Demand for Warehouse, Retail Space Continues to Be Strong

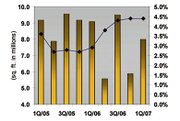

The search for quality distribution and warehouse space continued to be difficult during the first quarter of 2007 in Los Angeles County, where vacancies remained at the sub 2 percent level, according to Grubb & Ellis Research.

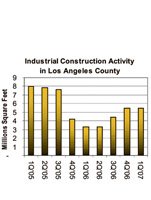

Analysts said that many companies want to upgrade from older, cramped facilities into more-modern ones, but they are facing scarcity of supply. There is hope on the way as more than 5.5 million square feet are being developed, up from 3.4 million last year.

The bulk of the development is being done in Los Angeles County’s San Gabriel Valley.

The good news is that there are opportunities for start-ups and smaller companies to pick up smaller buildings as larger companies grow out of them.

Sales and lease activity continued strong during the quarter as 7.6 million square feet were leased. Sales were limited to 1.7 million square feet as owners were holding off until the market further appreciates.

Heading to the end of the fiscal year, Grubb & Ellis analysts are forecasting a 5 percent annual growth rate in asking rates, and vacancy rates will remain between 1 percent and 2 percent over the next quarter.

Construction strong in the IE

The Inland Empire finished 2006 as the national leader in construction activity as almost one-fifth of all industrial construction activity occurred in the IE. The pace is continuing into 2007 with an increase of about 6 percent during the first quarter to 24.2 million square feet. Absorption was up 21 percent to 5 million square feet with flat vacancy rates of 4.4 percent.

The trend in the IE is to build bigger and better. More Fortune 500 and multi-national companies are coming to California and are demanding gigantic warehouses. Among them are Tesco, the giant British retailer that is building an 820,000-square-foot distribution center to accommodate a plan for 150 stores in the region. Oakley recently committed to another 300,000 square feet in the IE, bringing its total to 400,000 square feet.

Developers saw 65 percent of their speculative projects leased or sold during the quarter, which gives them more incentive to continue adding spec buildings—that is, projects that have no pre-leased or contracted clients.

Economy fuels retail

Retail demand in Los Angeles County also continued strong as vacancy rates dropped to 2.6 percent, down 1.3 percentage points from a year ago. The retail job sector added 10,000 jobs in California, and retailers have been demanding more space based on the health of the local economy. Los Angeles County especially has enjoyed steady job growth and high consumer spending. Apparel retailers reflected this, posting solid results and attributing the growth in the first quarter to fluctuating weather patterns, which prompted consumers to purchase a mix of cold- and warm-weather clothing, said Grubb & Ellis analysts.

West Los Angeles was among the key submarkets sought after. New choices also included ground-floor retail being offered via mixeduse developments with firstfloor retail and upper floors dedicated to residential space. Downtown Los Angeles is one of the areas being built up. Downtown posted $1.7 billion in taxable retail sales last year.

But analysts are worried that fluctuating energy costs and a housing slump may slow retail sales going forward.