RETAIL

Rents Keep Rising for Retail Space in Hot Los Angeles Neighborhoods

Stories abound about the death of bricks-and-mortar stores, but retailers in Los Angeles keep setting up outposts and rents keep going up.

“There is a tremendous amount of runway for your cooler, younger, edgier and more-sophisticated brands,” said Andrew Turf, senior vice president, high street retail at CBRE Group Inc. “Brands that have played out in gigantic boxes selling cheap stuff are going by the wayside. The Amazons of the world do it just as well.”

One example of a cool retail project is The Platform, the chic new mixed-use development that recently sprouted up next to a light-rail train station in Culver City, Calif. The concept behind the project was to populate the retail portion with unusual stores that aren’t that common in Los Angeles. Those stores include Aesop, an Australian purveyor of skincare and haircare products that opened in February at The Platform as well as Parabellum, an LA-based bison-leather accessories brand, and Magasin, a men’s specialty store.

In this day of e-commerce, retailers have to give shoppers a reason to walk into their store or shopping center, Turf noted. That’s why so many outdated and dowdy shopping centers in the Los Angeles area are blowing themselves up and practically starting over as they take a page out of the “how to build an open-air mall manual.”

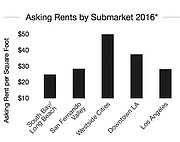

As cool retail spots are being developed, retail rents are edging upward in good shopping districts. According to a recent report by commercial real estate brokerage Marcus & Millichap, the average asking rents in Los Angeles County in 2016 will inch up 3.2 percent to $28.67 per square foot a year as competition for space nudges prices upward.

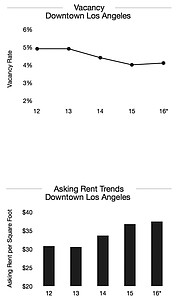

Several retail hot spots abound. Commercial real estate agents point to downtown Los Angeles as an up-and-coming neighborhood for stores. COS, or Collection of Style, the higher-end sister brand of H&M, is planning to take over the dilapidated 1927 Olympic Theatre on Eighth Street after it undergoes a major renovation. The COS store, scheduled to open in about a year, will be close to the new Freehand Hotel, rising inside the historic Commercial Exchange building at Eighth and Olive streets, which is being gutted and overhauled, and not far from Urban Outfitters and Acne Studios.

“There are about 90 projects that are in the works in downtown Los Angeles,” said Tony Solomon, vice president and regional manager at Marcus & Millichap, noting those projects range from apartment buildings to mixed-use facilities. “Rents have skyrocketed.”

Monthly asking rents around the Staples Center and LA Live neighborhood are as high as $12 per square foot while other downtown Los Angeles–area rents hover around $3 to $5 a square foot.

Other favorite retail areas include Venice’s Abbot Kinney Boulevard —with monthly rents at $15 a square foot—as high-tech companies occupying the Westside influence trendy stores. Melrose Avenue west of La Cienega Boulevard is moving forward with rents hitting $12 a square foot, and the area around the new Rams football stadium in Inglewood is ready to pop.

While so many commercial retail projects seem to be coming online, that process will dwindle in upcoming years. “We are starting to see a bit of a slowdown in permitting,” Solomon said.

Already that pace is declining. Developers will complete 600,000 square feet of retail space this year in Los Angeles County, down from last year, when 1.8 million square feet was brought to market. The most active area last year was the San Fernando Valley, where 570,000 square feet of retail construction was seen.

“People are starting to think, ‘Okay, we’ve had a good run for a number of years,’” Solomon said. “There is going to be a natural pause.”