Warehouse Growth Slowing While Retail Demand Remains Strong

Sales, leases and construction activity for warehouse and other industrial properties took a modest downturn in Los Angeles County at the end of 2007, but the slowing economy did not have much to do with it, according to real estate analysts. Rather, a lack of land and new projects coming on line contributed mostly to the slowdown, said researchers at Los Angeles–based real estate company Colliers International.

Construction activity in the Los Angeles basin slowed to a rate of 34 percent, to 19.8 million square feet, for the fourth quarter of 2007, down from the 30.1 million square feet underway the previous quarter. Most of the new construction is being done in the Inland Empire, which includes Riverside and San Bernardino counties.

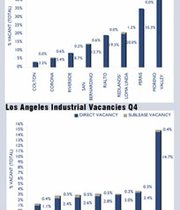

In Los Angeles and Orange counties, just 3.4 million square feet are under construction. As this space comes on line, it will expand the base by just 0.3 percent, well below projected demand. Vacancy rates in these counties are projected to remain in the 2 percent to 3 percent range, according to Colliers.

Companies will continue to experience significant difficulties in finding available space. In the Inland Empire, 16.3 million square feet are underway. As this space comes on line, it will expand the base in these locations by 4.5 percent, and vacancy rates there are projected to climb, particularly in the eastern Inland Empire.

At the end of the fourth quarter, sales and leasing activity for Los Angeles County totaled 17.9 million square feet, down from 21.5 million square feet the previous quarter and 2007’s quarterly average of 23 million square feet.

After five years of strong growth, the western Inland Empire industrial market slowed as only 2.6 million square feet were absorbed during the fourth quarter, half the value of the previous quarter.

Colliers’ researchers cited the sluggish economy, adjustment to the above-average activity in previous quarters, and resistance to rental rates and sale-price increases that have pushed users farther east.

In the eastern Inland Empire, vacancy rates climbed to 12.5 percent and as high as 30 percent in some submarkets, including Moreno Valley and Perris, due to the completion of several big projects. Demand is still strong, however. Net absorption unexpectedly turned negative—1.4 million square feet—while construction completions were significant at 4.5 million square feet, which caused the vacancy rate in the eastern Inland Empire industrial market to climb to 15.1 percent. A significant softening in the eastern Inland Empire industrial market has taken place due to the combination of a construction boom and the slowing economy.

Still, several Southern California submarkets were packed. Among them are Colton (5.8 percent vacancy), Corona (6.8 percent), Rialto (7.5 percent) and San Bernardino (6.4 percent).—Robert McAllister

Retail Expansion Slows

Executives at Marcus & Millichap Real Estate are forecasting continued strong performance for retail real estate in the metropolitan markets. In Los Angeles County, the lack of buildable land and higher development costs is keeping new construction below averages, but demand is still strong. The company cited the fact that Caruso Affiliated’s 475,000-square-foot Americana at Brand shopping center in Glendale, Calif., was almost completely pre-leased six months before its anticipated opening date.

But moderating consumer spending growth will hinder expansion efforts for some. As a result, vacancy rates are expected to rise slightly to 7.3 percent in 2008.

In the San Francisco market, new construction is also being limited, but the professional- and business-services sector is experiencing employment growth, and that should fuel retail growth for the long run, said Marcus & Millichap executives, who ranked San Francisco No. 1 in its national retail index.

Tourism and population growth will also help. The city’s Eastside Neighborhoods Plan is expected to convert some old industrial space into housing and boutique retail space. There’s also some revitalization being done in the panhandle area of Haight- Ashbury, which is helping to lure boutiques.

Rent growth is also advancing in the most desired markets, given the influx of luxury tenants such as Barneys New York, Prada and De Beers. As a result, asking rents are forecasted to climb 2.5 percent to $34.76 per square foot. —Robert McAllister