RETAIL

Los Angeles Retail Real Estate Shows Slight Recovery

Omni-channel retail tossed a lifeline to commercial real estate in Los Angeles and other U.S. cities during the second and third quarters of 2020, according to a recently released report from CBRE, a commercial-real-estate and advisory firm.

Many retailers closed shop during the more than six months of COVID-19’s stay-at-home orders and restrictions, said Eric Willett, CBRE’s regional director of research. “Many occupiers reevaluated their space needs in the second quarter, acting quickly to sublease unused space,” Willett said. “Regional retailers are embracing creative approaches including leaning into ‘buy online, pick-up-in-store’ models or outdoor pop-ups that benefit from SoCal’s favorable weather.”

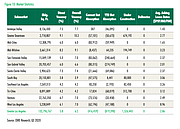

But a new reliance on the bricks-and-mortar aspect of omni-channel has not pushed back the high vacancy rate caused by the COVID crisis. According to the recent CBRE report, overall vacancy was 6.2 percent in the Los Angeles retail market during the third quarter of 2020. It was the highest in downtown Los Angeles, with a 10.2 percent overall vacancy rate and a 9.1 percent vacancy rate in the Mid-Wilshire area of the city. Overall retail vacancy has been relatively high in West Los Angeles, where overall vacancy was 7.0 percent during the third quarter.

Los Angeles County’s South Bay region, which includes the exclusive beachside cities of Manhattan Beach, Calif., and Hermosa Beach, Calif., as well as Torrance, Calif.—the address of the Del Amo Fashion Center mall, enjoyed the lowest overall vacancy in the greater Los Angeles region. The South Bay’s overall vacancy was 3.9 percent.

The CBRE report said that leasing has been most active for retailers in discount, home improvement, grocery and automotive. CBRE’s forecasters predicted that the retail rental and vacancy rate would recover in 2022.

Commercial-real-estate brokers not working with CBRE see a similar picture. Jay Luchs, a vice chairman for Newmark Knight Frank, said that his business has been growing since Labor Day.

“There’s a little more momentum, but we’re not back,” Luchs said.

The CBRE report found that the turbulence in the real-estate market has caused some declines in rental rates. In the greater Los Angeles area, the average asking rate has declined from $3.01 per square foot in the second quarter of 2020 to $2.86 per square foot in the third quarter. CBRE forecasters predicted that there would be an overall 7.0 percent decline in leasing rates over the next year with rates forecasted to rally in late 2022.