Lycra Style Helps Invista Reintroduce the Ready-to-Wear Fiber

Invista turns to biometric market research to fine-tune the message for its latest brand launch.

Lycra has had a strong presence in the ready-to-wear market for about a decade, but when it came to the ready-to-wear consumer, the stretch fiber was still tightly tied to activewear and swim.

“There is still a very strong association among women ages 18 to 49 with Lycra in our traditional business segments—swimwear, activewear, legwear and active apparel,” said Libby Neuner, global marketing director for outerwear for Lycra parent company Invista.

A traditional market-research study determined that younger women do not currently think of ready-to-wear apparel when they think of Lycra. For Invista, the ready-towear market represents the biggest growth opportunity in the apparel business, and, as Lycra’s core customer gets older, the company is looking to establish its brand firmly in the minds of the next generation.

“We really needed to separate ourselves from the traditional segment and get our own identity in ready-to-wear,” Neuner said. “We need to reach out to the emerging generation and create the brand equity with [those consumers]. We needed to have a name that has a strong association with ready-to-wear garments.”

Lycra defined that emerging market as a narrow slice of the youth market. It’s not a juniors customer but includes college age and those just starting out in their careers.

“We stay in that 25-to- 30-year-old sweet spot, which is a great age because you’ve got 18-years-olds aspiring to be that age and you’ve got 35-yearolds who want to be that age again,” Neuner said. “It covers a wide aspirational population that is increasingly important to us.”

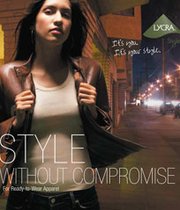

To reintroduce the popular fiber to a new generation and to firmly associate the name with the ready-to-wear market, Invista launched a new brand with a new identity: Lycra Style.

“People immediately associated [the Lycra Style name] with being modern, being fashion-forward, being contemporary—all the key attributes and purchase drivers in ready-to-wear,” Neuner said.

The next step in the marketing plan was to identify and highlight Lycra Style’s benefits for the ready-to-wear market.

“We looked at the other aspects of the ready-to-wear business and how we could cherry-pick an offering that was really wellsuited for the needs of that segment,” Neuner explained. “In intimate apparel, you need a whiteness additive. In activewear, you need compression. In swimwear, you need chlorine- resistance.”

But the difference between ready-to-wear and Lycra’s traditional market segments is one of fiber content. Activewear and swimwear typically contain 10 percent to 20 percent Lycra, but, in ready-to-wear, the Lycra content is far less. In denim, it’s typically 2 percent, and in circular knits the Lycra content ranges from about 5 percent to about 8 percent.

“The properties that go into the fabrics in ready-to-wear are different than the ones that go into the traditional end uses,” Neuner said.

For ready-to-wear, stretch and recovery performance are important, but equally important, Neuner said, is price.

“We rebranded, re-evaluated and took an aggressive position on pricing,” she said. “We are now in a position to very aggressively take market share for the largest segment in all of apparel.”

Using technology to measure emotions

The new brand will officially debut at Denim by Premiegrave;re Vision in Paris at the end of the month, where key Lycra customers will get a first look at the marketing for the new brand—and they’ll get a sneak peak at the technology behind the campaign.

Before bringing the new Lycra Style brand and campaign to market, Invista worked with Boston-based biometric marketing-research company Innerscope Research to test consumers’ emotional reaction to the brand and the campaign.

“Biometric market research is a breakthrough way to tap into the subconscious of your target audience,” Neuner said. “People can only really articulate about 20 percent of what they’re feeling. That other 80 percent is subconscious. You can’t get there in a traditional market-research environment.”

Innerscope’s biometric monitoring system measures heart rate, eye movement, body movement, respiration and perspiration to help identify whether a person is emotionally engaged, Neuner said. “And if you are emotionally engaged, it measures if it is in a positive way or a negative way,” she added.

Innerscope typically works with large consumer brands and entertainment properties. The company has measured consumers’ “biometric engagement” with on-air and cross-platform promotions on “American Idol,” as well as their emotional response to Super Bowl advertising. Innerscope’s Lycra Style research was conducted with a group of 60 women in Los Angeles, Chicago and Boston who previewed the Lycra Style logo, concept statement and marketing-campaign imagery. Innerscope measured the participants’ reactions and plotted them on a grid called an “affinity quotient map,” which measures reactions in quadrants: optimal, passive, ineffectual and intrusive.

“We got very interesting results,” Neuner said. “It really drove us to make some decisions around the imagery we use. It drove us to make some changes in the way we talked about the product to that demographic.”

For example, participants did not relate to one of the female models and neither of the menswear images in the original campaign. Four of the images tested well, landing squarely in the “optimal” quadrant on the affinity quotient map. And one of the images tested particularly well and became the central image in the campaign.

“The shot is a girl in just jeans and a T-shirt—she’s not your typical smiley, perky, bubbly face of Lycra,” Neuner said.

Using the feedback from the research, Invista reshot some of the images, adding the menswear back into the campaign.

“We think we have a very strong scientific foundation to tell brands and retailers that this brand will resonate with this consumer,” Neuner said.

Invista was so bullish on the biometric research technology, the company is now considering using it to measure the marketing impact of its core products.

“It is going to be something that we will use in all of our segments, particularly in some of our more mature segments, where we do tend to get the same information over and over again,” Neuner said. “If you want to get a fresh approach, this is what you need to do to better understand this emerging consumer base.”

But more than that, the company sees a place for biometric research beyond marketing, Neuner said.

“The whole organization got behind the research,” she said, adding that Invista Apparel Vice President of Technology Dr. Robert Kirkwood sees biometric research as a powerful tool for product innovation, as well. “We see it not just to dive deeper into our consumer market research around campaigns but also [to study] unmet consumer needs and future product developments,” Neuner said. “We will definitely be using it in a variety of applications.”