SAS TEXTILES

SAS Textiles: Offering Quick-Turn and Quality Knits in Southern California

For Sean Sassounian, the way to compete with cheap imports is to offer top quality and quick turnarounds.

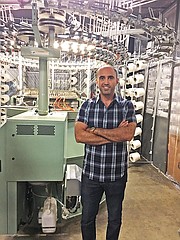

Sassounian is the chief executive officer and founder of Vernon, Calif.–based SAS Textiles, a versatile circular knitter of contemporary and performance fabrics.

Lots of changes have happened since he founded the company 23 years ago. Among them are smaller programs by customers and a move to online sales.

Sassounian founded SAS Textiles in 1993 while studying business at the University of Southern California. He had previously helped his father sell imported yarns from Brazil. He partnered with a knitter when he founded the company because, as he says, “I had no idea what knitting was all about.”

That’s no longer the case as SAS boasts a machinery arsenal of 150 assorted knitting machines with capabilities that include production of basic jersey fabric, double-knits and novelties.

Monarch makes the majority of the company’s machinery, and Sassounian recently purchased some new high-speed double- and single-knit machines, which he said offer much improvement over older models. He notes that with labor rates increasing, it is essential that SAS become as efficient as possible. He says he plans to switch out another 10 machines in 2017 for newer models.

SAS works with “select” dye houses in the Southern California area for dyeing and finishing. At one time, the company had a cut-and-sew partner in Mexico, but SAS is currently only offering fabrics. Sassounian said he hopes to move back into cut-and-sew sometime in the future. SAS has a product-development team that focuses on innovation and an extensive library of more than 20 years of styles that Sassounian says inevitably come back into vogue.

In addition to rising labor costs, which are coming about in part due to California’s new law that will gradually increase the minimum wage to $15 per hour by Jan. 1, 2021, textile companies are increasingly finding it difficult to recruit skilled labor.

“We have about 80 employees now and we are having a hard time finding knitters,” Sassounian said. “A lot of employees we had for a long time have moved to other states with a lower cost of living. Qualified labor is hard to find. Our head mechanic has trained some of our mechanics, so we have guys here who have been trained here from the ground up.”

SAS currently offers a starting pay of about $11 with more-experienced employees making more. The company offers a lot of overtime work and runs 12-hour shifts on a five-day week. All of this happens in a 140,000-square-foot plant and a warehouse that often holds 1.5 million to 2 million yards of yarn, so orders can be turned quickly.

Sassounian said his staff is working hard to increase efficiency throughout the plant. This includes a push for innovation to develop and offer products with added value so customers do not turn to imports.

SAS Textiles has moved into a more performance-oriented market in recent years as a way to diversify its product mix. Because SAS Textiles works with a lot of the better contemporary brands in the activewear market, quality control is essential and SAS puts a lot of effort into this area.

“We take our quality seriously here, and we don’t take shortcuts anywhere from yarn selection to the dye house,” Sassounian said. “We source yarns from all over the world.”

Yarn suppliers range from Parkdale Mills and Unifi in the U.S. to manufacturers in Mexico, South Korea and China.

“We go to the markets that make the best quality for what we are working on,” Sassounian said. That might be India or South Korea for cotton yarns made with U.S. cotton. We also buy from Indonesia and a lot comes from China. There are some mills in China that we have been working with for a long time. We buy a dyed rayon yarn out of Spain. We have 15 automatic stripe machines and we carry a big yarn inventory.”

Sassounian said he believes there is difficulty ahead for the California textile and apparel industry. He’s concerned that some manufacturers may opt to move to lower-wage states such as Texas and notes that some companies are considering moving to Texas due to tax incentives offered by that state. One answer may be increased factory automation.

“The traditional cut-and-sew factory operation will change in the next five years,” Sassounian said. “There will be more automation and robotics that will come into the plant, and as a result labor won’t be as great a factor. Some of the brands I have spoken to say that technology is on the way but a few years out.”

All the challenges notwithstanding, Sassounian is optimistic about his company’s future. Business has declined a little during 2016, but an improvement in sales in the early fall offers hope.

“We have customers in certain areas who are doing well, giving us the volume to keep things going,” he said. “The end of the year will be a tossup. I hope after the elections that people will begin spending more. It all depends on the economy.”