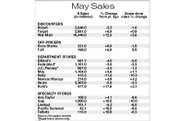

May Sales Slump

After a buoyant April, consumers’ lingering fears about rising gas prices and unemployment figures dragged down May retail sales. Unusually cool weather dampened shopper appetites for seasonal apparel as well as lawn and garden supplies. The slowdown impacted most chains and even the more resilient discounters posted modest gains. Apparel specialty chains, particularly Gap Inc., and department stores fared the worst. Among individual retailers, Wal-Mart posted a 3.8 percent gain, while notable trailers included Sears (down 3.3 percent), Federated Department Stores (down 3.3 percent), Saks (down 10.3 percent) and Limited (down 6.0 percent). Federated, whose department-store chains include Bloomingdale’s and Macy’s, cited cold weather in the East and rising energy prices in California as the reasons for its sales lag. Pacific Sunwear of California Inc. posted a 9.8 percent decline in same-store sales, results that were “significantly below plan,” according to chairman and chief executive Greg Weaver. Excess inventory will impact merchandise margins during the next two months, Weaver said, but he remains optimistic about back-to-school products. Comparable-store sales edged down 0.3 percent at Talbots Inc., a Hingham, Mass. retailer that focuses on career-wear. Talbots faced a tough comparison against May sales that shot up 29.4 percent last year. Many retailers are pinning their hopes on the $45 billion or so in tax cuts and subsequent taxpayer rebates that are expected to kick in over the next few months, as well as lower interest rates, which will go into effect in the third quarter, to shore up spending. Analysts also point out that cautious estimates and better inventory planning provide encouragement for the remainder of the year and may add fuel to retail stocks. They say the stocks have had nice runs in the past year, but there’s room for more upside in the anticipated economic recovery.—Nola Sarkisian-Miller