April '05 Retail Sales a Mixed Bag

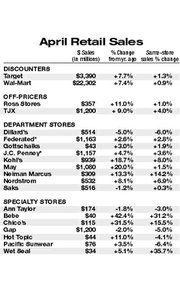

April beat the estimates, and economists such as Michael Niemira admitted surprise when retail sales grew 2.2 percent compared with April 2004. These gains were measured by an index of the comparative-store sales of 70 chain retailers tracked by the International Conference of Shopping Centers.

“Consumers were shopping. It goes against everything you expected because gas prices were rising,” said Niemira, chief economist for the New York–based ICSC. “It’s a good omen.”

But the gains, he noted, were shaky. While luxury stores and some teen-friendly retailers such as American Eagle reported strong numbers, discounters such as Wal-Mart Stores Inc. reported anemic comparative-store sales. Those retailers that had weak sales blamed them on a host of culprits, ranging from unseasonably cold weather to record-high gas prices to Easter’s falling in March, not April. Good sales were credited to superior products and wealthier people being better able to handle the shocks of fuel prices.

Niemira said he wonders how much longer the luxury sector’s successful run will last. “My big question is whether we’ll see a slowdown in the luxury market. It’s presumably affected by stock market performance; that’s always a worry,” he said.

While the stock market demonstrated a generally poor performance in April, California- based specialty retailers reported mixed performances.

Brisbane, Calif.–based Bebe Stores Inc. continued its stellar sales streak, reporting same-store sales gains of 31.2 percent. Foothill Ranch, Calif.–based The Wet Seal Inc. posted a double-digit comparative-store sales increase of 35.7 percent in April.

The high-achieving Anaheim, Calif.–based Pacific Sunwear of California Inc. surprised investors in April, reporting its first negative comps in three years. Retail analyst Jeffrey van Sinderen of B. Riley & Co. in Los Angeles said the retailer may be a victim of its own success. “After so many great quarters, it gets harder and harder to comp increases,” he noted.

Gap Inc. posted comparative-store sales decrease of 5 percent after reporting negative same-store sales during every month of the 2005 calendar year. But the company may be paving the way for a more profitable spring and summer, according to Andy Graves, a retail analyst for Pacific Growth Equities in San Francisco.

In a research note published April 27, Graves wrote that the San Francisco–based retailer’s management will introduce actions such as a changing the look of stores and targeting merchandise to the tastes of specific regions in 1,297 Gap stores. “We think this initiative could contribute to significant operating margin improvements,” he wrote. —Andrew Asch