February '01 Retail Sales Disappoint

February is the shortest month and one of the smallest contributors to retailers’ annual bottom lines. But this February was more important than most because analysts and prognosticators alike were anxiously awaiting some signs of renewed vigor in the retail sector. What they got instead was more of the same, and generally that was not good.

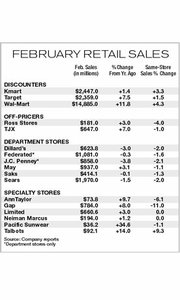

In February, as in previous months, two of the titans of discount retail, Bentonville, Ark.-based Wal-Mart (with a 4.3 percent rise in same-store sales) and Troy, Mich.-based Kmart (up 3.3 percent), showed they were not suffering from the general malaise. Their biggest competitors, however, continued to be buffeted: Plano, Texas-based J.C. Penney Co. and Hoffman Estates, Ill.-based Sears, Roebuck and Co., respectively, posted 2.1 percent and 2.0 percent same-store sales declines.

Meanwhile, such specialists as San Francisco-based Gap Inc., which posted an 11.0 percent decline in same-store sales, and New York City-based Ann Taylor Stores Inc., with a 6.1 percent same-store decline, continued to struggle in an economic climate turned frigid. So did old-line, full-service department stores, including Little Rock, Ark.-based Dillard’s Inc., Cincinnati-based Federated Department Stores Inc., St. Louis-based May Department Stores Co., Chestnut Hill, Mass.-based Neiman Marcus and Seattle-based Nordstrom Inc. There were exceptions, of course, and they were the same exceptional performers, among them Hingham, Mass.-based Talbots (with a 9.3 percent increase in same-store sales) and Menomonee Falls, Wis.-based Kohl’s Corp. (with a 7.3 percent increase), which also had weathered the holiday storms with healthy bottom lines and strong same-store numbers.

Analysts searching for reasons behind retail’s tepid February had to look no further than the front pages of local newspapers, where the headlines said it all: “Stock Market Still Volatile”hellip;“Tech Stocks in Decline”hellip;“Dot-com Shakeout Continues”hellip;“Energy Prices Soar”hellip;“Credit Card Debt at Record Levels”hellip;“Winter Storms Curtail Travel”hellip;“More Layoffs”hellip;and perhaps most important of all to retail: “Consumer Confidence in Free Fall.”

The influential Lehman Brothers index of aggregated same-store sales at 22 major retailers was up a modest 3.9 percent over February 2000, but the bottom line about retail’s February bottom line is this: Analysts who since the mid-point of holiday 2000 had been forecasting a slow first half in 2001, followed by recovery, are now beginning to hedge their predictions with hints that the economic downturn could last well into the second half of the year. —by Louis Chunovic and Darryl James