such as Geren Ford, Society for Rational Dress, Cosa Nostra, Grey Ant and Jeremy Scott—saw marked growth in 2007. In September, it opened a San Francisco office offering Northern California designers fitting and sample-sewing services. Then, in October, it announced its move to a new substantially larger production facility. The growth will help The Evans Group keep up with demand, but Chief Executive Jennifer Evans said the contractor will retain its boutique approach. “We don’t want to compete with the volume people,” she said. —Erin Barajas

Cooper Design Space

Los Angeles’ ever-growing contemporary market is making showroom space in the Fashion District scarce. This year, the Cooper Design Space met the need head-on by converting its mezzanine to showrooms and beginning construction on the 10th floor for the same purpose. In 2006, the Cooper building opened up its fifth floor to showrooms. Previously filled with studios for designers, the mezzanine and 10th floors add approximately 48,000 square feet of showroom space to the building, one of the hottest buildings in the Fashion District. Renovations on the 11th floor, which is largely dedicated to open space for trade shows and events, added room for several additional showrooms.

“There is just such a demand for space,” said Mona Sangkala, the Cooper’s leasing director. “The growth has been organic.” With contemporary and young designer showroom owners clamoring for space in the building, Sangkala and her team have had the luxury of carefully editing their building’s mix. Designers such as Trina Turk and Robert Rodriguez opened their first showrooms on the newly renovated floors, and 95 percent of the 10thfloor renovation was leased before construction began in earnest. —E.B.

Copyright/Counterfeit

This year, two often-confused concepts in intellectualproperty protection—copyright and counterfeiting— shared the spotlight for many in the fashion industry.

Copyright came to the fore thanks to the Design Piracy Protection Act, which was reintroduced to Congress and the Senate earlier this year. The proposed law, which, if it were passed, would extend existing copyright protection to fashion design, has been championed by the Council of Fashion Designers of America and opposed by the California Fashion Association.

Current copyright law, as it applies to the apparel industry, covers two-dimensional artwork such as textile design, sketches and decorative topical designs including embroideries and beading, but anything deemed “useful,” such as the entire garment, is not protected.

Proponents of the Design Piracy Protection Act argue that the legislation will protect designers from wholesale copying of their work by competitors or mass-market apparel makers. The law would allow designers to profit from their original creations for three years, giving them time to bring a design to market, sell it for a season and recreate the style in a secondary diffusion line before the design is released into the public domain.

Opponents of the law say it is impossible to create truly original design— it’s all been done before. According to the opposition, copying enables the free flow of trends and encourages designers to pioneer new trends. If passed, they argue, the law will create a chilling effect on designers and companies worried that they could face legal prosecution if their designs are found to be too similar to another company’s.

While the Design Piracy Act has proved to be a polarizing issue within the industry, there’s much more agreement regarding counterfeiting, which is defined as the unauthorized use of a company’s trademarked name or identifying mark (such as the Nike swoosh or the Adidas triple stripes).

This year saw increased action against counterfeiting on the local, national and international front. In February, the French Embassy invited a group of American business people to France to study France’s efforts to fight counterfeiters at home and abroad. In August, the United States Chamber of Commerce staged a four-day workshop series in Los Angeles aimed at educating consumers and California business owners about the dangers of counterfeiting and efforts to fight criminals trafficking in counterfeit goods.

And in November, several high-profile multi-agency raids in Los Angeles and New York resulted in the confiscation of millions of dollars in counterfeit goods and the arrest of several individuals charged with conspiracy, smuggling and trafficking in counterfeit goods. —Alison A. Nieder

Designers and Agents

Designers and Agents has carved out a niche in the contemporary and young-designer marketplace and continues to be an innovator in the trade-show biz. The show, which began as a small venue nearly a decade ago in Los Angeles, has expanded over the years to include a growing trade show in New York, as well as stops in Tokyo and London. The show draws buyers from all over the United States and around the world, including Japan, France, Spain, Germany and Italy.

D&A’s success can be credited to the tight edit of the exhibiting lines and the innovative approach of co-founders Ed Mandelbaum and Barbara Kramer. Their concept is to offer a fresh mix of juried designers that keep buyers returning each season. The focus is on quality rather than quantity, and buyers have come to respect their savvy in the marketplace. Their aesthetic extends to the architecture and design of the trade shows, which are always held in bright, open loft spaces such as the Cooper Design Space in Los Angeles and their new venue in the Chelsea Art Museum in Manhattan. Mandelbaum and Kramer work with notable design firms, such as Modernica and Art & Industry/Doctor Proper, to furnish their lounges. They also hold art installations and hire DJs to spin live during their shows.

New this year, D&A began a “Greening Initiative” to reinforce its commitment to support social causes. “We are always looking to ramp up and bring in a layering of interest because we feel like our show is a great platform to introduce people to new ideas, not just about fashion, but things that complement [it],” Kramer said. Trade shows in New York and Los Angeles last spring kicked off an ongoing eco-focus with a special area devoted to eco-friendly fashions and lifestyle products. Educational information was offered and eco-conscious practices such as recycling and the use of eco-friendly cleaning supplies have been incorporated into the production of the show. In addition, D&A created a “Green Leaf Award” to recognize ecofriendly designers and has formed an ongoing relationship with Earth Pledge to offer eco-fabric sourcing through its “FutureFashion” division.

Over the years, D&A has brought designers from different regions into the public eye. This fall, Mandelbaum and Kramer partnered with the Denmark Foreign Trade Council to exclusively showcase 11 top Danish fashion collections at their New York and Los Angeles shows.

In addition, this year the Council of Fashion Designers of America invited D&A to partner with their Business Services Network. Each season, Kramer and Mandelbaum and the CFDA will select two CFDA members to showcase at D&A trade shows in New York, Los Angeles and London. —N. Jayne Seward

Downtown Los Angeles

Downtown Los Angeles, still a work in progress, is shaping itself to become a viable venue in which to live, work and play.

The urban renaissance taking place was in full bloom in 2007 with ongoing loft construction and new commercial and entertainment venues sprouting up to serve the growing population, which, according to the Los Angeles Downtown Business Improvement District, is now close to 30,000. By the end of 2009, that number should hit 40,000.

During the past year, Ralphs opened its Fresh Fare gourmet market, which quickly became a hangout for students at the Fashion Institute of Design & Merchandising and downtown residents and businesses alike. AEG opened elements of its massive L.A. Live project, including the 7,000-seat Nokia Theatre, which has hosted concerts by Neil Young, The Eagles, Dixie Chicks and others.

FIDM is wrapping up an expansion project that, during the first quarter of 2008, will bring much-needed classroom and housing to the campus at 919 S. Grand Ave. The additional space is situated across the street from the main campus. And about the same time at Stanford and 12th streets, the Stanford Wholesale Mart, a showcase for juniors lines, will start its ground opening.

The fashion industry has taken advantage of the growth in Downtown. It staged shows at the former St. Vibiana Cathedral, which is now known as Vibiana. Its baroque interiors served as dramatic backdrops to Fashion Week. Downtown’s historic-theater owners are continuing renovations pioneered by Steve Needleman, who a few years ago revived the grand Orpheum Theatre, which, in addition to fashion shows, hosted events for “American Idol” and the movie “Dreamgirls” as well as the L.A. Theater Awards. Moving forward, The Related Cos. has just started construction on the long-awaited Grand Avenue project. The first phase of the Frank Gehry–designed endeavor will feature new retail, hotel, residential and entertainment projects. The organic-minded Urth Cafeacute; has begun development on a location at Fifth and Hewitt streets that is set to open in fall 2008. —Robert McAllister

Eco-Fashion

Last year, it seemed that everyone in fashion went green. This year, it seemed as if green went fashionable.

Eco collections were all over the runways at Los Angeles Fashion Week in October, from Linda Loudermilk’s runway show at green gas station BP’s Helio House and the recycled rococo looks of Gary Harvey at BoxEight in downtown Los Angeles to the Green Initiative group show at Mercedes-Benz Fashion Week at Smashbox Studios.

The lineup included local designers such as Loudermilk, Avita’s Amanda Shi, Ecoganik’s Geneveive Cruz, and Evidence of Evolution’s Ali Aborzi and Andrew McCarthy, as well as out-of-towners such as New York–based Bahar Shahpar and Londoner Harvey.

The Green Initiative was the brainchild of The Gallery Showroom owner Mikey Koffman, who organized a mix of eco lines including Rene Geneva Designs, M the Movement, Protect the Element, Wet Cement, Peligrosa and Vintage China.

Like the Green Initiative, Ecoganik and Evidence of Evolution were part of the Smashbox lineup, while Avita, Harvey and Shahpar showed as part of EcoNouveau, a six-hour fashion, art and music event designed to draw attention to the eco movement and held at BoxEight at Vibiana in downtown Los Angeles.

Designer Deborah Lindquist combined eco-consciousness with social responsibility for her show, held during a breast cancer benefit for Susan G. Komen for the Cure.

Meanwhile, the eco efforts extended to event and trade-show producers. IMG, the producers of Mercedes-Benz Fashion Week at Smashbox Studios, worked with Carbon Neutral Co. to measure and reduce the carbon emissions generated at Los Angeles Fashion Week. Contemporary and young-designer trade show Designers and Agents launched an eco-initiative, featuring eco-friendly designers, educational information and eco-conscious practices at the show. Organic and recycled fashions were on the runway at the Global E.C.O. Show in Las Vegas, which ran concurrently with the MAGIC Marketplace, which also put the spotlight on organic apparel and textiles in its sourcing section. —A.A.N.

E-tail

Online retailing hit a crescendo this year as online apparel sales performed like a sprinting thoroughbred outpacing the competition, moving ahead of computer products for the first time in cyber history. Thanks to more user-friendly navigation tools and the ever-present convenience factor, more people than ever are buying online. And West Coast e-tailers from Shopintuition (www.lisakline.com) are doing their part to make West Coast fashion more accessible to the interiors of the country.

The outlook shows the momentum sustaining. Yahoo Shopping executives said apparel is still the top category, although the wii game console is the top product for the 2007 holiday season. ComScore Inc. reported that Cyber Monday sales (the Monday after Thanksgiving) hit a record $733 million followed up by $803 million in sales on Dec. 6. Sales for the season are up 18 percent so far.

“As we go into 2008, I think there’ll be continued natural growth in e-commerce as more and more consumers get comfortable with e-commerce as a true alternative for them,” said Eric Allen, an executive with Los Angeles–based One- Stop Internet, which produces e-commerce vehicles for 7 For All Mankind , Trina Turk, Nicole Miller and others. “That growth will be increased even more as companies like ours continually refine technologies and improve strategies for our clients. Whether it’s user-generated content to create a voice for the consumer or adopting new technologies to improve the overall shopping experience, e-commerce will create even more of an opportunity in 2008 for the companies that do it right.” —R.M.

Fashion Blogsphere

Like many fashion salespeople, William Sledd had his opinions on how people should dress. But living in the small western Kentucky town of Paducah, his audience was, putting it diplomatically, limited. Yet multitudes were listening to him at the end of 2007, and he had the fashion blogosphere to thank for catapulting him to fame.

In 2006 Sledd posted a series of fashion video blogs called “Ask a Gay Man” at online video community YouTube. Since then his videos reportedly command more than 70,000 viewers. Cable channel Bravo also announced this year that it will co-produce a reality series on Sledd.

There is only a handful of fashion bloggers who post on YouTube, according to Julie Supan, a representative for the San Bruno, Calif.–based Web site. But interest is skyrocketing. Ford Models posts videos with its models giving fitness and makeup hints on YouTube. Neiman Marcus posted a video on the luxury department store’s 100-year history.

YouTube is part of the burgeoning fashion blogosphere that exploded in 2007, grabbing the attention of retailers, corporate America and average people obsessed with fashion. Popular fashion blogs include Fashionista (www.jezebel.com); Glossed Over (www.glossedover.com); Threadbare (www.la.com/blog/style); Stylephile (www.latimesblogs.latimes.com/alltherage); The Moment (http://themoment.blogs.nytimes.com); and On the Runway (http://runway.blogs.nytimes.com).

For retailers, the importance of fashion blogs makes up for their relatively small audience, said Jeannie Lee, owner of fashion boutique Satine on Los Angeles’ stylish West Third Street. Blogs drive only slightly more than 5 percent of the visitors to her e-commerce site (www.satineboutique.com). But people in the blog audience are the diehard fashion obsessives, Lee said. So much so that Lee said she is considering advertising on some blogs because their audience is almost guaranteed to spend on fashion.

Blogs are typically the work of a lone reporter or photographer. The blogger for New York–based The Sartorialist, Scott Schuman, spends his days shooting photographs of how people dress in Manhattan. But 50,000 people reportedly visit his site daily, and Time magazine called him one of the 100 most influential people in design.

Other blogs are also being gathered onto online communities. “Project Runway” designers Nick Verreos and Rami Kashou blog on Uber.com, a Los Angeles–based online community for creative people that started in 2007. Fashion journalist and boutique owner Rose Apodaca also blogs on the site as well as fashion club kid Cory Kennedy.

Uber.com co-founder Glenn Kaino, who is married to fashion designer Corey Lynn Calter, said his site is a place where artists and designers can build businesses. It also will be a place where 16-year-old “Miss Atl,” an Uber.com blogger from Georgia, can build her own community while writing about the fashion that she loves.

Entrepreneurs also are looking for other ways to build fortunes on the fashion blogosphere. New York–based MyStylePost will launch in early 2008. It will host fashion communities and sponsor style contests. It expects to make handsome profits by offering market intelligence on their Web communities to major apparel companies.—A.A.

Fashion Business Inc.

Founded in 1999, Fashion Business Inc. continues to support fledgling businesses with educational seminars, business tools, peer networking, marketing services and business consultation. Known for its seminars, which range from basic training on computer programs to costing for market and how to build a sales team, FBI took its show on the road in 2007 and presented 10 seminars in Las Vegas during the MAGIC Marketplace. “Earlier this year we also launched our new Web site (www.fashionbizinc.org) and can now provide some of our most sought-after seminars online,” said Frances Harder, the founder of FBI. Harder herself has been a hot commodity this year. She traveled to Donghua University in Shanghai to present a seminar about full-package manufacturing for Western clients and was among the American business people who traveled to France to study counterfeit and copyright issues.

Despite her globe-trotting, Harder’s focus remains squarely on California’s up-and-coming designers. This year, FBI secured a contract from the city of Los Angeles to provide business assistance to 12 local manufacturers. Come the new year, FBI has plans to offer more technical pattern-making classes and is working on providing more job-training programs for displaced workers who have been laid off due to offshore competition.—E.B.

Financo Inc.

Since its founding more than 35 years ago, Financo Inc. has brokered deals for large and well-known apparel, beauty and retail companies, including the Kellwood Co., Gadzooks Inc., Cynthia Steffe, Ellen Tracy Inc., Value City Department Stores Inc., McRae’s Department Stores, Farah Inc. and Montgomery Ward. Over the years, clients of the New York–based investment bank and financial consultancy have included several California companies, including Cherokee, Joe Boxer, The Wet Seal and Paul Davril Inc. But until this year, the company conducted all its business from its East Coast offices. In January, Financo opened its first West Coast office in Beverly Hills with Steven H. Reiner serving as managing director of the office and overseeing the company’s West Coast team.

“We saw too much opportunity [here],” said William “Billy” Susman, president and chief operating officer, earlier this year. “This community has a significant number of middle-market companies—some are looking for growth capital, some to be sold.”

Financo has helped broker a number of West Coast deals, working with manufacturers and retailers including Guess? Inc., Nordstrom, Nike and Gottschalks. The company recently served as financial advisor to the St. Louis–based Kellwood Co. in its acquisition of Royal Robbins, a manufacturer of active sportswear and travel apparel based in Modesto, Calif. The company also worked with Phillip-Van Heusen on its acquisition of Los Angeles–based tie manufacturer Superba.

In late October, Anaheim, Calif.–based retailer Pacific Sunwear retained Financo to explore strategic alternativesfor its demo division.

Financo was founded by Gilbert W. Harrison in 1971 and had established itself as one of the largest independent mergers-and-acquisitions companies by 1985, when Harrison sold it to Lehman Brothers. Harrison remained at Lehman Brothers, serving as a member of the investment banking operating committee and the merchandising group as well as chairman of the Financo unit. In 1989, Harrison reacquired the Financo name, left Lehman Brothers and relaunched the business. Today he serves as Financo’s chairman. Reiner joined the company with nearly 20 years of experience as an investment banker. Before joining Financo, he was with CIBC World Markets, where he founded the company’s consumer/retail practice and helped broker deals with several apparel and retail clients, including Skechers, Quiksilver, Heeleys, DSW and American Eagle Outfitters. —A.A.N.

Green Ports

Clean air has been at the top of the agenda this year for the ports of Los Angeles and Long Beach.

Geraldine Knatz, executive director of the Port of Los Angeles, and Richard Steinke, executive director of the Port of Long Beach, have joined forces to sweep clean the environment around the nation’s busiest port complex, where 40 percent of all the goods shipped into this country are handled.

Knatz, who took the top spot at the Port of Los Angeles in early 2006, has lots of experience working in the world of green. During her years as managing director at the Port of Long Beach, she charted the waters for the Port of Long Beach’s environmental programs years before most ports knew the meaning of green.

After she moved over to the Port of Los Angeles, Steinke and Knatz developed the Clean Air Action Plan.

The plan aims to reduce pollution around the ports by 45 percent in five years. Part of the plan involves a controversial clean-truck program that would eliminate 16,000 polluting trucks from calling on the ports after 2012. The ports are figuring out how to pay for the $1.8 billion program, which starts in October 2008. They are considering dirty-truck fees or extra container fees to fund the project.

Both ports are updating terminals so ships can dock and power themselves with electricity instead of diesel fuel. This process is known as “cold ironing.”

At the Port of Long Beach, workers have been rehabbing the BP oil terminal so ships can plug in by next year. Then the “K” Line container terminal and later the Matson container terminal will be renovated for plugin activity.

At the Port of Los Angeles, workers are busy installing equipment to allow ships calling at the Evergreen terminal next year to plug in as well as passenger cruise ships docking at the World Cruise Center. One container terminal for the China Shipping Co. and NYK Line has already been converted for cold-ironing activity. —D.B.

Ilse Metchek/California Fashion Association

The California Fashion Association had an active year organizing panel discussions, addressing state labor issues and taking a stand against the proposed Design Piracy Prohibition Act.

Now in its 12th year, the Los Angeles trade organization has been headed by Ilse Metchek since its inception. The group helps grow the state’s apparel industry and educate it about relevant current issues.

The year started out with Metchek traveling to Hong Kong Fashion Week, where she and Los Angeles apparel manufacturer Vera Campbell, owner of KWDZ, held a panel discussion for overseas clothing makers about retail opportunities in the United States. Other panel discussions CFA members and Metchek participated in included discussions about doing business with China and South Korea as well as creating brand identity in the U.S. market.

The CFA is constantly monitoring state rules and regulations governing apparel contractors and manufacturers, focusing on labor, business and workers compensation matters. In October, CFA members met with new state Labor Commissioner Angela Bradstreet, who oversees labor and wage issues.

Customs problems were first and foremost at the annual CFA membership meeting in downtown Los Angeles in May. Janet Labuda, director of textile and apparel enforcement for U.S. Customs and Border Protection in Washington, D.C., talked about problems affecting apparel importers getting their goods through customs as well as various schemes to circumvent quotas and tariffs.

Closer to home, the CFA worked with recruiter 24/Seven to create the “California 2007 Salary Survey,” the first industry survey for the region in 10 years.

Business was not the only thing on the CFA agenda. The association organized a few walks down the runway this year. It helped produce a fashion show of Los Angeles designers for Mayor Antonio Villaraigosa’s business trip to China and South Korea in March.

Another fashion event had the CFA partnering with the Port of Los Angeles to celebrate the port’s 100th anniversary. The CFA and the port organized the “L.A. by Design” fashion show in a downtown park. Los Angeles–designed creations, many made in Asia and imported through the port, were highlighted. Models included Los Angeles City Council members Eric Garcetti, Jan Perry and Richard Alarcon.

The CFA joined the heated discussion on the Design Piracy Prohibition Act, a bill introduced in Congress that, if it were passed, would extend copyright protection to fashion designs for three years. The CFA met with U.S. Rep. Howard Berman (D-Calif.) about the issue and has held several panel discussions explaining the bill and opposing its passage.—D.B.

Indie Fashion Shows

Indie fashion shows garnered much of the Los Angeles Fashion Week buzz in 2007, thanks to two multi-line, multi-day fashion events in downtown Los Angeles and a passel of independent fashion shows scattered across town.

In March, Los Angeles saw the debut of two multi-line events: BoxEight, with headliners Eduardo Lucero and Jared Gold, and Kitten Fashion Week, with newcomers Suh-Tahn and Ziji. By October, Kitten sat the season out while BoxEight returned with an expanded format, a new venue and a greater focus on combining fashion with music and art. In a mark of the event’s buzz factor, Los Angeles Mayor Antonio Villaraigosa attended BoxEight’s runway presentations for Eduardo Lucero and Louis Verdad.

BoxEight followed the well-established fashion/music/art format of Gen Art, which has been showcasing Los Angeles’ creative talent for 10 years. Held at the Petersen Automotive Museum, Gen Art was, for some fashion watchers, the highlight of the October fashion week.

This season, some designers and brands—including Linda Loudermilk, Juan Carlos Obando and Ed Hardy—opted to stage solo presentations away from the tents of Mercedes- Benz Fashion Week at Smashbox Studios, which upped its own buzz factor with well-attended runway shows by Randolph Duke, Petro Zillia and Grey Ant.

The result was a fashion week that stretched over 18 days and had buyers, press and fashion fans racing around town to catch the next show.

For many, the week was reminiscent of the days before Mercedes-Benz Fashion Week arrived with its professional format and international media draw.

Indeed, before Mercedes-Benz Fashion Week teamed with Smashbox Studios designers including Michelle Mason, Alicia Lawhon and Jared Gold staged their own fashion presentations in eclectic venues such as downtown alleys and tunnels and the Chinatown arts district. There was even a precursor to Smashbox, in the form of a multi-line, multiday event, Audi Fashion Week, organized by local public-relations company SPR in 2001. And until recently, an indie fashion week, P.KaBu, ran concurrently with the shows at Smashbox.

In all, this year’s multiple venues and wide-ranging fashions—from well-established brands and well-organized events to newly minted up-and-comers and a grass-roots approach— all contributed to the vibrancy of Los Angeles and helped illustrate the rich diversity of the city’s fashion community. —A.A.N.

Kent Smith/Los Angeles Fashion District Business Improvement District

Kent Smith, executive director of the Los Angeles Fashion District Business Improvement District, has the Herculean challenge of keeping the district’s 94 square blocks of bustling wholesale and retail trade running smoothly. The district continues to experience booming growth with loft construction as well as wholesale and retail projects. Over the past 10 years, the district has nearly doubled in size from 56 to 94 blocks.

Under Smith’s helm, along with the support of the BID’s board of directors, the Fashion District has become a model for urban planning. Within the past year, Smith was elected treasurer of the International Downtown Association, which is a leader of and champion for vital, livable urban centers. The IDA is a guiding force in creating healthy, dynamic centers that anchor the well-being of towns, cities and regions of the world.

Over the past year, the BID has worked with local businesses to bring a farmer’s market as well as events such as the “Find Your Fit” shopping tour to support local retailers.

Smith has also been a key liaison between the Fashion District and the city of Los Angeles and other governmental and private agencies. All the while, the BID continues to keep the district among the safest and cleanest in the city. —R.M.

L.A. Look

Informed by the sun, the sand, the palm trees, the gritty East side, the posh West side, celebrities and street kids, Los Angeles fashion made a powerful statement in 2007. The “L.A. look,” captured best by the city’s contemporary and young designer brands, got plenty of attention from retailers, showroom owners and the fashion media. Laid-back but not casual, luxurious without being stuffy, sexy but chic, Los Angeles’ fashion came into its own in 2007. Designers such as Rodarte, Monique Lhuillier, BCBG Max Azria, Michon Schur and Jovovich-Hawk were warmly welcomed on the catwalk at New York Fashion Week, and contemporary brands proved their mettle.

“The California style of dressing has filtered through to the East Coast,” said Stella Iishi, founder of The News, an influential New York–based showroom with a second location in Los Angeles’ Cooper Design Space. Her stable of lines includes Los Angeles–based Jovovich-Hawk, Kazuo, Rose and Band of Outsiders as well as Shipley & Halmos, a new line from two Trovata alums who took their quirkymeets- classic aesthetic to New York. “Now people everywhere are doing light and layering—more like California.” Even Vogue magazine focused keenly on the West Coast in 2007. For its “7 Closet Classics” piece in its November issue, five of Vogue’s selected must-haves hailed from Los Angeles: Mike & Chris leather jackets, Free City sweats, J Brand’s perfect denim, Haverhill’s indispensable swimsuits and designer basics from James Perse. —E.B.

Lingerie Trade Shows

Lingerie buyers hoping for a West Coast lingerie trade show received their wish twice over when two upscale lingerie trade shows launched in Las Vegas this year, running during the same time as the giant MAGIC Marketplace, Pooltradeshow, Project Global Trade Show, The Exclusive, ASAP Global Sourcing Show , WomensWear in Nevada show, Accessories The Show and Off-Price Specialist Show.

Curvexpo, headed by intimate-apparel industry veterans Jean-Luc Teinturier and Laurence Teinturier, launched as CurveNV in February. Held at The Venetian hotel, the trade show was attended by 1,500 buyers who shopped the high-end intimate-apparel exhibitors. Curvexpo will raise the cutting-edge designer quotient next year through a partnership with Samantha Chang’s Boutique Lingerie trade show, which features many high-end British labels. Curvexpo also has its eye on New York and will launch CurveNY in February 2008.

The New York–based intimate-apparel trade show Lingerie Americas continued its steady climb with its launch of a Las Vegas leg of the trade show in August 2007. Since its New York debut in August 2002 with 120 brands, Lingerie Americas has expanded its East Coast show to include 270 lingerie and swimwear brands. More than 1,700 buyers attended the first edition of Lingerie Americas Las Vegas, held at The Venetian hotel. Lingerie Americas recently announced a partnership with the biggest trade show on the block, WWDMAGIC, the women’s section of the MAGIC Marketplace. In February, MAGIC will host Lingerie Americas Las Vegas at the Las Vegas Hilton.—Rhea Cortado

Matt Priest

It’s been almost one year since Matt Priest was named the U.S. Commerce Department’s deputy assistant secretary for textiles and apparel. His multifaceted job affects every apparel and textile importer and exporter in this country.

He is head of the Committee for the Implementation of Textile Agreements (CITA), an interagency committee headed by the U.S. Department of Commerce that makes sure all the free-trade agreements between the United States and other regions run smoothly. The CITA also decides if safeguard measures, or temporary quota restrictions, are placed on apparel and textile imports. Currently, there are safeguards until the end of 2008 on 34 categories of apparel and textiles coming from China. CITA also has been monitoring apparel and textile imports from Vietnam ever since that country joined the World Trade Organization in early 2007.

Priest also oversees the Office of Apparel and Textiles (OTEXA), which compiles industry data on imports and exports and monitors imports for various trade agreements.

In July, Priest oversaw the first reorganization ever of OTEXA, shifting it away from an agency responsible for quota monitoring to an agency with greater focus on logistics and financing issues. A liaison is working with the industry to understand logistical and transportation issues better and to resolve problems in these areas.

Priest’s philosophy has been to maintain an open door for apparel importers and textile producers to discuss their concerns and problems.

One of his goals has been to open new markets for the U.S. textile industry, which has been shrinking because of increased worldwide competition.—D.B.

PLM (Product Lifecycle Management)

Product Lifecycle Management (PLM) is being touted as the next must-have in technology. The software application manages the many steps involved during the pre-production stages via an Internet-based database. Technology vendors call it the “single version of the truth,” putting everybody in the supply chain on the same page.

More than just a depot of information, PLM is emerging as a collaboration tool to give companies insight as to where problems lie and where opportunities can begin. While factories may be thousands of miles away, PLM has given product managers visibility like never before.

The technology has also proved itself. According to vendor New Generation Computing’s case studies, PLM can reduce cycle times from 20 percent to 50 percent, enhance margins by 2 percent to 5 percent and reduce sample production by 3 percent to 7 percent.

California resources such as Freeborders, PoriniUSA, Siemens/UGS, Centric Software and others are among those lining up to join the market leaders in luring a large base of retailers and manufacturers looking to jump on the PLM bandwagon and help them give up the world of Excel spreadsheets, e-mails and faxes.

“As the apparel industry shifts from PDM to enterprise PLM and its benefits, the industry is finding two key areas missing: sourcing and line planning. Improving these processes is essential to shorten go-to-market and sourcing cycles,” said Chris Groves, chief executive officer of Centric Software. —R.M.

Project Global Trade Show

When the gargantuan MAGIC Marketplace acquiredthe Project Global Trade Show, a boutique contemporary menswear show, in 2005, industry folk wondered if the move would kill the goose that laid the golden egg. But two years later, it is clear Project, now 5 years old and with editions in Las Vegas and New York, has remained the perennial cool kid on the block. In 2007, Project cemented its place in the upper echelon of influential trade shows when it doubled its size and formally added women’s contemporary and high-end offerings to its mix. The sea change happened during the February edition in Las Vegas and, by the August Sin City show, Project had doubled in size from the previous year. Now, with the addition of women’s highend and contemporary lines—including notables such as Vivienne Westwood, Twinkle by Wen Lan, BetseyJohnson, Charlotte Tarantola and Juicy Couture— Project is changing when women’s contemporary brands bow their new seasons. While brands traditionally debut their Spring collections in September during ENK’s Fashion Coterie trade show in New York, this year, more and more brands opted to preview Spring at Project’s August show.

In all, the addition of women, the added square footage and the sneak peeks at upcoming seasons made Project a must-attend show in 2007. —E.B.

Rising Retail Rents

Commercial rents have skyrocketed for the premier retail streets of Los Angeles, and there is no indication that the rush to higher prices is going to slow down at any of those places, according to a Nov. 2 forecast presented by Ed Sachse, president of the Sachse Real Estate Co. Inc., based in Beverly Hills.

Commercial rents have increased 10 percent from the third quarter in 2006 to the third quarter in 2007, according to a report from Grubb & Ellis, but merchants might find themselves paying much higher prices in the upcoming year.

While rents for the premier places on Robertson Boulevard ranged from $15 to $25 per square foot in 2007, Sachse forecasted that the prices will jump to $20 to $30 in 2008. Rodeo Drive prices averaged $45 per square foot in 2007. He projected that prices will jump to $55 in 2008.

Prices at Santa Monica, Calif.’s Third Street Promenade hovered between $18 and $20 per square foot in 2007. They might jump to $20 to $25 per square foot, according to Sachse’s research. He presented the forecast at the Sixth Annual Westside Economic Summit at the Skirball Cultural Center in Los Angeles.

The slowing national economy is unlikely to impact commercial rents on Los Angeles’ high-profile retail streets, according to Matthew May, president of Encino, Calif.–based May Realty Advisors. The reason is basic economics. There’s a limited supply and an overwhelming demand for these spaces.

But prices might drop for secondary retail streets in 2008, May said, which could open up new retail districts. “Retailers need to make money. Eventually they’re going to say, ’We will take our deals somewhere else,’” he said.

However, many specialty retailers might be caught in a bad position when it comes to commercial rents, said Fred Levine, co-owner of the 21 M.Fredric boutiques located in some of Los Angeles’ most-coveted real estate, such as The Grove shopping center in Los Angeles.

“Lease rates are outrageous,” said Levine, who recently renewed some of his leases. “I have no choice. Either you pay the price, or you move on,” he said.

He claimed that desirable space is so expensive in Southern California that what seems outrageous typically is a fair-market value. “We have a very loyal following. We’re going to have the business,” he said. “But we’re going to have to go home with less profit this year.” —A.A.

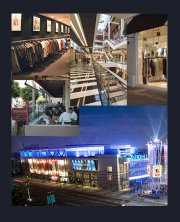

San Francisco RetailIn recent years, San Francisco luxury offerings have expanded in the city’s Union Square district and nearby neighborhoods, which include the Westfield San Francisco Centre.The area is home to six major retailers, including Macy’s, Neiman Marcus and Saks Fifth Avenue. Barneys New York opened a flagship in the area in September.

In late 2006, a Bloomingdale’s opened at the Westfieldmall and Nordstrom unveiled a major remodeling.

The area’s identity as the go-to place for luxury comes at a price. Rates for Union Square commercial real estate increased 20 percent in the past two years, according to Kazuko Morgan, a senior director in the San Francisco office of real estate company Cushman & Wakefield. In 2007, a square foot of retail real estate in Union Square typically costs $30.

Union Square has traditionally been a center for luxury retail. Prada maintains a boutique at 140 Geary St. Cartier runs a boutique at 231 Post St. However, the area gained new popularity with retailers in 2005 when Hennes & Mauritz LP (H&M) opened two boutiques in the area at 150 Powell St. and 150 Post St.

H&M also opened an additional store in The Westfield San Francisco Centre in September.

Many San Francisco retailers have embraced the retail boom at Union Square and Westfield San Francisco Centre. Terri Olson, co-owner of the Minnie Wilde boutique, located in the neighboring Mission District, thought the department-store flagships could boost San Francisco’s standing as a fashion city.

But the retail spots may not be limited to San Francisco residents. The area has long been a center for tourism at California’s most unique city, and tourists have reportedly flocked to the luxury retail offered at Union Square, said Tanya Zilinskas, owner of San Francisco e-tail boutique Maneater Threads.

She said that locals typically pop into Westfield San Francisco Centre for necessities, but they also devote shopping expeditions to the city’s other retail neighborhoods, such as Hayes Valley. —A.A.

Streetwear

2007 marked the year that streetwear climbed to the top of the activewear heap, dominating youth styles and taking some of the most highly coveted retail real estate in Los Angeles.

Los Angeles–based streetwear brand Crooks & Castles made one of the biggest splashes. On Dec. 7, the upstart label opened its first flagship shop on Melrose Avenue, just across from one of the most celebrated names in specialty retailing, Fred Segal. The Crooks & Castles store is just one of the shops that will make this high-profile section of Melrose a hub of streetwear, the more fashion- and hiphop friendly look of the closely related categories of surf and skate apparel.

Japanese streetwear label A Bathing Ape will open soon at 8001 Melrose Ave., and streetwear-friendly store DC Shoes opened Dec. 8 at 8025 Melrose Ave. Less than one mile away, streetwear brands have dominated the 400 block of North Fairfax Avenue since 2006, including highprofile boutiques The Hundreds, Supreme, Reserve and Flight Club.

Streetwear retailer Greg Selkoe, owner of Boston-based Karmaloop, said Los Angeles is becoming known as a capital for streetwear. “New York is highly important for streetwear, but Los Angel