FINANCE

UCLA Anderson Forecast Shines a Light on the Troubled Retail Industry

Even though the U.S. economy has been chugging along at a steady pace for several years now, much of the retail industry has been left out of this picture of prosperity, with certain sectors shedding jobs at a rather alarming rate.

In one year, retail employment declined by 29,000 jobs. What had been the second largest private-sector employer in the United States has dropped to the fourth largest.

“What is significant here is that we are seeing a decline in retail employment in a growing economy,” said Jerry Nickelsburg, senior economist and director of the UCLA Anderson Forecast, an economic forecast released on Sept. 27.

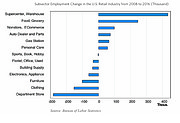

While grocery stores and big-box discounters are in positive territory, the biggest losers have been department stores and outposts that sell furniture, electronics, appliances, clothing, building supplies, sportswear, books and hobbies.

Other winners have been gas stations, auto dealers, personal-care stores and e-commerce sites, according to the forecast.

“Over the past decade, only supercenters and grocery stores have remained intact under the competition with e-commerce,” noted William Yu, an economist with the UCLA Anderson Forecast. “In terms of percentage change, the supercenters and e-commerce providers are the two biggest winners while department stores and furniture stores are the biggest losers.”

From 2007 to 2016, supercenters such as Walmart created 432,000 jobs. The second largest job generators were grocery stores such as Whole Foods and Trader Joe’s, adding 245,000 jobs.

On the other end of the spectrum, retail job growth was aggressive for e-commerce retailers such as Amazon.com, which showed an uptick of 98,000 jobs during that 10-year time period.

In contrast, department stores lost 282,000 jobs, furniture stores shed 100,000 positions, and electronic and appliance stores were down 61,000 jobs.

When the retail industry is analyzed from August 2016 to August 2017, the e-commerce retail sector had a robust 5.3 percent growth in jobs. The second fastest growing segment were auto dealers, parts stores and gas stations because of the continued boom in car sales, which have been helped by low gas prices.

What is surprising is that in that one-year period, building-supply and furniture stores reversed their long-term decline in jobs due to the continued recovery of housing markets across the country.

Some would ask why retail jobs growth isn’t stronger with Amazon expanding at a brisk rate. That’s because many of those jobs at Amazon are not really retail jobs but positions in warehouses, transportation companies and order-filling venues.

When the retail industry was analyzed by metropolitan centers between 2007 and 2016, it showed that New York had 15 percent total employment growth while it had an 18 percent growth in retail jobs. Orlando, Fla.’s total job growth was 11 percent while its retail job growth was 18 percent, and Miami’s job growth was 7 percent while its increase in retail growth was 10 percent.

On the other end of the scale, San Francisco saw a 22 percent increase in jobs during that 10-year period but jobs in the retail industry barely budged, increasing 0.6 percent. Los Angeles’ total job growth was 3 percent, but its retail job growth was -0.9 percent.

Economists were unable to completely explain these discrepancies but noted that when a city has a thriving tourist industry, local stores benefit from the influx of visitors.

Tax cuts and infrastructure

On the national front, the economy continues to move forward with modest growth in real GDP (gross domestic product) and relatively strong gains in employment.

David Shulman, senior economist for the UCLA Anderson Forecast, predicts that real GDP will grow 2.1 percent this year and then rev up a bit next year with a 2.8 percent GDP rise and then taper off in 2019 with 2.1 percent GDP growth.

“The economy is good but not great,” he said, noting that chaos in Washington, D.C., hasn’t dampened economic progress. “”The economy has been cooking along as if Washington were irrelevant. Things change there week to week right now.”

Tropical storms Harvey and Irma—which hit Texas, Florida and surrounding areas—are expected to lower economic growth in the current quarter and possible into the fourth quarter of this year.

But next year, as rebuilding occurs in those areas, the economy will get a boost in housing and infrastructure construction and purchases of appliances and automobiles, Shulman noted.

He estimates that the post-hurricane rebuilding effort could amount to $200 billion to $300 billion in government and insurance spending. “Indeed, the dollars will flow more rapidly compared to Hurricane Katrina in 2005 because FEMA [the Federal Emergency Management Agency] is accepting applications via smartphones,” he explained.

The UCLA Anderson Forecast is predicting that Congress, not the White House, will probably take the lead to pass a $1.6 trillion tax cut—split between corporations and individuals—that will be beneficial to the economy over the next 10 years. Shulman expects Congress to reduce the 35 percent corporate tax rate to 20 percent and eliminate several business deductions and loopholes.

“However, if we are wrong on the tax cuts, growth in 2018 will be slower than what we are now projecting,” Shulman noted.

Along with tax cuts, the UCLA Anderson Forecast is expecting Congress to pass a $250 billion infrastructure program and dramatically increase defense spending because of global tensions rising with other countries, particularly with North Korea.

“Aside from defense, the sources of growth over the next two years will come from consumption, housing [in 2018] and equipment spending,” Shulman added.

Inflation will increase modestly, running slightly above the 2 percent range. The combination of full employment and somewhat higher inflation will prompt the Federal Reserve to continue its modest tightening path by raising interest rates roughly 0.25 percent per quarter into 2019.

Real consumption spending is expected to grow just under 3 percent in 2018 and remain strong into 2019.