RETAIL

L.A. Drops in Retail-Real-Estate Investment Index

Los Angeles County commands global attention for its entertainment glitz, health-conscious lifestyles and bustling malls, but its ranking for retail-real-estate investment dropped in the recently released 2019 forecast from influential commercial-real-estate brokerage Marcus & Millichap.

L.A. County dropped eight notches from the 18th most-favorable place to invest in retail real estate, according to the company’s 2019 National Retail Index rankings, which have been released since 1999.

The top two spots were held by the Seattle-Tacoma area and San Francisco out of the 46 metropolitan regions ranked by the annual forecast.

Still, John Chang, a senior vice president of research services for Marcus & Millichap, based in Calabasas, Calif., said that Los Angeles continues to be a good place for retail-real-estate investment. “Los Angeles is performing very well. It has a lot of momentum and strength going for it,” Chang said. “But the pace of growth is slowing down in Los Angeles.”

L.A. has one of the slowest rates of job growth among the largest U.S. metropolitan areas, according to data released in 2018 by the U.S. Bureau of Labor Statistics. Los Angeles’ job growth increased by 1.1 percent during the one-year period between July 2017 and July 2018, according to data compiled by Bloomberg.

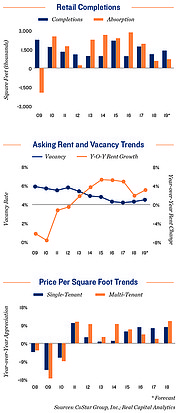

A slowdown in job growth in Los Angeles County happened at the same time as an increase in construction and higher vacancy rates for commercial properties. Higher-ranked areas enjoyed greater job growth, which spurred greater demand for retail and services.

The mere location of a region could help boost its ranking. Oakland, Calif.’s ranking increased six places to number 15 in the Marcus & Millichap study. Located near to the Silicon Valley hot spots of San Francisco and San Jose, people are looking for relatively cheap rents in Oakland. Property development has slowed in the city, and more businesses are leasing commercial space, so the study deemed Oakland as an increasingly attractive place to invest.

Chang also talked about Los Angeles County’s changing retail-real-estate scene. Over the past few years, malls that previously devoted most of their space to fashion retailers have been experimenting with their tenant mix. Mall managers are increasingly looking for previously nontraditional tenants such as gyms and medical offices to fill up spaces.

One of the biggest Los Angeles retail-real-estate stories in 2018 was the transformation of Macerich’s Westside Pavilion mall into office space. About 90 percent of the mall was leased by tech giant Google.

“This is a hallmark event,” Chang said. “You have a shopping mall that was not doing great. It had a transformation and solved a problem for Google.”

Google is one of a number of tech companies creating offices to be closer to where job talent lives. In 2018, Google made Southern California headlines for opening 525,000 square feet of offices in the former Spruce Goose hangar in Los Angeles’ Playa Vista region. Amazon also has made news for seeking cities for a second headquarters. Like Google, it is bringing its offices to where the job talent lives rather than bringing them to company headquarters, Chang said.

It’s not just malls that are being changed to suit the needs of tech giants and retailers. Retailers are taking former light-industrial facilities and transforming them into warehouses and fulfillment centers to serve the last leg of omni-channel retail, said Larry Kosmont, chief executive officer of the real-estate and advisory firm Kosmont Companies.

“The digital generation wants goods immediately. They can see something, order it and receive it quickly,” he said. The move to omni-channel retail needs more fulfillment centers located close to major population centers. This real-estate trend, Kosmont said, is called “re-industrial.”

Chang and Kosmont forecast there will be more changes down the road for malls and retail streets. Chang said that in Los Angeles County, there would be increased growth in boutique shopping, reflecting new trends in consumers’ evolving shopping habits. “There’s a lot more boutique and smaller-footprint retailers. Their styles remain fresh and innovative,” Chang said.