Quarterly Financial Review: Luxury Goods to Regroup as Economy Recovers

Discounters and off-price stores were the real winners in 2009 as bargain-hungry shoppers gobbled up inexpensive clothing and sale items. Meanwhile, luxury goods were pariahs, stuck on shelves as well-to-do consumers re-evaluated their stock portfolios and played it conservative.

But that scenario could be turned upside down this year.

With the Dow Jones industrial average up around 25 percent over last year and businesses expecting modest growth, affluent shoppers are feeling confident and venturing back into stores such as Neiman Marcus and Saks Fifth Avenue, picking up designer sweaters, pants and dresses again.

“We started to see the luxury segments show better performance at the end of the holiday season, and I suspect that will be the area that will be the strongest in 2010, in part because that was the hardest hit during the last recession,” said Michael Niemira, chief economist and director of research for the International Council of Shopping Centers. Luxury goods will see stronger recovery starting in mid-2010.

Discounters and off-pricers may not do as well as last year, which was a strong year for retail chains such as TJX Companies, parent of T.J. Maxx and Marshalls, and Ross Stores Inc. Both those entities saw same-store sales grow 6 percent in the 11 months ended Jan. 2, 2010. In December alone, TJX stores experienced a 14 percent growth in same-store sales. Ross Stores’ sales were up 12 percent.

However, discount stores at the bottom end, such as Family Dollar Stores and Dollar Tree, could see the good times turn into moderate times as consumers refine their shopping habits.

“It is part of a cyclical story,” Niemira said. “You may end 2010 where JCPenney and Sears and Target are doing a lot better, but you might see a softening in the dollar stores. That type of rotation will play out as the economy improves.”

In general, Niemira said, the retail year for everyone will be choppy in January and February, gradually picking up speed and starting to hit its stride in the third and fourth quarters of this year.

The ICSC predicts that chain stores will experience a 3 percent to 3.5 percent increase in sales this year, compared with a 2 percent decline in 2009.Keeping it cool in California

The Golden State was one of the hardest hit when the Great Recession gripped the country in late 2007. And California may be on a longer road to recovery than other states, economists said.

“2010 will be okay but not great,” said Christopher Thornberg, one of the founders of Beacon Economics, headquartered in Los Angeles and San Francisco.

“We are looking for a very muted recovery,” noted Jack Kyser, a long-time economist with the Los Angeles County Economic Development Corp.

The problem in California is that the housing market is still in a questionable position. Yes, stimulus packages for new-home buyers have egged reluctant consumers along, but that $8,000 new-home-buyer tax credit ends on April 30.

And many people who own homes are struggling to keep them. “Sixteen percent of all mortgages in California are non-performing,” said Thornberg, explaining that these homeowners aren’t making any payments at all. “That is a huge number. We are talking 400,000 to 500,000 households. Most of them are going to be foreclosed upon. With that in mind, understand the market is not out of the woods by any stretch of the imagination.”

During past recessions, the housing industry has nudged the state’s economy back into the fast lane. It might not be that way this time.

“The argument is that a lot of recoveries are helped by a rebound in housing construction,” Thornberg said. “I don’t see a rebound in housing construction. Hence, it won’t help the economy along.”

And it won’t help the unemployment situation. Currently, the state’s unemployment rate stands at 12.3 percent, exceeded only by Michigan at 14.7 percent and Rhode Island at 12.7 percent. Nevada and South Carolina’s unemployment rates are the same as California’s. While the economy is slowly churning to positive territory, no one is predicting that businesses will start hiring soon.

Esmael Adibi, director of the A. Gary Anderson Center for Economic Research at Chapman University in Orange, Calif., noted that the economy is improving on the spending side, gradually pushing gross domestic product up. California’s exports are rising as trading partners such as China and Europe buy the state’s agricultural goods and high-tech products.

But people still aren’t hiring new employees. Predictions show that unemployment may rise before it gets better. “Chief executives would rather do temporary hiring or extend workers’ hours before they hire anyone,” Adibi said. “That is a problem we will be facing during the first and second quarter.” Adibi expects companies to start looking around for new staff members by the middle of this year.

When those new jobs do appear, they will be in service industries such as health services and private education, as well as in professional business services provided by attorneys, accountants and computer programmers.

One problem still not resolved is the credit crunch. Small- and medium-sized businesses are finding it hard to get loans to keep their ventures running. “Banks aren’t lending,” said the LAEDC’s Kyser. For apparel makers, that makes it difficult to order fabric, buttons and zippers to put their lines together. And retailers are still finding it tough to come up with funds to fill their shelves.

With cost savings in mind, retailers have been taking stock of their store locations and evaluating which ones to keep open. Macy’s Inc. recently announced it would close five stores across the country, but none of them were in California. Recently Footlocker Inc. said it would shutter 117 stores across the nation. The company had 3,601 stores as of Oct. 31.

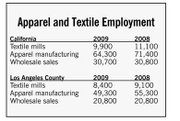

Closing stores hasn’t boded well for California’s apparel manufacturing industry, which lost 7,100 jobs last year.