Hurley Forges New Plan for Growth

On a recent sunny fall morning, the sprawling Hurley campus in Costa Mesa, Calif., was typically abuzz.

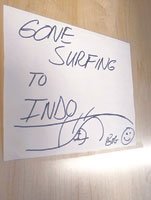

There’s a new art exhibit at the surf/skate company’s own gallery and an elaborate on-site installation celebrating an apparel collaboration with Disney for its “Tron: Legacy” film, set to debut in December. Weezer’s new album, “Hurley”—which was recorded at Hurley’s own record studio and is supported by Hurley x Weezer–branded apparel, sold exclusively at Pacific Sunwear—debuted Sept. 10 in the No. 6 slot on the Billboard 200 chart. One Hurley employee sits in a room with a blaring TV, cheering on a Hurley-sponsored surfer competing in a World Championship Tour event in Hossegor, France. Employees skate from one building to the next while a note on founder Bob Hurley’s surfboard-shaping studio announces he’s “gone surfing to Indo.” And somewhere in the campus’ women’s design studio, designers are hard at work on Hurley’s fledgling but fashion-forward young contemporary line.

Not much about the mood at Hurley reflects the concerns about the industry that have been voiced at action-sports trade shows for the last several seasons. And for good reason, say executives. The $221 million company is poised to grow to $500 million in five years through a combination of business restructuring and expanding into a variety of new categories, including the contemporary market.

The first hint of major changes at Hurley came in 2009, when the company opted out of Surf Expo’s September edition and exited the Action Sports Retailer Trade Expo entirely in favor of the much smaller Agenda trade show. “Retailer feedback [at trade shows] was consistently inconsistent,” said John Heelan, Hurley’s senior vice president of sales. “A lot of money was being spent on huge booths and parties and, basically, marketing ourselves to our competition.”

Bowing out of the traditional trade show circuit gave Hurley the funds and the ability to reinvent its relationships with retailers, fine-tune its distribution, and increase its visibility through strategic sponsorships and marketing strategies, he said.

In late 2009, the company cut its distribution by 30 percent. “We want to be able to put our efforts into the biggest and best opportunities. We’re focusing on the accounts that want to focus back on us and partner with us,” Heelan said. Cuts to its distribution were made across all distribution channels, he said, from department store and mall-based chains to boutiques and core surf/skate shops. Those stores that remain on the Hurley distribution list benefit from more personalized attention and a product mix that is better suited for their needs, Heelan said. Hurley, which operates 18 of its own stores domestically, in turn benefits from a bigger, deeper presence in its remaining doors. “Our vision is about focus on the account level. Where we pulled back [from trade shows and underperforming or oversaturated doors] we want to allocate those funds and resources to elevating our marketing and the business of the retailers,” he said.

A select number of stores have been designated as “icon doors”—premium accounts that are outfitted with Hurley shop-in-shops, signage, a carefully curated product mix and marketing support. “We’re just rolling these out. We have four or five now, but we expect to grow to a couple dozen ’icon doors’ that give us an increased footprint on their sales floor and increased representation,” Heelan said. Retailers that have gotten the “icon door” treatment include Huntington Surf and Sport, Surfside Sports, Spyder Surf and ZJ Boarding House.

Surprisingly, dropping a third of its doors has not resulted in a slump in business. A 2010 shareholders’ letter by Mark Parker, president and chief executive officer of Nike Inc., Hurley’s parent company, said action sports is its fastest-growing category, thanks in part to strong sales by Hurley, the smallest of its subsidiaries. For the 2010 fiscal year, revenue from Hurley and brother brands Converse and Umbro increased by 4 percent and offset losses suffered by Nike’s Cole Haan and Nike Golf brands. During an investor meeting in May, Nike said it expects to grow its annual revenues by more than 40 percent to $27 billion over the next five years by growing its store roster and rapid brand expansion for Hurley, Converse and Umbro.Core and beyond

As it poises for growth, Hurley has steadily been increasing its brand presence in other arenas. In 2009 Hurley became the title sponsor for the Hurley Pro at Trestles and the U.S. Open of Surfing in Huntington Beach, Calif., two of the surf industry’s premier competitions. Collaborations with musicians, artists, surfers and brands outside the surf/skate market continue to expand Hurley’s reach. In recent seasons, however, Hurley’s product evolution has picked up the pace, pushing the brand’s reach beyond the mall and core shop.

One ongoing collaboration that earned Hurley fashion credibility is the capsule of Pendleton x Hurley apparel. Now in its second year, the collection is inspired by Pendleton’s heritage prints and spiked with a dose of Hurley’s breezy cool-kid vibe. Wholesaling for an average of $112, the collaboration has been a hit for Hurley and achieved the goal of helping to prepare boutiques and specialty stores to accept more directional offerings from Hurley. “Barracuda in Los Angeles gave [the collaboration] a huge wall in its store,” said Laura Wasser, Hurley’s vice president of marketing. “That means something.”

Spring 2011 will mark the debut of a full premium collection within Hurley’s women’s offerings. Retailers, Wasser said, had been requesting more forward items from Hurley. “Young contemporary has always been addressed in the line, but it was a small component,” Wasser said. Going forward, the category will grow to include outerwear, crochet dresses, loose-knit sweaters, leather jackets, silk and silk-blend tops and dresses, shorts, denim, and more, all inspired by contemporary fashions and street trends—not necessarily the beach or the skate park. The garments, which will be produced overseas, carry almost no exterior Hurley branding. Wholesale prices for the upper-tier offerings average $60—a significant jump from the $16 to $39 wholesale prices of the core Hurley line. “This is just the beginning,” Wasser said.