Slow but Steady Growth Seen for 2007

A slight chill is blowing over Southern California’s economy, much like the recent weather that swept through the area.

Housing prices and new residential constructions are expected to remain soft this year, putting a slight damper on the economy. But there should still be a smidgeon of job growth throughout the region and modest movement in retail sales.

“Overall, the outlook is not dim or grim, but it is cautionary,” said Esmael Adibi, director of the A. Gary Anderson Center for Economic Research at Chapman University in Orange, Calif.

Since 2000, the main engine driving California’s economic growth has been the rapid run up of housing prices, turning ordinary citizens into seemingly affluent millionaires. With housing prices doubling and tripling in a matter of years, consumers not only felt rich, they capitalized on that paper wealth by refinancing their homes. That extra cash turned into purchases of cars, clothes and vacations. “People have been spending more than they earn for a while. That was caused by real estate,” said Christopher Thornberg, the Los Angeles principal in Beacon Economics. “Over the last 18 months, the private-savings rate went into negative territory.”

The Southern California housing market started stuttering at the end of 2005. Housing inventories have nearly doubled. Home prices are beginning to dip, and year-over-year housing sales numbers have plummeted.

“With prices pinching in 2007, people will think, ’This is a mess. I need to backtrack and get my finances in order,’” Thornberg said.

For the last few years, several financial pundits have been predicting that California’s offkilter real estate prices were going to have to return to reality. Many believe that time has come.

Thornberg said he first noticed housing sales dipping 1 1/2 years ago. He expects that to level off by the end of the first quarter of 2007. But housing prices, he believes, will slip over the next two years.

Many economists agree that Los Angeles’ sliding real estate market will put a damper on this year’s financial well-being.

“You are going to see growth that is slower than in 2006, but you are coming from a big level of growth,” said Jack Kyser, chief economist at the Los Angeles County Economic Development Corp.

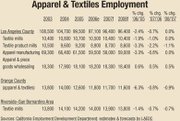

The apparel-manufacturing sector in Los Angeles County will continue to shed a few jobs, but it seems to be leveling off. In 2006, apparel manufacturing lost 1,600 jobs. Total employment was at 79,009. The textile industry had it a bit easier. Employment declined by only 200 positions, for a total of 10,500 jobs. The apparel-wholesaling sector plateaued at 18,100, with relatively no job attrition, according to the California Employment Development Department.

One factor that may have an uncalculated but beneficial effect on Los Angeles’ apparel manufacturing industry is the fast-fashion concept, with stores quickly restocking with new styles and fashion.

Could that mean that small factories might be overloaded with quick-turn orders to fill the shelves of growing fast-fashion chains such as H&M or Mango or Zara? “H&M is coming to Southern California in a big way,” Kyser observed. The Swedish-based retailer opened its first store in Southern California in Pasadena, Calif., last year and has been aggressively expanding, with a store opening in the Beverly Center in Los Angeles and more slated to launch soon in the Crystal Court near South Coast Plaza in Costa Mesa, Calif., and at the new Americana at Brand mall being developed by Rick Caruso in Glendale, Calif. “What impact is that going to have on your traditional apparel retailers like the department stores and the specialty chains?” Kyser asked.

These new retail chains crossing the Atlantic Ocean from Europe bode well for retail jobs. Despite the consolidation last year of Federated Department Stores Inc. with the May Department Stores Co., which operated the Robinsons-May department stores, Los Angeles County gained 2,800 retail positions in 2006, for a total of 415,000 retail jobs. “Retail employment should show a little more growth in 2007 than 2006 because of the sorting out of the Fed-May merger in 2006. You have lots of dark stores, but in 2007, especially toward year’s end, you’ll see more stores opening up in those spaces, such as Bloomingdale’s in the old Robinsons-May space in South Coast Plaza,” Kyser said.

Overall, job growth in the state is expected to inch up about 1 percent. That will help apparel sales weather much of the economic slowdown in 2007, said Adibi of Chapman University. He predicts apparel sales in California will grow 6.1 percent this year. That sounds pretty healthy, but it is down from the 8.6 percent growth experienced in 2006 and the healthy 11.4 percent increase seen in 2005. “The numbers are positive, but it is not as strong as it used to be,” he observed.

Apparel companies should also be seeing their sales revenues grow at a decent rate this year, said Bruce Berton, director of international business consulting at Los Angeles accounting firm Stonefield Josephson Inc. “Companies’ sales revenues will be 3 to 5 percent above what they were in 2006,” he said. “But as far as profits are concerned, I think they will have to work a little harder to generate sales. So gross margins might be a point or two less.”

Overall, the apparel and retail industries will have a pretty good year, with modest gains and a few changes in the air. “It is going to be an interesting year in apparel manufacturing and retailing,” Kyser said.