Economy Shifts Into Third Gear

The falling value of the U.S. dollar doesn’t bode well for tourists wishing to visit exotic lands overseas.

But for the apparel industry, it means that the price of clothing and textile manufactured overseas is also falling.

That’s one of the high points in the Los Angeles County Economic Development Corp.’s 2007–2008 Mid-Year Economic Forecast, presented on July 18.

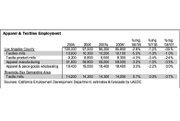

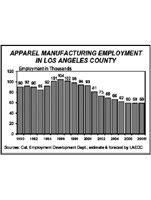

Economists handed the apparel industry a C+ economic grade early this year. Five months later, the industry received the same grade on its economic report card. Employment in Los Angeles’ apparel manufacturing sector is expected to dip no more than 1 percent from 59,200 in 2007 to 59,000 in 2008.

While Los Angeles tops the charts as one of the country’s fashion hot spots, there are a few hurdles in the way. “We have some challenges,” said Jack Kyser, the LAEDC’s chief economist and one of the speakers at the economic forecast. “Los Angeles is the capital of denim, and interest in denim is fading. But we can respond. We are very strong in juniors and contemporary. If you want something that is new and exciting, you come to Los Angeles.”

In addition, Macy’s Inc.’s acquisition of its department-store rival The May Department Store Co. in 2005 is still affecting the small- and medium-sized apparel companies that dominate the local garment industry. Since the merger of the two retail chains, several other large retailers have been developingtheir own private labels, cutting into the local apparel industry’s financial health.

Steady ahead

Southern California’s economy is expected to grow slowly in 2007 and rev up a notch in 2008.

Employment in Los Angeles County will grow by 1.2 percent this year after adding 50,100 jobs to a record-level 4.1 million jobs.Most of that employment falls into areas such as professional jobs, scientific and technical services, health services, and the leisure and hospitality industry.

Employment will pick up 1.5 percent in 2008 even if there is a strike next year when the contracts for the Screen Actors Guild and the Directors Guild of America expire in June. One sticking point rests on additional compensation for actors and directors in the era of distributing movies and TV shows over the Internet and by podcasting.

Also, the labor contract for the International Longshore and Warehouse Union, whose members work at the ports on the West Coast, expires next summer. The last time the contract was negotiated, in 2002, there was a 10-day lockout at the ports of Los Angeles and Long Beach, creating a logistical nightmare for importers and exporters.

Outside of labor negotiations, the local economy’s only pothole is the subprime mortgage business.

A number of high-credit-risk individuals with subprime mortgages have defaulted on those loans, sending the subprime lending industry into a tailspin.

And it’s not over. “One thing I can predict with almost 100 percent certainty is that there is going to be a rise in foreclosures,” said John Burns, president of John Burns Consulting in Irvine, Calif., another speaker at the economic forecasting seminar. “Subprime loans are fixed for two years, and other loans [such as adjustable rate mortgages] are fixed for three years, and then they are reset.”

Burns noted that by March there will be three times the number of loans reset as today, with those homeowners seeing their monthly mortgage payments increasing anywhere between 20 percent and 40 percent.

Unlike the early 1990s, when prices in the housing market nosedived, there is enough job growth in Southern California to keep the housing market from falling apart.

However, there is a glut of housing on the market. While home-loan interest rates have risen, homeowners still are reluctant to lower their selling prices. And buyers believe if they wait a few more months, they can negotiate a better deal.

Currently, Los Angeles County has a sixmonth supply of home listings, Burns said. A more reasonable listing would be a three- to four-month supply.

Nancy Sidhu, LAEDC’s senior economist and vice president, observed that the decline in home sales in Los Angeles and across the country means durable-goods purchases of appliances and cars will slow in 2008 even though growth in the gross domestic product should creep up 3.1 percent next year. GDP growth is expected to be 2.2 percent this year compared with 3.3 percent in 2006.

Rising rents

Office rents are rising in several hot spots around Southern California.

Office space in West Los Angeles is at a premium. And downtown office space is getting pricier because investors who have recently acquired expensive property are trying to get a reasonable return on their investment, said Joe Vargas, executive managing director for commercial real estate company Cushman & Wakefield of California.

Currently three companies—Maguire Properties, Brookfield Properties and Thomas Properties—own 80 percent of the downtown Los Angeles office buildings.

When the entertainment complex L.A. Live in downtown Los Angeles near Staples Center is completed next year, the area will attract new residents as well as companies searching for downtown office space.

“[Office] vacancy rates will continue to go down,” Vargas said, “because of a slow, steady economy.”