Consumers Leave Department Stores Out in the Cold

Counting on tax-rebate checks and back-to-school needs to spur spending, department stores and apparel chains continued to see emptier store aisles in August as most consumers pinched pennies at discount chains. The Bank of Tokyo-Mitsubishi Ltd. retail index, which measures the performance of 80 retailers, was up 3.5 percent, below the 4.1 percent increase expected. Meanwhile, TeleCheck Services, the world’s No. 1 check-acceptance company, saw a 3.0 percent rise in same-store sales for August—the strongest growth since April. Consumers write out checks for one-third of all retail spending.

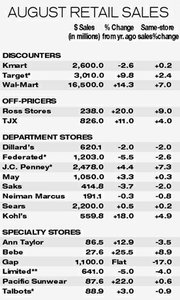

Leading the positive charge was Wal-Mart Stores Inc., which reported a robust sales increase of 7.0 percent in stores open at least a year, well beyond the 5.8 percent increase estimate from Thomson Financial/First Call. Men’s and women’s apparel, health and beauty aids, and cosmetics all sold strongly at the company’s Wal-Mart division. But the heavy discounting tactics of the nation’s largest retailer may eat into its own profits; Wal-Mart is estimating that same-store sales for September will be in the range of 4 to 6 percent. Kmart, which has been on its own aggressive discounting campaign, turned in a 0.2 percent increase in same-store sales. A number of department stores reported figures below expectations, including the 2.6 percent same-store sales decline for Federated Dept. Stores. Among the companies reporting healthier returns was J.C. Penney, which posted a 7.5 percent gain in same-store sales due to strong sales in women’s apparel, and May Co., which eked out a 0.3 percent increase in comparable store sales. Upscale department store chains continued to flounder in the slow economy. Saks Inc. posted a 2.0 percent drop in same-store sales, saying sales were hurt by weak consumer demand for men’s apparel and women’s designer apparel. Neiman Marcus Group Inc. reported that comparable sales fell 0.8 percent and predicted first-quarter same-store sales would be down 1 to 3 percent. Most specialty stores continued to disappoint, including Limited Inc., which saw same-store sales fall 4.0 percent. The woes continued for Gap Inc., operator of the Gap, Old Navy and Banana Republic stores. Same-store sales dove 17.0 percent, following a 14.0 percent decrease last year. Gap chief executive officer Millard Drexler told attendees at a Goldman Sachs retail conference in New York that the Gap chain is working to improve its store layouts and focus on the “updated, classic” styles that sell better than older designs. Bebe Stores Inc. was a shining light amid dim retail sales, posting an 8.9 percent increase in same-store sales. The company said sales were strongest in the Southwest region and cited denim, coats and shoes as popular categories. —Nola Sarkisian-Miller