Industrial Real Estate Drops for Fifth Straight Quarter

Demand for warehouse and manufacturing space declined for the fifth straight quarter at the end of the first quarter of 2009, reflecting what’s been happening on the global trade front as exports to the United States continue to dwindle.

According to real estate company Colliers International, 11 percent of the world’s shipping fleets are idle, and port activity at Los Angeles and Long Beach, Calif., was down in February by 36 percent over the previous year.

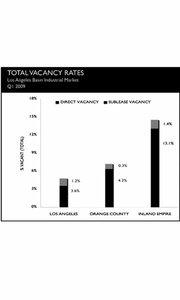

In the Los Angeles basin, which includes Los Angeles and Orange counties as well as the Inland Empire (Riverside and San Bernardino counties), net absorption (the rate of leases and sales during a given period) totaled negative 7.5 million square feet while the vacancy rate climbed to 7.2 percent from 6.6 percent for the first quarter.

Construction activity for the region has shrunk to its lowest level in over two years as the market continues to correct.

Among the hardest-hit areas, according to Colliers researchers, was the Inland Empire, where unemployment hit 12.2 percent in February, well above the regional average of 10.6 percent. Negative net absorption hit 3.3 million square feet for the first quarter. The central Los Angeles market also lagged, falling to the slowest rates in eight years, with negative 727,200 square feet.

Overall vacancy rates surged to 7.2 percent from 5.1 percent in 2008. The eastern Inland Empire area was hardest hit, with vacancy rates topping out at 23 percent. Lease rates for the region fell to 47 cents per square foot from 55 cents, and the average sales price dropped to $115 per square foot from $118.

Despite the slowdown, the Los Angeles basin still maintains some of the strongest rates in the country. —Robert McAllister