Economy on Track to Grow With Solid Retail Sales

If the U.S. economy were a car, it would be rolling down the highway of finance at 55 miles per hour instead of traveling at the speed limit.

It certainly isn’t racking up any speeding tickets, but progress is being made.

Bumps down the road include two federal tax cuts set to expire at the end of the year, rising gas prices and Europe’s stumbling economy.

But the tax cuts haven’t expired yet, and U.S. consumers are out and about in the stores, as seen in solid retail sales during the first part of this year.

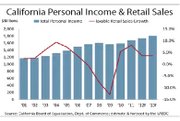

The National Retail Federation predicts that store sales will climb 3.4 percent this year to $2.53 trillion (which includes auto, gas and restaurant revenues). That may be down slightly from 2011, when retail sales jumped 4.7 percent for the overall year.

That’s because shoppers remain cautious. “Consumers say the problem is they don’t know what the future brings, and that is what scares them,” said Britt Beemer, a retail analyst and founder of America’s Research Group, which polls 1,200 consumers a week to take the pulse of their retail-spending attitude. “Forty percent of parents say they are worried because when their kids go to college, they cannot use their home equity to get a loan. ... So people are putting their money into a college fund if their kids are in the fifth grade or higher.”

However, consumers do feel better off this year than last year. Families have less credit-card debt and are getting their financial houses in order.

For example, Beemer said more women are willing to spend a little more on their spring wardrobe. Last year, women surveyed said they would wait until goods were 40 percent off before they bought something. This year, they are willing to buy apparel at 20 percent to 25 percent off.

“That is a positive sign for retailers,” Beemer said.

Balmy days

Mild weather this winter provided a boost for retailers. According to David Shulman, senior economist at the UCLA Anderson Forecast, temperatures in most of the country averaged 5 to 6 degrees above normal during January and February.

Nary a snowstorm dusted New York and New Jersey early this year, unlike late December 2010, when the mother of all snowstorms blanketed New York City and the East Coast.

In California, residents practically have been doing a rain dance to get a few drops of moisture to let loose from the sky. In Southern California, rainfall totals are half of normal.

So instead of staying inside, consumers went shopping. In February, department-store sales were up 4.8 percent. At home-improvement stores, sales skyrocketed 18.2 percent. “Though February is typically a month for consumers to stay home and wait for spring, shoppers this year took advantage of mild weather to get a head start on outdoor projects and warm-weather apparel,” NRF President and Chief Executive Matthew Shay said.

Warm weather led to more hiring at the beginning of the year. There were 227,000 and 284,000 net new payroll jobs created in January and February, respectively. But March turned out to be less ebullient, with only 120,000 net new payroll jobs added. “Everyone expected it to be over 200,000,” said Esmael Adibi, director of the A. Gary Anderson Center for Economic Research at Chapman University in Orange, Calif. “To me it was not a very big surprise because the January and February numbers were so strong.”

Tax man

Financial pundits believe the country’s economy will grow moderately this year. Gross domestic product is predicted to inch up between 2 percent and 2.7 percent. That is much better than last year’s pace, estimated at 1.7 percent, but below a healthy 3 percent, which would generate enough jobs to bring down the country’s 8.2 percent unemployment rate. In California, the unemployment rate is the third highest in the country, at 10.9 percent, right behind Nevada (12.3 percent) and Rhode Island (11 percent).

Unemployment figures have been stubborn to fall, but economists warn that if the payroll tax cut and the Bush-era tax cuts are not extended by the end of the year, there will be more financial turmoil on the horizon. “The big bump in the economy is the expiration of the taxes at the end of this year,” said the UCLA Anderson Forecast’s Shulman. With politicians in election-year mode, it is unlikely that the problem will be tackled until after the November elections.

The payroll tax cut, which is really a 2 percent reduction in Social Security taxes, adds $20 to a person’s pocketbook for every $1,000 earned.

The Bush tax cuts, which significantly lowered the marginal tax rates for nearly all U.S. taxpayers, expire at the end of 2012—after being extended in 2010.

Gas man

Gas prices are the boogeyman that keeps haunting the economy. In California, fuel prices have tracked higher for months, averaging $4.29 a gallon, compared with $3.94 nationwide. But prices at the pump have been slipping slightly in recent weeks. Still, they pose a problem.

“Fifty percent of the people I interviewed said that when gas prices hit $4.50 a gallon, they will go into panic mode and not buy anything,” said America’s Research Group’s Beemer. He noted the average family only has $164 left in its checking account at the end of the month. A $40-a-week rise in gasoline costs pretty much wipes that out.

Euro man

On the global front, economists worry that financial woes in Europe could sail across the ocean to the United States, which gets an economic boost from exports and financial investments to that region. Spain and Italy have massive debts they are trying to reduce. And many wonder if Greece will stay in the Euro-currency system, given its large debt problems and stiff economic-reform policies imposed upon it by European bankers and the International Monetary Fund.

“There is a lot of resistance in Spain and Italy to reforms. They are painful in the short run but necessary in the long run, and that is the problem,” Shulman said. “It will hurt U.S. exports.”

Still, California is expected to continue its growth mode in fields such as technology, healthcare, exports, and business and professional services.

The UCLA Anderson Forecast calls for California’s unemployment to hover around 10.8 percent this year and to slip to 9.8 percent in 2013. By 2014, the unemployment rate should dip to 7.7 percent, a half percentage point higher than the U.S. forecast.