In Slow Economy, Retail Jobs Growth Up

In an economy marked by a tough outlook for the jobs market overall, employment at California’s clothing and clothing-accessories retailers increased this year, but economists and industry watchers do not know if the jobs gains will be sustained.

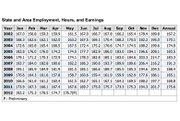

Gains in 2012 outpaced those from 2009 to 2011, according to data from the U.S. Bureau of Labor Statistics. Through its surveys of employers, the BLS is considered to provide some of the most current and accurate information on the jobs market.

Yet growth has not been steady. Clothing-store employment gains seemed to have taken a statistical roller coaster ride this year. In January, retail sales jobs increased 4.8 percent, with182,200 people employed at California clothing and clothing-accessories shops, compared with the same time last year, when 173,900 people were employed in that sector.

January is considered the end of the Christmas holiday season, and by February retail jobs were cut back to 175,300. March represented an improvement for the retail job market, when the BLS reported 178,500 Californians at work at clothing and clothing-accessories stores. And the pattern continued with a drop in April and a 5.6 percent increase in May, the most recent month in the BLS survey.

Retail employment is increasing, albeit modestly, because the economy is growing overall, said Jack Kleinhenz, chief economist for the Washington, D.C.–based National Retail Federation. He forecast the US gross domestic product will grow 2 percent in 2012. If the economy is growing, demands for goods and services will grow. “People need clothing,” he said.

According to the NRF, clothing retail is the third-largest category of retail employers in California—behind food service, restaurants and bars (1.2 million employed), and food and beverage stores (353,000)—according to NRF figures published in 2011.

Retail store employees are needed to provide customer service and watch inventory, said Ilse Metchek, president of trade group California Fashion Association. Every category of clothing retailer has been hiring this year. Macy’s Inc. made headlines this month when the department store announced it hired 1,000 college graduates for the company’s executive-development program and internships nationwide.

Luxury and e-tail

The retailers hiring the most are luxury brands and overseas retailers opening new stores in America, according to Tracy O’Connor, vice president, fashion and retail division, for the Los Angeles office of global recruitment firm 24Seven Inc. She estimated 70 percent of her store-based recruitment offers come from luxury companies looking for candidates to serve in a range of positions from store managers to executive positions.

Another section for job growth is fashion e-commerce, O’Connor said. Her office has seen continued demand for a wide variety of e-commerce jobs, ranging from copywriting to art direction, database management, customer service and buying.

While the BLS does not break down the number of retail jobs by full-time, part-time and temporary status, there has been growth in the total number of retail jobs, said Kimberly Ritter-Martinez, associate economist with the Los Angeles County Economic Development Corp.

“We’re still seeing a lot of part-time work,” Ritter-Martinez said. “There continues to be a large number of persons who are employed part-time who would like full-time work. There are also a lot of people out there who are underemployed. Temp agencies are still seeing job growth. Many companies, unsure of the economic outlook and consumer demand, will take on temporary workers before committing to a permanent, full-time hire. This is typical behavior following a recession.”

But can retail job growth be sustained for the rest of this year? Some economists are forecasting an economic slowdown for the second half of this year. But some sectors of California retail might escape the economic doldrums, Ritter-Martinez said.

“We’re expecting some growth in tourism this summer, which is another avenue for growth in retail sales,” she said. However, slow growth in wages and recent declines in consumer confidence could put a damper on domestic spending. On June 15, the Thomson Reuters/University of Michigan Index of Consumer Sentiment reported a decline in consumer confidence; it fell in June to 74.1 from 79.3 in the previous month. Consumers are spooked on a range of issues—from the European debt crises to slow growth in wages.

“If anything shakes, it will cause them to rein in spending,” Ritter-Martinez said.

But hiring could ramp up again. An NRF survey on Father’s Day spending reported increases in purchases, and next month, the Back-To-School season starts. After the Winter/Holiday season, it’s the second-busiest time of the year.