IMPORT/EXPORT

A Free-Trade Agreement Between the U.S. and Europe Waiting in the Wings

Trade experts were expecting a free-trade agreement between the United States and Europe to be signed, sealed and delivered by the time Barack Obama left the White House.

But things didn’t turn out as planned as the political winds in Europe and the United States shifted recently from pro free trade to increased protectionism.

President Donald Trump, after taking office early this year, indicated he wasn’t a big fan of multilateral free-trade accords. He quickly torpedoed the Trans-Pacific Partnership—the free-trade accord between the United States and 11 other Pacific Rim countries—and then threatened to tear up the 23-year-old North American Free-Trade Agreement.

And he wasn’t too kind about the Transatlantic Trade and Investment Partnership (T-TIP) between the European Union and the United States. He said he preferred bilateral trade deals with individual European nations rather than one big pact with all 27 countries that make up the European Union.

But hope springs eternal in trade circles that a free-trade pact between the United States, with its 324 million people, and the European Union, with its 515 million citizens, will happen.

“The free-trade agreement between the European Union and the United States is like Sleeping Beauty,” said Hans Jörg Neumann, the German consul general in Los Angeles. “There are lots of princes waiting to awaken it. It is not dead.”

Between July 2013 and October 2016, there were 15 negotiating rounds to hammer out details of the free-trade accord.

Klaus Brisch, head of technology at German law firm DWF, said T-TIP may be on life support now, but it will be rebranded under a different name with different elements incorporated into the pact.

Brisch and Neumann were speaking at a May 16 panel on the future of U.S. and European trade, organized by the Los Angeles Area Chamber of Commerce at its downtown LA headquarters.

Recently, Europe has been dealing with a wave of protectionism and anti-immigrant sentiment culminating with the United Kingdom voting last year to leave the European Union to better control its own policies and economy. The exit is commonly known as Brexit.

Many felt France might go in the same direction as recent presidential elections pitted right-wing candidate Marine Le Pen, who advocated closing borders and leaving the European Union, against the ultimate winner, Emmanuel Macron, a middle-of-the-road politician who is pro European Union and free trade.

“The recent elections have fortunately shown that the anti-EU forces do not have enough support to break up the European Union,” said Sinisa Grgic, the consul general of Croatia in Los Angeles and another panel member.

Britain’s decision to turn its back on free trade and leave the European Union will have its economic costs, which will be felt not only now but three to five years down the road, Brisch said.

Tariffs on traded goods will be imposed after Britain leaves the European Union, which is already influencing corporate decisions. “ BMW used to produce Mini cars in Oxford [England],” Brisch said. “But because of the fear of cars being too expensive to ship to Europe because of tariffs, they have shifted their production of the Mini to Germany.”

It will also be more difficult to bring in workers from Europe because they will need a special work visa that wasn’t necessary with Britain part of the European Union.

For the United States, it means that Britain will no longer be its vital partner when dealing with the European Union. “The United Kingdom was the spokesman for the United States in the European Union. Now the U.S. will have to find a new spokesman,” Neumann said.

The European Union is closely watching what happens to Trump’s decision to renegotiate the North American Free-Trade Agreement, the panelists said. Germany is a heavy investor in Mexican companies that produce automobiles, which primarily end up in the United States. “If NAFTA does not continue as we hope, it would be a big blow to Germany,” Neumann said.

The trade experts cautioned that the Trump administration should think twice about higher tariffs on the steel industry or trade sanctions. “Do not expect that Europeans will stand still and suffer,” Neumann said. “There will be counter matters and discussions about how we can react.”

Instead, reviving trade talks between Europe and the United States would help both regions’ economies as 97 percent of tariffs would be eliminated over time.

The California connection

Europe plays an important part in California’s trade scene. Europe was the top export market for California in 2016, with $270 billion in goods sent to the EU countries, said Robert Kleinhenz, executive director of research at Beacon Economics in Los Angeles. That was closely followed by Canada with $266 billion in goods receiving California exports and Mexico with $231 billion. China was fourth with $116 billion.

When it comes to imports, China sends more merchandise to California than anyone else, followed by the European Union. “We in California rely heavily on trade in general,” Kleinhenz said, noting that 7.9 percent of the gross state product comes from trade.

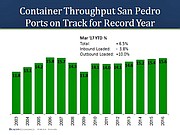

That trade contributed to the number of warehouses constructed in the Inland Empire region east of Los Angeles and around Southern California. It employs thousands of truck drivers, customs brokers, longshore workers, warehouse employees and air-freight workers. In 2016, transportation accounted for 7.6 percent of all jobs in the state, Kleinhenz said. About one-third of the cargo containers coming into the country arrive at the ports of Long Beach and Los Angeles.

A free-trade agreement with Europe would only boost the U.S. economy, which has been humming along since 2009 and will continue to grow through at least 2018.

European companies have made significant investments in California. In 2014, U.K. companies accounted for 98,200 jobs in California, followed by German companies with 69,600 and French companies with 68,000. “So there is so much potential,” Kleinhenz said, “for going forward.”