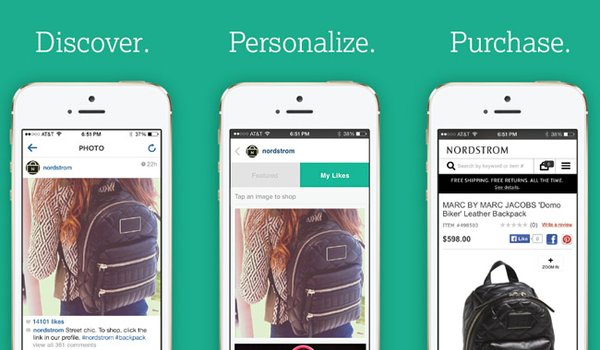

NORDSTROM LIKES: A demonstration of Curalate’s Like2Buy program. Nordstrom recently signed up to use the program to drive traffic from Instagram.

RETAIL

Making Sales on Social Media Elusive, But Intriguing

After a decade of building audiences and communities, many think that social-media sites should be able to transform into a giant cash register.

With hundreds of millions of people visiting brands’ pages on social-media sites such as Facebook, Twitter, Instagram and Pinterest, many analysts thought the next obvious step for these sites would be to sell products on their forums. So far, the retail promise of social media has not been met, but a handful of companies are looking for gold in social media.

Nordstrom made a splash on Aug. 28 when it became the first brand to use Like2Buy, a program from Philadelphia company Curalate that links photos from Instagram accounts to products available on a brand’s e-commerce site.

Twitter raised eyebrows last year when it hired Nathan Hubbard, former chief executive officer of ticketing at Live Nation, to find ways to make sales through Twitter. Media reports said that Twitter and online payments company Stripe, both headquartered in San Francisco, have been developing a system to make it possible to make sales on the Twitterverse.

Since 2011, various companies have been seeking to turn Facebook “likes” into “buys” by building online marketplaces on the social-media giant.

Yet technology analysts have been split on whether social-media malls will be ghost towns or whether they will gross more than bricks-and-mortar malls.

In 2011, Booz & Co., now called Strategy&, forecast that the market size for social media would grow to $30 billion in 2015. Sucharita Mulpuru of Forrester Research was the lead writer on a report that sought to take down expectations of social-media riches. A 2011 Forrester report noted that Facebook’s ability to drive e-commerce revenue was elusive.

In 2013, Mulpuru had doubts on Twitter being able to make sales from its tweets. In a report, she claimed that some of the retail success stories on Twitter are companies liquidating inventory or promoting sales, and other success stories have been hard to find on the free service.

Social media’s retail success has still not been decided, said retail and tech consultants. Judah Phillips of SmartCurrent, based in Boston, said that social media is spectacular for spreading the word on a product or a service—but not much else.

“Sure, social can build demand,” he said. “But the demand is often fulfilled in other channels—the brand’s site or in-store or via an affiliate. How much does Coke sell on Facebook or Twitter?”

Social media typically serves as the first step in a process to making a purchase, said Mercedes Gonzalez, director of Global Purchasing Companies, a New York–headquartered retail consultant and buying office.

“People look for brands’ credibility through social media,” she said. “It helps in the research process.” But consumers will make an actual purchase at a bricks-and-mortar store or at an e-commerce site.

The research process and customer engagement that Facebook offers has continued to motivate companies, according to the State of Retailing Online study, which surveyed 81 retailers in May and June. It was undertaken by the National Retail Federation, a major retail trade group, and Forrester Research.

It found that 62 percent of retailers surveyed planned to spend more on Facebook interactive marketing efforts this year compared with last year. In a prepared statement, Mulpuru said that Facebook is popular because the denizens of Facebook end up doing work for the advertisers. “People think of Facebook as a social network, but, in reality, it’s another medium for personalized display advertising,” she said.

These companies also intend to spend more marketing dollars on Instagram, YouTube, Pinterest and Twitter, according to the survey.

Social-media sites are playing their retail cards close to their proverbial vests. Facebook and Twitter did not reply to emailed requests for comments. An Instagram spokeswoman said the popular social-media site would keep its focus on “brand advertising” and that it wouldn’t comment on “developing commerce.”

However, companies such as Curalate will continue to make retail possible for sites such as Instagram. Its Like2Buy program will take a brand’s profile link on Instagram and pull up a gallery of shoppable Instagram photos, then purchase the products on the brand’s website, said Apu Gupta, Curalate’s chief executive officer.

“Instagram turns creativity into commerce by changing the way consumers engage with products from their favorite brands,” Gupta said. “With Like2Buy, Curalate is providing retailers the most seamless and secure method of driving traffic and revenue from Instagram while providing digital marketers the ability to immediately demonstrate value from their efforts.”

Still, the retail industry continues to test when it comes to social, said Artemis Berry, vice president of digital retail for NRF. “What we are seeing is a continued testing approach,” she said. “There’s not a massive investment increase, but there is a ton of opportunity in overall marketing campaigns as well as engagement. It is changing all of the time. You blink and there is a new platform out there.”