Mid Year Financial Review: Few Bright Spots on the Economic Horizon

Election-year politics usually produce an upturn in the economy, even during tough times.

But that probably won’t happen this time around, warned economists speaking at the Los Angeles County Economic Development Corp.’s mid-year update and economicforecast held July 16 at the downtown Los Angeles Marriott.

There are too many factors standing in the way of any sort of recovery. Any improvements will not come until 2010. Oil prices remain high. Housing has recovered somewhat, but there are still high levels of inventory in the marketplace.

Financial institutions are under pressure, as seen by the recent failure of IndyMac, and unemployment rates are climbing in some key areas. In addition, the U.S. dollar remains at near-record lows in Europe and elsewhere.

“IndyMac caught the attention of a lot of people,” said Jack Kyser, senior vice president and chief economist at the LAEDC. He pointed to the long lines of customers trying to get their money back from the failed institution. “We’ve been tip-toeing on the brink of a recession. In some areas, we are in a recession. Nevertheless, it’s going to be a tough year for many,” he observed.

As far as the apparel industry is concerned, retailing is expected to struggle as consumer confidence languishes at record lows and rising food and gas prices cut into apparel spending. The recent Chapter 11 bankruptcy filing by Port Washington, N.Y.–based apparel retailer Steve & Barry’s is one example of how chains are struggling.

Looking at the situation from a microeconomics perspective, the Southern California apparel industry can take advantage of opportunities as smaller manufacturers adapt to the marketplace because of their ability to do quick turns and smaller orders, Kyser said. That should contribute to an expected 5 percent increase in exports out of the ports of Los Angeles and Long Beach, hitting a record $367 billion this year. Imports, however, are expected to decline 4.5 percent to 15 million 20-foot containers in 2008.

“It’s been tough. The holiday ’08 season is probably going to be a nail-biter. The good thing is that we’re strong in juniors and contemporary [fashion] as well as the action-sports market,” Kyser said.

Some markets such as Los Angeles and San Francisco could benefit from improving tourism and growing industries in technology and bio-medicine.

Apparel and textile jobs

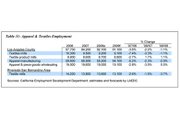

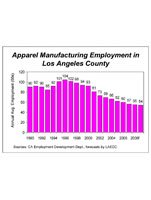

Apparel manufacturing employment ended fiscal 2007 at 56,500 jobs, down from 59,600 the previous year. The forecast is another 1,000 jobs will be lost in 2008.

Jobs at Southern California textile mills were expected to fall to 92,100 this year from 94,200 in 2007, while apparel and piece-goods wholesaling was down to 19,000 this year from 19,600 in 2007.

“Retailers are still coming to Los Angeles to buy, but they are placing smaller orders,” Kyser said in the economic forecast report prepared by the Kyser Center for Economic Research.

The recent announcement that two new textile shows were coming to Los Angeles was a vote of confidence, but at the same time, it could cause some confusion within the industry.

Other factors affecting business next year include increasing retail competition when fast-fashion retail chains H&M and Forever 21 expand.

Even high-end stores will feel some pinch from the faltering economy, said Kyser.

Undoubtedly manufacturers and importers will be challenged on pricing due to rising costs overseas. The cost of doing business in China is going up as well as the cost of importing.

Kyser said there is also nervousness over immigration laws and continued pressure by Immigration and Customs Enforcement on manufacturers to verify the immigration status of their employees.

During the May Day protests, many apparel-industry workers marched in support of more freedom in the workplace.

Kyser warned that other factors could change the area’s economic outlook quickly. Longshore workers at the local ports still do not have a contract, and a work stoppage could be devastating to local industries, particularly apparel importers and retailers.

The entertainment industry, which fuels a good portion of California’s economy, is still reeling from this year’s writers’ strike, which cost the economy more than $2.5 billion. Elections for Screen Actors Guild officers in September could also pose complications. In addition, the film and television companies continue to move out of state for production because of heavy incentives in states such as New Mexico.

Real estate reeling

The real estate market remains challenged by high levels of inventories and higher standards to obtain mortgage loans, said real estate consultant John Burns of Irvine, Calif.–based Burns Consulting.

He said the housing market is suffering because of mistakes made by lenders a couple of years ago, blaming lenders such as IndyMac and others for approving many subprime and adjustable-rate mortgages, no-income loans and other high-risk lending packages.

The fallout from the lending industry has hit markets such as Orange County particularly hard. Orange County lost about 6,000 jobs in 2007 and stands to lose close to 19,000 more this year, Kyser said, due to the county’s large base of subprime lenders.

“There is still high demand, but housing costs relative to income is higher than normal. There’s a massive pullback of credit now. We may be back to the days when you had to put 20 percent down for a mortgage,” Burns said.

The gas crisis is also becoming a factor in housing as buyers reconsider whether to live in outlying markets such as the Inland Empire. Added gas costs to commute to work can be a detrimental factor to that area’s housing.

That is causing a big downturn in employment in the Inland Empire, which has relied on housing construction over the past few years to fuel its economy. Kyser said as many as 20,000 jobs could be lost by the end of next year in that region.

Staying alive

With all the negative factors affecting the economy, the key to surviving the economy will be to weather the financial downturn and prepare for the upturn, said Richard Weiss, chief investment officer for City National Bank.

Weiss said categories such as housing, apparel and consumer goods have not experienced many price increases. Commodity prices are killing the economy, he noted, pointing to items such as grain and oil. Weiss thinks the stock market is close to a turning point, which could occur some time next year, he estimated. “It’s not there yet but is getting close,” he said.

The semi-annual conference featured a new area of research covering foreign investment in Los Angeles County. “Until now, we haven’t really had any data,” said Nancy Sidhu, vice president and senior economist at the LAEDC.

Sidhu and her team showed that about 4,500 foreign companies have operations in Los Angeles County, comprising about 2 percent of the county’s economy. “That may not seem a lot but because our economy is as large as some countries’, it is big,” she noted.

Japan, with about 1,400 companies, has the lion’s share, with 31 percent, followed by Europe (United Kingdom, France and Germany), comprising another 30 percent, and Canada, with about another 278 companies.

Retail, wholesaling and manufacturing make up the largest business categories. Employees of these foreign companies contribute about $1 billion annually in taxes.

One of those companies is Soex, a German textile recycler that is trying to set up a manufacturing operation in Southern California. The company has operated a pilot program in Vernon, Calif., over the past two years, showing success, said director Michael Kouml;lln. The company takes used clothing and fabrics and turns them into products such as insulation for automobiles or other textiles.

“We are 100 percent green. We don’t use water or chemicals. We could use help [from local government] in finding real estate because real estate here is so expensive,” Kouml;lln said. His company stands to bring more than 1,000 jobs to the local economy.