FINANCE

How This Year’s Economy Will Affect Apparel Sales

After a harsh winter put a chill on the national economy, warmer weather is putting a spring back into consumer activity, which should translate into higher retail sales and apparel purchases for the rest of the year.

California didn’t suffer through freezer-like temperatures and blinding snowstorms, but California manufacturers were affected by retailers in the Northeast seeing sizable slumps in their same-store sales at the beginning of the year.

Marc Crossman, president and chief executive of Joe’s Jeans in Los Angeles, noted that traffic at the 34 Joe’s Jeans stores experienced a 10 percent to 12 percent drop in traffic early this year. Other retailers experienced the same predicament, with consumers sitting warmly at home rather than freezing their toes off to make it to the malls.

But March retail sales thawed out. Figures released by the U.S. Census show that March retail sales, which include automobiles, gasoline stations and restaurants, increased 3.8 percent adjusted year over year.

The National Retail Federation said its calculations, subtracting automobiles, gas stations and restaurants from the equation, saw retail sales rise 1.6 percent year over year.

Sales at clothing and clothing accessories stores inched up 2.3 percent year-over-year. E-commerce sites were booming with sales mushrooming 8 percent year-over-year.

This positive sales growth should continue throughout the country and in California, which has been seeing solid gains in job growth.

In February, the state’s unemployment rate dipped to 8.1 percent, which is far below its peak of 12.4 percent in February 2010. “We believe job creation is going to stay strong,” said Esmael Adibi, director of the A. Gary Anderson Center for Economic Research at Chapman University in Orange, Calif. “Last year we played catch-up, but this year we are on a sustainable path.”

Adibi predicted that employment would grow in California by 2.6 percent in 2014.

Some economists believe employment will return to its pre-recession level by late this year or early next year. At its pre-recession best, California employed 15.45 million people. Currently, there are 15.35 million workers with full-time jobs in the state. The state needs to add another 100,000 jobs to return to that higher level. “We should be able to make up that difference over the next several months,” said Robert Kleinhenz, chief economist at the Los Angeles County Economic Development Corp. “As households are experiencing wage gains and a better performance of the economy, we will see more discretionary spending.”

The UCLA Anderson Forecast predicts that employment in California (including farm, non-farm and self-employed) will rise 1.8 percent in 2014, 2.2 percent in 2015 and 2.1 percent in 2016. Non-farm payroll is expected to grow 2.2 percent, 2.3 percent and 2 percent for the three forecast years.

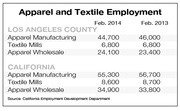

Jobs, however, continue to shrink in California’s apparel manufacturing sector. In February, 55,300 people worked in apparel manufacturing, a 2.5 percent decline from the same time last year. Still, 40 percent of the country’s apparel manufacturing jobs are located in California.

Rising tides

Healthy consumer demand means that activity at ports in the Los Angeles area should see cargo-container traffic move up by 3 percent to 4 percent this year. That means the Port of Long Beach and the Port of Los Angeles, the busiest port complex in the nation, will have about 14.5 million cargo containers pass through their docks. At their peak in 2007, the ports processed 16 million containers.

Stocks and blocks

Consumers buoyed by the wealth effect last year of rising home prices and booming stock prices are curtailing their enthusiasm this year. While stocks were riding high in 2013 with double-digit gains, that has changed.

U.S. stock markets have been on a see-saw pattern with the NASDAQ down 1.94 percent so far this year and the Dow Jones Industrial Average off by 1.01 percent.

“The only thing that gives me pause this year is the stock market,” said Adibi of Chapman University. “Are we going to go downhill or stay at this level? The stock market has a wealth effect on consumers, just like housing.”

Real estate is still on a strong foundation. Median home prices in Southern California were up a healthy 15.8 percent in March compared with the same month last year. The $400,000 median price in the six-county area of Los Angeles, San Bernardino, Riverside, San Diego, Orange and Ventura counties is the highest it has been since February 2008, according to statistics by San Diego–based DataQuick, which tracks real estate prices.